What Is the FDMS Charge on Your Bank Statement?

Finding an unexpected or unclear charge on your bank statement can be unsettling. You scan the list of transactions, and a name you don’t recognize pops up, causing a moment of confusion or even concern. One common example that often puzzles people is a charge labeled “FDMS.” If you’ve seen this on your statement and wondered what it is, you’re not alone. This article will explain what an FDMS charge is, why it appears, and what you should do about it.

What Does FDMS Mean?

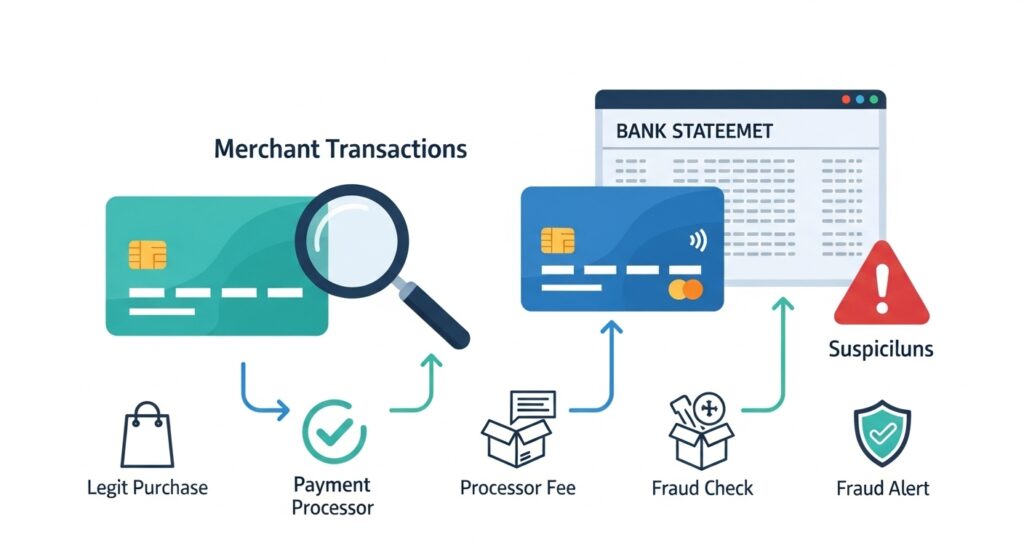

FDMS stands for First Data Merchant Services. First Data, which is now part of the company Fiserv, is one of the largest payment processing companies in the world. Its main role is to act as a middleman, facilitating secure transactions between a customer, a merchant (the business you bought from), and the customer’s bank.

When you use your credit or debit card to buy something, companies like FDMS handle the technical process behind the scenes. They ensure the funds are correctly transferred from your account to the merchant’s account. Millions of businesses, from small local shops to large national chains, use Fiserv’s First Data services to process their payments.

Why Does the FDMS Charge Appear on Your Statement?

The most common reason an FDMS charge appears on your statement is that you made a purchase from a merchant that uses First Data to process its payments. Instead of the merchant’s familiar business name appearing on your statement, the name of the payment processor—FDMS—shows up instead.

This kind of confusion is similar to other billing descriptors like the SQ charge on a bank statement or the SP AFF charge, which can also make cardholders pause before realizing the transaction is legitimate.

This can happen for a few reasons:

- The merchant’s billing name is set up this way: Some businesses, especially smaller ones, might not have their billing descriptor configured to show their public-facing brand name.

- A parent company name appears: The charge might be listed under the name of the merchant’s parent company, which uses FDMS for its payment processing.

- It’s a recurring payment: Subscriptions or recurring bills are sometimes processed in batches, and the processor’s name might appear instead of the service you signed up for.

Essentially, the FDMS label is just a clue about how the transaction was processed, not necessarily who you paid. The actual purchase was likely with a business you know.

Is the FDMS Charge Legitimate?

In most cases, an FDMS charge is perfectly legitimate and corresponds to a purchase you actually made. It could be from a recent stop at a gas station, a meal at a restaurant, or an online purchase. The confusion arises purely from the unfamiliar name on the statement.

If this situation feels familiar, you may also want to review similar cases like the LPS charge or even the Infinite Loop charge, both of which often cause the same type of uncertainty until you trace the transaction back to the source.

However, like any transaction, there is a small possibility of a mistake or fraudulent activity. It could be a billing error, or in a worst-case scenario, it could be a fraudulent charge made by someone who has your card information. That’s why it’s always important to verify any charge you don’t immediately recognize.

