What is the WLY Complete Save Charge on Your Bank Statement?

Seeing an unfamiliar charge on your bank statement can be unsettling. Your mind might jump to the worst-case scenario, like fraud or a mistake. One charge that often causes confusion is labeled “WLY Complete Save.” If this has appeared on your statement, you’re not alone in wondering what it is and where it came from. This article explains what the WLY Complete Save charge means, why it appears, and the steps you can take if you don’t recognize it.

What Is WLY Complete Save?

WLY Complete Save is a subscription-based service that offers members access to discounts, cashback rewards, and other shopping perks. It is not a direct purchase of a physical item but rather a membership fee for a savings program.

Typically, you enroll in this service after making a purchase on another website. During the checkout process, you might have been presented with an offer for cashback or a discount on your next purchase. Accepting this offer often involves signing up for a trial of the WLY Complete Save program, which then converts to a paid monthly or annual subscription if not canceled.

Why Does the WLY Complete Save Charge Appear on Your Bank Statement?

The charge appears because you have an active subscription with the service. Enrollment usually happens in one of two ways:

- Intentional Sign-Up: You may have knowingly signed up for the program to take advantage of its discounts and shopping benefits.

- Trial Offer Enrollment: More commonly, people sign up unintentionally. This often happens when accepting a promotional offer, like “Get 10% cash back on this order,” after completing a purchase with a third-party online retailer. The terms of this offer may have included enrollment in a trial for WLY Complete Save, which then automatically started billing you after the trial period ended.

Because WLY Complete Save partners with various online stores, you might not remember the specific transaction that led to the subscription. This confusion is similar to how other recurring charges appear on statements, such as the Fid Bkg Svc LLC charge or the WUVI SAAFT charge.

Is the WLY Complete Save Charge Legitimate?

In most cases, the WLY Complete Save charge is legitimate, even if you don’t recall signing up. It usually stems from an agreement you accepted, perhaps by checking a box or clicking “accept” on a promotional offer. The terms and conditions, which detail the trial period and subsequent billing, are often included in fine print that is easy to overlook during an online checkout.

While the business practice can feel deceptive to some, it is often legally sound. The charge becomes a problem if you were enrolled without any form of consent or if you have already canceled the service and are still being billed.

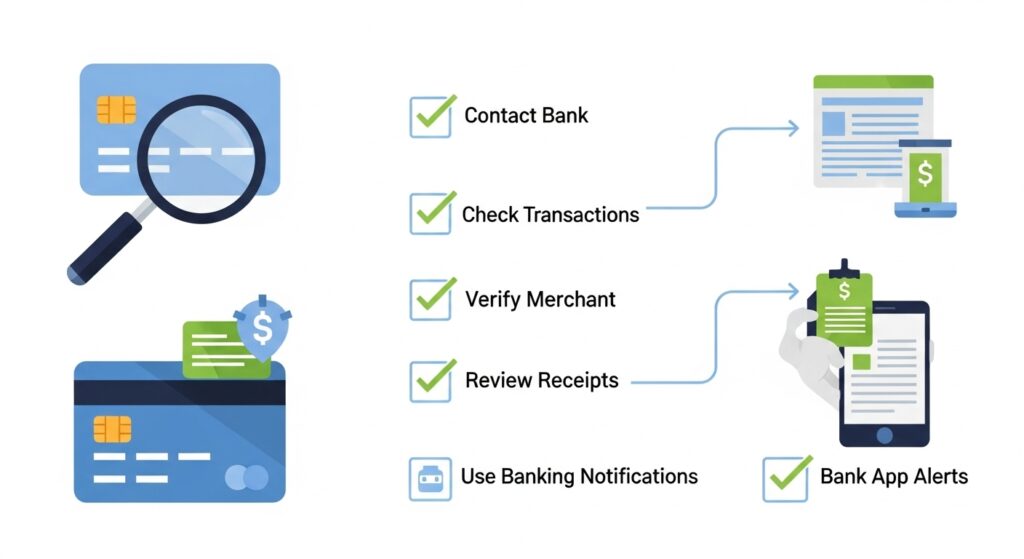

How to Verify the Source of the Charge

If you’re unsure about the charge, a little investigation can provide clarity.

- Check Your Emails: Search your inbox and spam folder for “WLY Complete Save” or “Complete Save.” You will likely find a welcome email with membership details, including the sign-up date and terms.

- Review Recent Online Purchases: Think back to any recent shopping activity. Did you accept a cashback or discount offer from a pop-up window after your purchase? This is a common entry point for the subscription.

- Look at Your Bank Statement: Sometimes, your bank statement will include a phone number or partial website URL next to the transaction description. This is the same way services like Paramount Plus subscriptions or even Walmart transactions appear.

- Contact WLY Complete Save: The most direct way to get answers is to contact their customer support. They can confirm how and when you signed up and provide details about your membership.

What to Do If You Don’t Recognize the Charge

Once you’ve confirmed the charge is for a WLY Complete Save subscription, you can decide what to do next.

- Cancel the Subscription: If you do not want the service, you should cancel it immediately to prevent future charges. You can usually do this by logging into your account on their website or by calling their customer service line. Make sure you receive a cancellation confirmation email or number.

- Request a Refund: When you call to cancel, you can also request a refund for the most recent charge, especially if you haven’t used the service. Policies vary, but it is worth asking.

- Dispute the Charge with Your Bank: If you believe the charge is unauthorized or if you’re unable to resolve the issue with the company, you can file a dispute with your bank or credit card provider. Explain that you did not authorize the subscription and provide any relevant information you have. Your bank will investigate the claim.

How to Avoid Unexpected Charges in the Future

A few simple habits can help you prevent surprise subscription fees.

- Read the Fine Print: Before accepting any offers, especially free trials or cashback deals, read the terms and conditions carefully. This helps you avoid situations similar to the NWEDI charge that sometimes puzzles account holders.

- Monitor Your Bank Statements: Regularly review your bank and credit card statements. Checking them weekly or bi-weekly helps you spot unfamiliar charges quickly.

- Set Up Transaction Alerts: Many banks allow you to set up email or text alerts for any transaction or for charges over a certain amount. This gives you real-time visibility into your account activity.

- Use a Specific Card for Subscriptions: Consider using one credit card for all recurring subscriptions. This makes it easier to track your monthly commitments in one place and spot unusual activity like the Infinite Loop charge.

Conclusion

The “WLY Complete Save” charge on your statement is typically a fee for a discount and rewards subscription program you likely signed up for after an online purchase. While often legitimate, the way customers are enrolled can cause confusion.

By investigating your email, reviewing past purchases, and contacting the company, you can verify the charge. If you don’t want the service, be sure to cancel it to stop future payments. Staying vigilant about your bank statements and carefully reading offers are the best ways to keep control over your finances and avoid unexpected expenses.