What Is the FID BKG SVC LLC Charge on Your Bank Statement?

Reviewing your bank statement and finding a charge you don’t recognize can be unsettling. Mysterious acronyms and company names often create confusion and immediate concern about unauthorized activity. One such entry that frequently appears on statements is “FID BKG SVC LLC.” While it may look unfamiliar, this charge is often legitimate and connected to financial activities you’ve already initiated.

This article will explain what FID BKG SVC LLC means, why it appears on your bank statement, and what steps to take if you don’t recognize the transaction.

What Does FID BKG SVC LLC Mean?

The label “FID BKG SVC LLC” is an abbreviated name that represents a financial transaction. Let’s break it down:

- FID: This stands for Fidelity Investments, one of the largest and most well-known financial services companies in the world.

- BKG SVC: This is an abbreviation for Banking Services.

Essentially, FID BKG SVC LLC refers to a transaction processed through Fidelity’s banking services division. Fidelity uses this entity to handle the movement of money between your external bank account and your Fidelity accounts, such as for deposits, withdrawals, or transfers.

Why Does the FID BKG SVC LLC Charge Appear on Your Statement?

If you see this charge, it most likely means you have an account with Fidelity and recently moved money. The charge is not a fee but a record of a transfer or electronic funds transaction (EFT).

Common reasons for this entry include:

- Funding a Brokerage Account: You transferred money from your bank account to a Fidelity brokerage account to buy stocks, ETFs, or mutual funds.

- Contributing to a Retirement Account: You made a contribution to your Fidelity IRA, Roth IRA, or 401(k).

- Automatic Investments: You have a recurring automatic transfer set up to move funds from your bank to a Fidelity account on a regular schedule.

- Account Management: The charge could relate to a withdrawal or another type of money movement you initiated from your Fidelity account to your bank.

In nearly all cases, the FID BKG SVC LLC charge is directly linked to an action you took within your Fidelity portfolio.

Is the FID BKG SVC LLC Charge Legitimate?

The charge is almost always legitimate if you have any type of account with Fidelity. It’s simply the descriptive name Fidelity uses for its electronic banking transactions. Before assuming it’s an error, take a moment to think about your recent financial activities. Did you open a new account, contribute to your IRA, or set up an automatic investment plan?

For more insights on identifying unfamiliar entries, you can also see our guide on what is the SEI charge on your bank statement, which covers similar banking transaction clarifications.

However, there is always a small possibility of error or unauthorized use. If you have absolutely no relationship with Fidelity Investments, this charge could be a mistake or a sign of fraudulent activity.

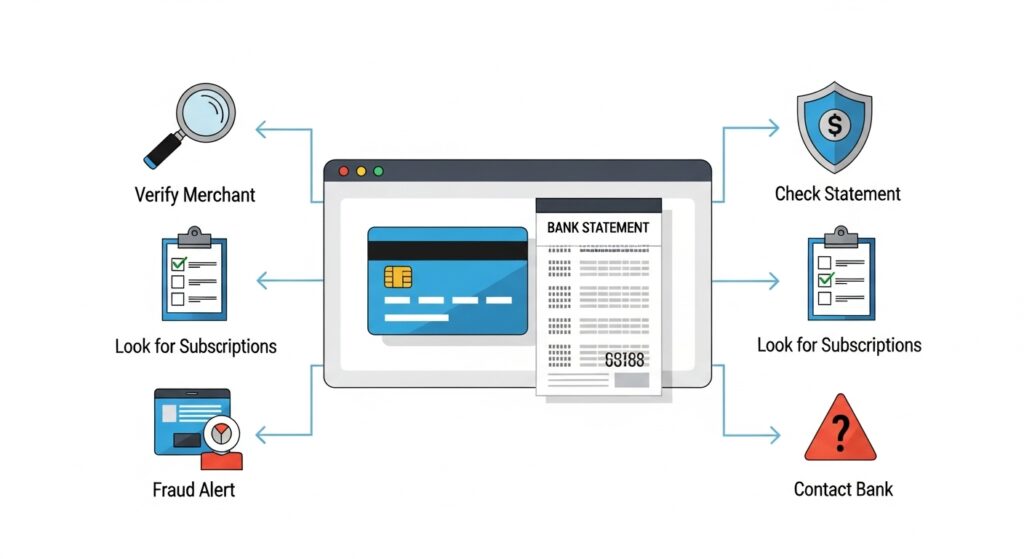

How to Verify the Charge

If you’re unsure about the transaction, a few simple steps can help you verify its legitimacy. Checking your Fidelity account activity is a good starting point, but if you also handle multiple accounts or subscriptions, reviewing guides like what is the MSFT charge on your bank statement or what is the SXM SiriusXM COM ACCT charge on your bank statement can help you spot patterns in recurring charges across different services.

