What Is the PNP BILLPAYMENT Charge on Your Bank Statement?

Seeing an unfamiliar charge on your bank statement can be unsettling. Your mind might jump to the worst-case scenario, like fraud or a mistake. One charge that often causes this kind of confusion is labeled “PNP BILLPAYMENT Charge.” While it might look cryptic, it’s usually a legitimate transaction you’ve made. This guide will help you understand what this charge means, why it appears, and what to do if you don’t recognize it.

What Is PNP BILLPAYMENT?

PNP BILLPAYMENT is a generic transaction description that stands for “Plug’n Pay Bill Payment.” Plug’n Pay is a third-party payment processing company. They provide the technology that allows businesses to accept online payments securely. Think of them as a bridge between your bank and the company you’re paying.

Many different types of businesses use services like Plug’n Pay to handle their online transactions. This includes:

- Utility companies (electricity, water, gas)

- Online retailers

- Subscription services

- Government agencies for taxes or fees

- Telecommunication providers (internet, phone)

Because Plug’n Pay processes payments for so many different merchants, the charge on your statement might not name the specific company you paid. Instead, it shows the name of the payment processor, leading to confusion.

This is similar to other cryptic transaction labels you might have seen, such as SQ charges on bank statements or the SP AFF charge. Each of these descriptions points to a payment processor or billing system rather than the merchant itself.

Why Does It Appear on Your Bank Statement?

The PNP BILLPAYMENT charge appears on your statement whenever you make a payment to a company that uses Plug’n Pay’s system to process its online transactions. Much like the LPS charge or the Infinite Loop charge, it reflects the payment network rather than the actual business.

Common reasons for this charge include:

- Online Bill Payments: You may have paid a monthly bill online, such as your electricity, internet, or insurance premium.

- Subscriptions: A recurring charge for a subscription service (like a streaming service, software, or a monthly product delivery) might be processed through this system.

- One-Time Purchases: You might have made a one-time purchase from an online store that uses this payment gateway.

Essentially, you authorized a payment to a specific merchant, and that merchant used Plug’n Pay to complete the transaction. Your bank statement reflects the processor’s name instead of the merchant’s.

Is the PNP BILLPAYMENT Charge Legitimate?

Most of the time, the PNP BILLPAYMENT charge is completely legitimate. It’s simply a payment you made that was processed through this particular gateway. However, it’s always wise to verify any charge you don’t immediately recognize.

This is true across all unusual transaction labels, including Ikano Bank charges or merchant-specific codes. By comparing amounts and reviewing receipts, you can usually confirm whether the charge is authentic.

In some cases, the charge could be a mistake or, less commonly, fraudulent. A legitimate charge can feel like a mistake if you forgot about a recurring subscription or a one-time payment. A truly fraudulent charge occurs when someone has stolen your card information and used it to make a purchase with a merchant that uses Plug’n Pay.