How to Verify the FDMS Charge

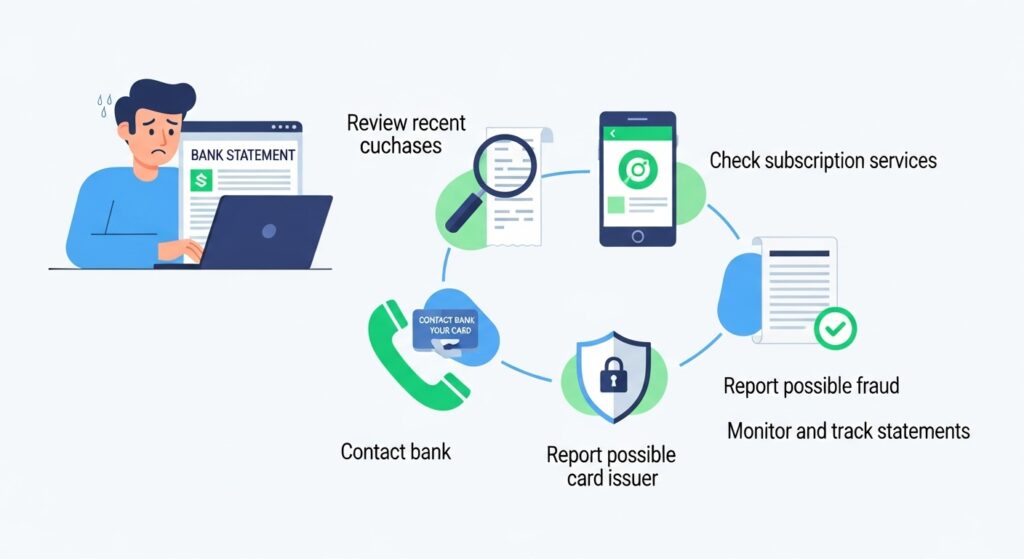

If you see an FDMS charge and can’t recall the purchase, don’t panic. A little investigation can usually clear things up.

- Examine the Transaction Details: Look closely at the charge on your bank statement. Note the date and the amount. Try to match it with recent purchases you’ve made. Check your physical or digital receipts from around that date.

- Think About Your Recent Purchases: Did you recently shop at a new store, eat at a different restaurant, or sign up for a trial service online? Small, independent businesses are common users of FDMS.

- Check Your Bank App: Many banking apps provide more detailed transaction information. Tapping on the charge might reveal the actual merchant’s name, location, or other helpful details.

- Contact Your Bank: If you’re still unsure, your bank’s customer support team can help. They often have access to more detailed transaction data and may be able to identify the merchant for you.

What to Do If You Don’t Recognize the Charge

If after your investigation the charge still seems suspicious, you should take action promptly.

- Contact Your Bank Immediately: Report the unrecognized charge to your bank or credit card issuer. They can help determine if it is fraudulent and guide you on the next steps.

- Dispute the Charge: If the charge is confirmed to be unauthorized, you can file a dispute (also known as a chargeback). Your bank will investigate the claim. During this process, they will likely credit the disputed amount back to your account temporarily.

- Cancel or Block Your Card: If fraud is suspected, your bank will likely recommend canceling your current card and issuing a new one to prevent further unauthorized transactions. This is a critical step to protect your account.

Tips to Prevent Confusion in the Future

Staying on top of your finances can help you quickly spot and resolve issues with unclear charges.

- Set Up Transaction Alerts: Most banks allow you to set up email or text alerts for every transaction, or for purchases over a certain amount. This gives you real-time visibility into your account activity.

- Keep Track of Subscriptions: Maintain a list of your recurring payments and subscriptions. This makes it easier to recognize these charges when they appear on your statement each month.

- Review Your Statements Regularly: Make it a habit to review your bank and credit card statements at least once a month. The sooner you spot a problem, the easier it is to fix.

Setting up alerts and reviewing your account activity regularly makes it much easier to identify what’s real and what might be suspicious. If you want to stay ahead, it may also help to explore resources like the FintechZoom best credit cards guide, which highlights cards with strong fraud protection and transparency tools.

And if you’re dealing with recurring confusion around billing names, reading up on cases such as the Ikano Bank charge can give you a clearer picture of how different financial institutions handle transactions.

Conclusion

Seeing “FDMS” on your bank statement can be confusing, but it usually just refers to a purchase from a business that uses First Data (Fiserv) for payment processing. By carefully reviewing the transaction details and thinking back on your recent spending, you can often identify the purchase.

Always be proactive about monitoring your financial accounts. Regularly checking your statements and questioning unfamiliar charges is a key part of keeping your finances secure. By staying vigilant, you can ensure that every transaction on your statement is one you authorized.