What Is the ScoresMatter Charge on Your Bank Statement?

Introduction

Finding an unexpected charge on your bank statement can be confusing and stressful. You scan through your recent purchases, trying to remember what you bought and where. One name that sometimes appears and causes this confusion is “ScoresMatter.” While it might seem unfamiliar, it’s often linked to a service you may have signed up for. This article explains what the ScoresMatter charge is, why it might be on your statement, and what to do if you don’t recognize it.

What Is ScoresMatter?

ScoresMatter is an online service that provides credit score monitoring and financial tools. It’s designed to help you stay on top of your credit health. The platform typically offers services such as access to your credit reports from major credit bureaus, credit monitoring with alerts for significant changes, and identity theft protection features. By using these tools, you can get a clearer picture of your financial standing and protect your personal information.

Why Does the ScoresMatter Charge Appear on Your Statement?

The most common reason for a ScoresMatter charge is a subscription. Many people sign up for a free or low-cost trial to check their credit score. These trials often require you to enter your credit card information. If you don’t cancel the trial before it ends, it automatically converts into a paid monthly or annual subscription. For more tips on spotting unexpected charges, you may also find our guide on what does TST mean on your credit card statement helpful.

Another reason is that you may have subscribed to a service that bundles ScoresMatter’s features without realizing the specific branding. The charge appears on your statement once the recurring billing cycle begins.

Is the ScoresMatter Charge Legitimate?

In most cases, the ScoresMatter charge is legitimate. It usually stems from a trial period you forgot to cancel or an active subscription you may not have remembered signing up for. It’s easy to overlook the terms and conditions when signing up for a service, which can lead to these unexpected recurring payments.

For comparison, similar charges like the MSFT charge on your bank statement often arise from legitimate subscriptions, so reviewing your statements carefully is key.

However, there are times when a charge could be unauthorized. This could happen if someone else used your card to sign up for the service without your permission. While less common, it’s also possible for a charge to be fraudulent. If you are certain you never interacted with ScoresMatter or any affiliated sites, it’s important to investigate further.

How to Verify the ScoresMatter Charge

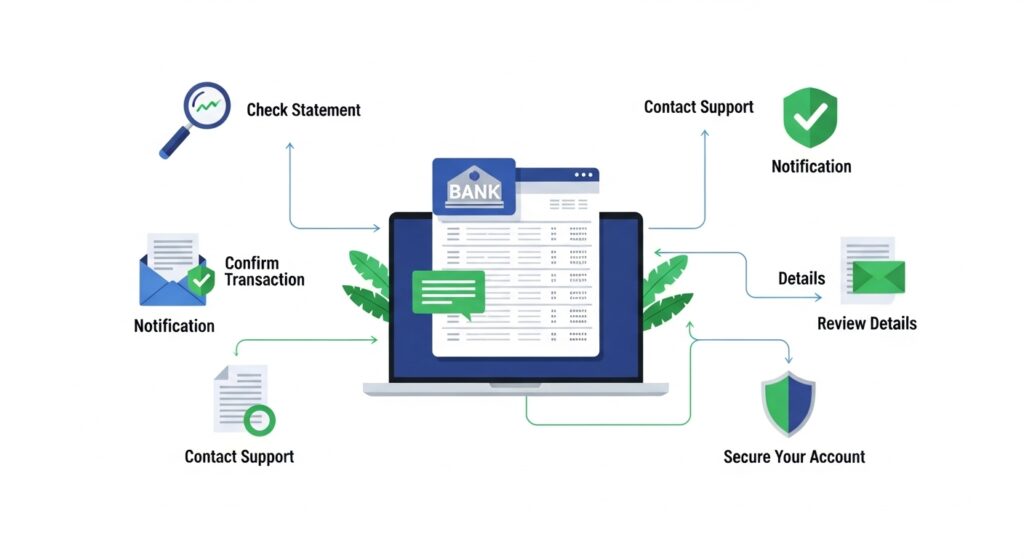

If you see a ScoresMatter charge and aren’t sure why, take a few steps to verify it. Check your email: Search your inbox and spam folder for “ScoresMatter” to find any welcome emails, account confirmations, or billing notifications. Reviewing your account details is essential; logging into the ScoresMatter website lets you see your subscription status and billing history.

You can also use resources like our bank statement loan calculator to understand recurring deductions and reconcile your records.

What to Do If You Don’t Recognize the Charge

If you’ve verified the charge and want to stop it, follow these steps:

- Cancel the subscription: The first step is to log into your ScoresMatter account and follow the instructions to cancel your membership. If you can’t find this option, contact their customer support directly to request cancellation.

- Request a refund: If you believe you were charged unfairly, for example, if you were unaware that a trial had converted to a paid plan, you can request a refund from ScoresMatter. Explain the situation clearly and politely to their support team.

- Dispute the charge with your bank: If you suspect the charge is fraudulent or you cannot resolve the issue with the company, contact your bank or credit card provider. You can dispute the charge as unauthorized. Your bank will investigate the claim and may reverse the transaction.

How to Avoid Unwanted Charges in the Future

Managing subscriptions can prevent unexpected bills down the line. When you sign up for a free trial, make a note of the expiration date in your calendar. Set a reminder a day or two before the trial ends so you have time to cancel if you don’t want to continue with the service.

- Manage free trials carefully: When you sign up for a free trial, make a note of the expiration date in your calendar. Set a reminder a day or two before the trial ends so you have time to cancel if you don’t want to continue with the service.

- Read the fine print: Always read the terms and conditions before providing your payment information. Understand how and when you will be billed.

- Monitor your statements regularly: Review your bank and credit card statements at least once a month. This helps you catch unwanted or fraudulent charges quickly.

Additionally, monitoring other potential deductions like the WLY Complete Save charge or checking investment-related statements such as FintechZoom Google stock can help you stay ahead of surprises.

Conclusion

A ScoresMatter charge on your statement is typically for a legitimate credit monitoring subscription, often originating from a free trial that has converted to a paid plan. While it can be surprising, it’s usually easy to resolve. By checking your email, logging into your account, or contacting customer support, you can clarify the charge. If it’s unwanted, you can cancel the service and, in some cases, get a refund. Regularly monitoring your financial statements helps you stay in control of your money and avoid similar surprises in the future.