Checking Your Fidelity Account Activity

The first and best place to look is your Fidelity account. Log in to the Fidelity website or app and review your transaction history. You should see a corresponding credit or debit that matches the amount and date of the charge on your bank statement.

Reviewing Recent Deposits, Withdrawals, or Automatic Transfers

Think back on any recent financial moves. Did you make a one-time deposit to invest in a specific security? Does the amount match a scheduled transfer you set up months ago? Cross-referencing the date and amount with your planned transactions can quickly solve the mystery.

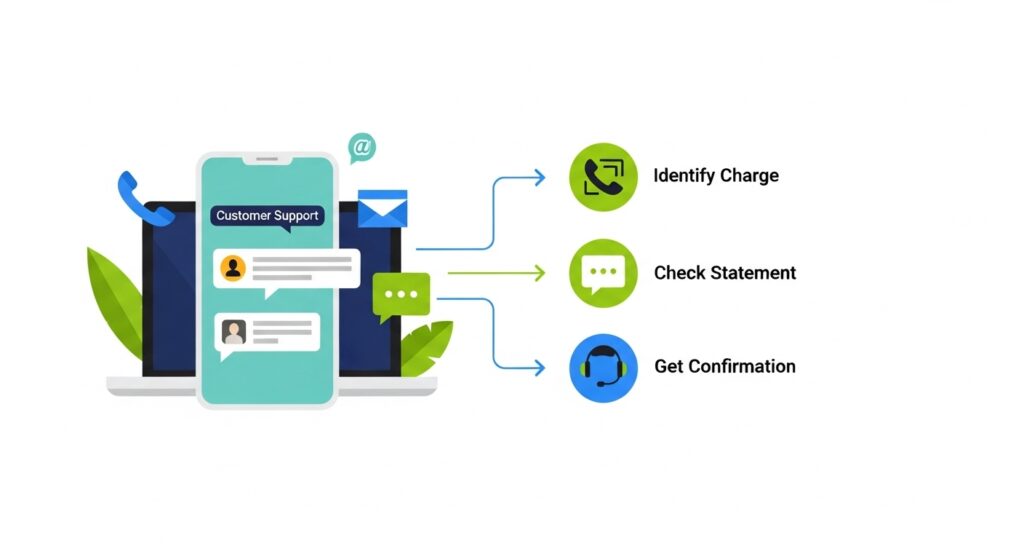

Contacting Fidelity Customer Support for Confirmation

If you still can’t identify the transaction after checking your accounts, Fidelity’s customer support can provide clarity. Have your account information, the transaction date, and the amount ready. A representative can look up the transaction and confirm its purpose.

What to Do If You Don’t Recognize the Charge

If you’ve reviewed your accounts and are certain you did not authorize the transaction, you should act quickly. Contact Fidelity if you have an account or your bank if you suspect fraud.

For larger financial management, understanding loan or investment eligibility might also be useful, such as reviewing the DSCR loan requirement to ensure your accounts are properly managed and reconciled.

- Contact Fidelity: If you have an account, call them immediately to report potential unauthorized activity. They can help you secure your account.

- Contact Your Bank: If you do not have a Fidelity account or suspect fraud, call your bank to report the unrecognized charge. They can help you dispute the transaction and may recommend closing the compromised account or card to prevent further issues.

- Safeguard Your Accounts: Change the passwords for both your bank and any investment accounts. Enable two-factor authentication (2FA) for an added layer of security. This makes it much harder for anyone to gain unauthorized access.

Tips to Prevent Confusion in the Future

A little proactive management can help you avoid future confusion over bank statement charges. Set up account alerts and regularly monitor your accounts. Additionally, keeping a record of transfers and subscriptions, such as recurring investments or media services, can help you reconcile transactions quickly.

For example, our bank statement loan calculator can assist in tracking deposits and withdrawals efficiently, while checking commodity-related accounts can be guided by resources like silver price FintechZoom.

- Set Up Account Alerts: Both your bank and Fidelity offer alerts for transactions. You can set them up to notify you via email or text whenever money is moved, so you’re always aware of activity.

- Regularly Monitor Your Accounts: Make it a habit to check your bank and investment accounts weekly. Regular monitoring helps you spot discrepancies or unfamiliar charges right away.

- Keep Records of Transfers: When you initiate a transfer, make a note of the date and amount. This helps you easily reconcile your bank statement with your own records.

Conclusion

Seeing an unfamiliar charge like FID BKG SVC LLC on your bank statement can be alarming, but it’s usually just a record of a transaction with Fidelity Investments. In most cases, it corresponds to a deposit, withdrawal, or transfer you initiated for your brokerage or retirement account.

By checking your Fidelity transaction history, you can quickly verify its legitimacy. While it’s important to stay vigilant and protect your financial information, this particular charge is typically a normal part of managing your investments.