What Is the WUVISAAFT Charge on Your Bank Statement?

Introduction

Finding an unfamiliar charge on your bank statement can be stressful. Your mind might race with questions about potential fraud or account errors. For instance, many people worry when they see codes like MSFT or PNP BILLPAYMENT on their statements because they don’t resemble typical merchant names. One such confusing entry is labeled “WUVISAAFT.”

While it may look cryptic, it usually has a straightforward explanation. This article will break down what the WUVISAAFT charge means, why it appears, and what steps to take if you don’t recognize it.

What Does WUVISAAFT Mean?

The term “WUVISAAFT” is a combination of codes that financial institutions use to describe a specific type of transaction. Let’s decode it:

- WU: This stands for Western Union, a well-known company that facilitates global money transfers.

- VISA: This indicates that the transaction was processed through the Visa card network.

- AFT: This is an acronym for Automated Funds Transfer, a system that moves money from one account to another electronically.

When you put it all together, a WUVISAAFT charge on your statement almost always points to a money transfer made through Western Union using your Visa debit or credit card.

Why Does the WUVISAAFT Charge Appear on Your Statement?

This charge appears whenever you use your Visa card to fund a Western Union transaction. Common sThis charge appears whenever you use your Visa card to fund a Western Union transaction. Common scenarios include:

- Sending money to family or friends.

- Paying a bill through the Western Union platform.

- Funding an online purchase where the merchant uses Western Union for payments.

The label can be confusing because it doesn’t look like a typical merchant name, such as how Walmart shows up on a bank statement. Instead, it’s a standardized descriptor that combines the service provider (WU), the payment network (VISA), and the transaction type (AFT).

Is the WUVISAAFT Charge Legitimate?

Most of the time, the WUVISAAFT charge is legitimate and reflects a transaction you initiated, even if you don’t immediately recognize the name. Think back to any recent money transfers or bill payments you may have made online or through the Western Union app. Similar to the Infinite Loop charge or other unusual transaction codes, it may not be obvious at first glance but often has a simple explanation.

However, like any transaction, there is always a chance it could be fraudulent. An unauthorized WUVISAAFT charge could indicate that someone has gained access to your card details and is using them to send money.

How to Verify the WUVISAAFT Charge

If you’re unsure about the charge, a little investigation can quickly clear things up:

- Check with Family: First, ask if a spouse, partner, or other authorized user on your account made a Western Union transfer.

- Review Your Records: Look for any email confirmations or digital receipts from Western Union that match the date and amount of the charge. Your Western Union account history will also have a complete record of your transactions.

- Compare with Other Codes: Unfamiliar entries like NWEDI or MSFT charges often cause the same confusion. By cross-checking dates and amounts, you can confirm if it’s linked to a purchase or subscription.

- Contact Customer Service: If you still can’t place the charge, you can contact Western Union’s support team. Provide them with the transaction details from your statement, and they should be able to help you identify it. You can also call your bank to see if they have any additional information.

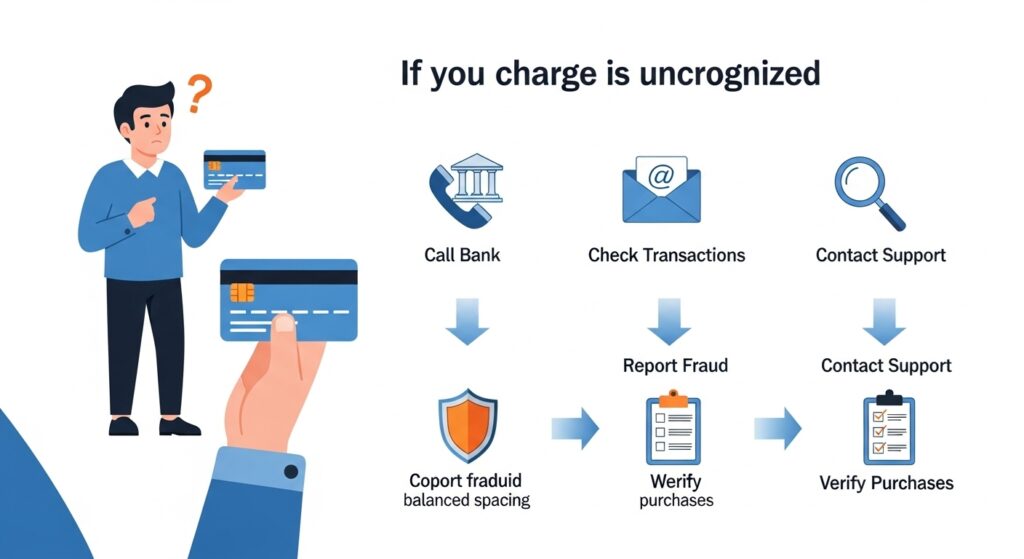

What to Do If You Don’t Recognize the Charge

If you have completed the verification steps and are certain the charge is not yours, you must act quickly to protect your account.

- Contact Your Bank Immediately: Call the fraud department of your bank or credit card company. Inform them that you suspect an unauthorized transaction. They will likely freeze or cancel your card to prevent further fraudulent activity and issue a new one.

- Dispute the Charge: While on the phone, formally dispute the WUVISAAFT charge. Your bank will guide you through the process, which usually involves signing a declaration that you did not authorize the payment. Banks have established procedures for investigating and resolving fraudulent charges.

- Secure Your Accounts: Change the passwords for your online banking and any associated accounts, including your email and Western Union login, to be safe.

Tips to Avoid Confusion in the Future

A few simple habits can help you stay on top of your transactions and spot issues early:

- Keep Good Records: When you make a money transfer, save the email confirmation or take a screenshot of the transaction summary.

- Enable Alerts: Most banking apps allow you to set up real-time notifications for all card activity. This is especially useful for catching unfamiliar codes such as PNP BILLPAYMENT charges before they become a bigger concern.

- Review Your Statements Regularly: Don’t wait until the end of the month. Log in weekly to your banking app and compare entries. If something like a Western Union or even credit card fee looks out of place, you can address it immediately.

Conclusion

The WUVISAAFT charge on your bank statement is typically just a formal description for a Western Union money transfer paid for with a Visa card. By understanding what the code means, you can quickly identify whether it’s a legitimate transaction. Always take the time to verify any charge you don’t recognize, and if you suspect fraud, contact your bank without delay. Staying vigilant is the best way to keep your financial accounts secure.