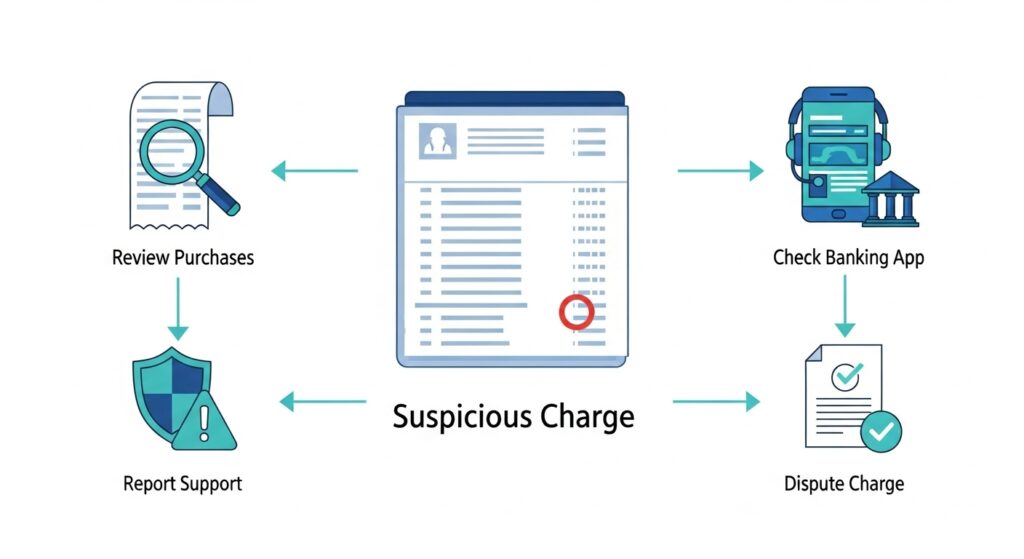

How to Verify the Source of the Charge

If you see a PNP BILLPAYMENT charge and aren’t sure where it came from, a little detective work can usually solve the mystery.

Here are the steps to track down the source:

- Check the Amount: Does the amount of the charge match any recent purchases or bills you’ve paid? Think about your utility bills, online shopping, or any new subscriptions you signed up for.

- Review Your Receipts: Look through your email inbox for recent order confirmations or payment receipts. The merchant name on the receipt will be the true source of the charge.

- Think About Recent Activity: Did you recently pay a bill online for the first time or switch a payment method for a recurring service? This is a common trigger for seeing a new transaction description.

- Examine Your Subscriptions: Check your active subscriptions for services like streaming, software, or monthly memberships. One of them may have renewed.

If these steps don’t help, you can contact your bank’s customer support. They may have more detailed information about the merchant who initiated the charge.

What to Do If You Don’t Recognize the Charge

After investigating, if you still can’t identify the source of the PNP BILLPAYMENT charge, it’s time to take action.

- Contact Your Bank Immediately: Call the customer service number on the back of your debit or credit card. Inform them that you have an unrecognized charge on your account. They will guide you through the process of filing a dispute. Be prepared to provide the date and amount of the transaction.

- Dispute the Charge: Your bank will likely place a temporary hold on the charge and launch an investigation. If they determine it was fraudulent, the charge will be reversed.

- Cancel Unwanted Subscriptions: If you discover the charge is for a subscription you no longer want, visit the merchant’s website or contact their customer service to cancel it. Simply disputing the charge with your bank won’t cancel the service, and you may continue to be billed.

How to Avoid Unexpected Charges in the Future

Staying on top of your finances can prevent the stress of discovering unexpected charges.

- Monitor Your Accounts Regularly: Get into the habit of checking your bank and credit card statements at least once a week. This helps you spot unfamiliar charges quickly.

- Set Up Transaction Alerts: Most banks allow you to set up email or text alerts for every transaction. This gives you real-time notifications of activity on your account.

- Keep Track of Subscriptions: Use a spreadsheet or an app to keep a list of all your recurring subscriptions, their costs, and their renewal dates. This helps you remember what you’re paying for each month.

- Keep Your Receipts: Save email receipts for online purchases in a dedicated folder. This makes it easy to cross-reference them with your bank statement.

Beyond monitoring your statements, choosing the right financial tools can help. For example, using one of the best credit cards recommended by FintechZoom may offer added protection such as fraud alerts, zero-liability policies, and cashback benefits. These perks not only safeguard your money but also make it easier to manage recurring payments.

Conclusion

Finding a PNP BILLPAYMENT charge on your statement can be puzzling, but it’s rarely a cause for alarm. Most often, it’s a valid payment you made to a merchant who uses the Plug’n Pay processing service. By reviewing your recent payments and subscriptions, you can usually identify the source quickly. However, it’s important to trust your instincts. If a charge seems suspicious and you cannot verify it, don’t hesitate to contact your bank to protect your account. Vigilance is key to managing your finances effectively and securely.