What is the Google Miniclip Charge on Your Bank Statement?

Finding an unexpected charge on your bank statement can be unsettling. It often leads to a moment of confusion and concern about potential fraud. One entry that frequently puzzles people is the “Google Miniclip charge.” This description can seem vague, but it usually has a simple explanation. Before you panic, let’s break down what this charge is, why it might be on your statement, and how to handle it.

What Is Google Miniclip?

Miniclip is a very popular digital gaming company. It develops, publishes, and distributes a wide range of online and mobile games, with famous titles like 8 Ball Pool, Agar.io, and Subway Surfers. Millions of people around the world enjoy their games on smartphones, tablets, and web browsers.

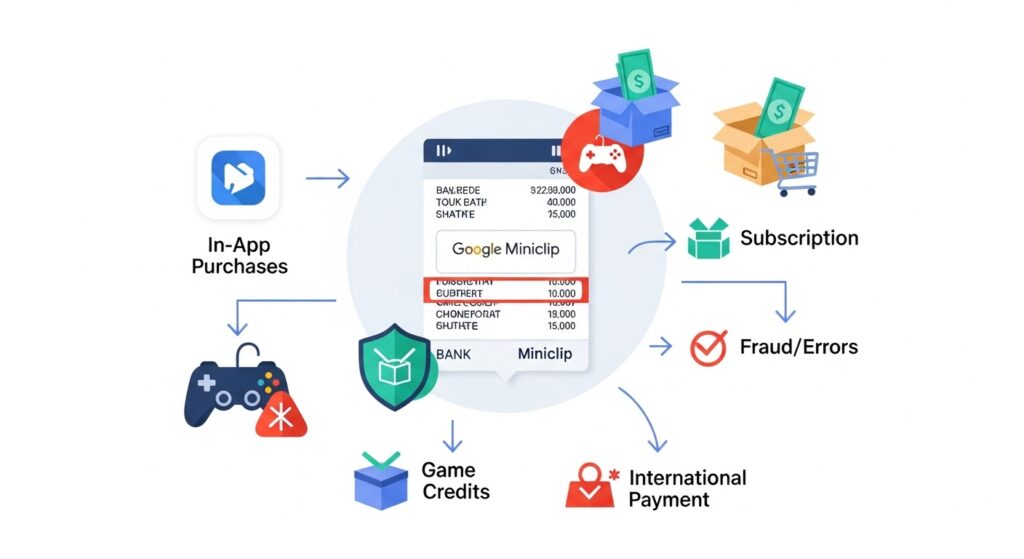

When you see “Google Miniclip” on your statement, it typically means a purchase was made for a Miniclip product through the Google Play Store. Google acts as the payment processor for all transactions on its platform. So, instead of seeing just “Miniclip,” the charge includes “Google” to show where the transaction was processed.

Why Does the Google Miniclip Charge Appear on Your Statement?

The appearance of a Google Miniclip charge is almost always linked to a transaction made through a Google account. The charge is usually for one of three things:

- Game Downloads: Some Miniclip games are not free and require a one-time payment to download.

- In-App Purchases: Many free-to-play games offer optional purchases for virtual items, currency, extra lives, or cosmetic upgrades. These small transactions can add up.

- Subscriptions: Certain games might offer a subscription for exclusive content, a battle pass, or an ad-free experience, resulting in a recurring charge.

When any of these purchases are made using a credit or debit card linked to your Google account, the charge will appear on your bank statement with a description like “GOOGLE *MINICLIP” or something similar.

Is the Google Miniclip Charge Legitimate?

In most cases, the charge is legitimate. It might have been a purchase you made and forgot about. Another common scenario is that a family member, like a child or partner who has access to your Google account or a linked family account, made the purchase. Many people share devices or payment methods, making it easy for someone else to buy something without your immediate knowledge.

However, there are situations where the charge could be unauthorized. This might happen if your account details were compromised or if there was a technical glitch. It’s important to investigate before assuming the worst.

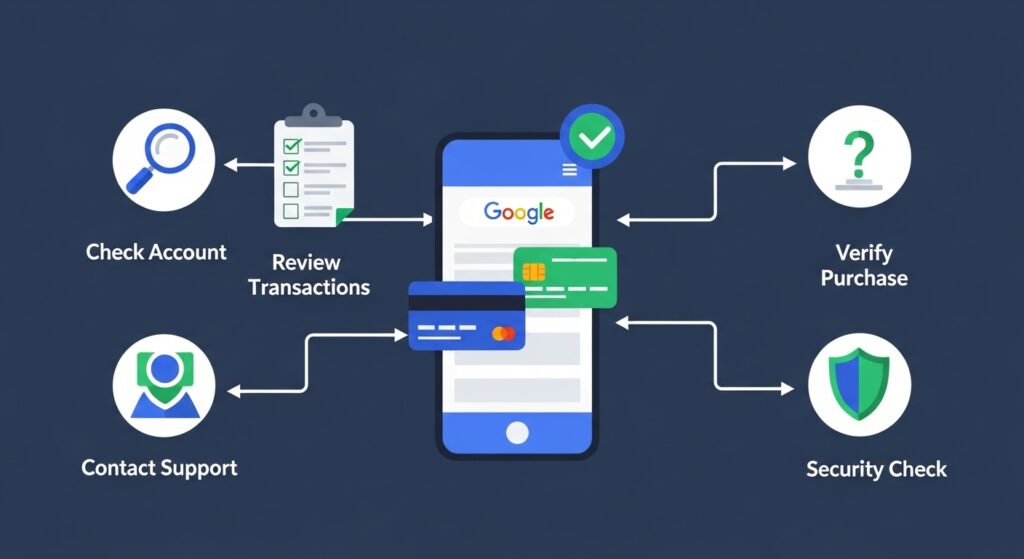

How to Verify the Charge

If you don’t recognize a Google Miniclip charge, your first step is to check your Google Play purchase history. This will give you a detailed list of every transaction made with your account, similar to how you might review your bank statement using our loan calculator to track all financial activity.

- Check your Google Play purchase history:

- Open the Google Play Store app on your device or visit play.google.com/store/account/orderhistory in a web browser.

- Log in with the Google account linked to your payment method.

- Review the list of recent purchases. Look for any orders from Miniclip that match the amount and date of the charge on your statement.

- Check linked family accounts: If you use Google Family Link or share your payment method with family members, check their purchase history as well. A child might have made an in-app purchase without realizing it would cost real money.

- Contact Support: If you’ve reviewed your history and still can’t find the source of the charge, you can reach out to Google Support or Miniclip’s support team for more information. They may be able to provide more details about the transaction.

What to Do If You Don’t Recognize the Charge

If you have confirmed that neither you nor a family member made the purchase, you should act quickly. You can also compare this with other unexpected entries like the LH Trading charge on your bank statement to understand common patterns in digital payments.

- Dispute the charge with Google: You can report unauthorized charges directly through your Google Play account. Google has a process for investigating these claims.

- Contact your bank: Inform your bank or credit card company about the unauthorized transaction. They can initiate a chargeback and may advise you to cancel your card to prevent further fraudulent activity.

- Cancel subscriptions: If the charge is for a subscription you didn’t sign up for, make sure to cancel it in the “Subscriptions” section of your Google Play account to stop future payments.

For mistaken purchases, such as a child buying something accidentally, you may be able to request a refund from Google. Google’s refund policies vary, but they often grant refunds for accidental or unauthorized purchases, especially if reported quickly.

How to Prevent Similar Issues in the Future

A few simple precautions can help you avoid unexpected charges from Google Play in the future.

- Enable purchase authentication: In your Google Play Store settings, you can require a password or biometric authentication (like a fingerprint) for every purchase. This is the most effective way to prevent accidental or unauthorized buys.

- Monitor family account purchases: If you have a family account, talk to your children about in-app purchases and set spending limits or approval requirements through Google Family Link.

- Set up alerts: Many banks allow you to set up text or email alerts for any transaction made with your card, helping you catch suspicious activity immediately.

- Review your statements regularly: Make it a habit to check your bank and credit card statements each month. This helps you spot small, recurring charges you may have forgotten about.

Conclusion

A “Google Miniclip charge” on your statement is usually just a payment for a game or in-app item from Miniclip, processed through the Google Play Store. Before assuming it’s fraud, take a moment to check your purchase history and any linked family accounts. Similar to understanding charges like the SEI charge or interpreting symbols like SQ on a bank statement, reviewing your statement carefully can often reveal a simple explanation.