What Is NWEDI on a Bank Statement? A Simple Guide

Reviewing your bank statement can sometimes feel like trying to decode a secret message. With so many abbreviations and codes, it’s easy to feel confused. One of the terms that often leaves people scratching their heads is “NWEDI.” If you’ve seen this on your statement and wondered what it is, you’re not alone. This article will explain what NWEDI means, why it appears, and what you should do if you don’t recognize the transaction.

What Does NWEDI Stand For?

NWEDI is an abbreviation that typically relates to electronic payment systems. While it can be linked to specific entities like “Northwest Electronic Data Interchange,” it’s more broadly used as a generic descriptor for certain types of automated transactions.

In simple terms, NWEDI is a label that banks use for electronic fund transfers (EFTs) or automated clearing house (ACH) payments. Its role is to help categorize and track money moving into or out of your account digitally, without physical cash or checks changing hands.

Why Does NWEDI Appear on a Bank Statement?

Banks use short codes like NWEDI to keep transaction descriptions brief on statements. An NWEDI entry usually signals some form of automated electronic payment. If you’ve ever wondered about other unusual codes, such as TPG Products charge or PNP BillPayment charge, they serve a similar purpose—identifying digital transactions in a condensed format.

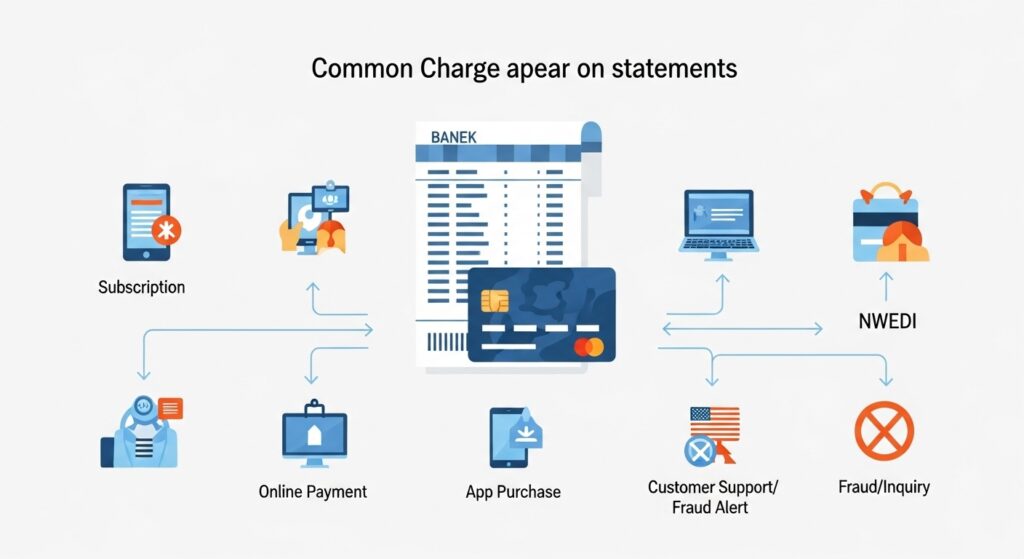

Common reasons for an NWEDI transaction include:

- Direct Deposits: Your employer might use an electronic system to deposit your paycheck.

- Electronic Bill Payments: You may have set up an automatic payment for a utility bill, loan, or credit card.

- Government Payments: Funds from agencies like Social Security or the IRS are often sent electronically.

- Online Transfers: Money you moved between your own accounts or sent to someone else.

Essentially, any transaction processed through an automated clearing house system could be labeled with this or a similar code.

Is the NWEDI Transaction Legitimate?

Most of the time, an NWEDI transaction is completely legitimate. For instance, if you see an NWEDI deposit for the exact amount of your paycheck on your regular payday, it’s almost certainly your direct deposit. Similarly, if you see an NWEDI withdrawal that matches your monthly car payment, it’s likely a scheduled auto-payment.

However, it could signal a problem if the amount is unfamiliar, the timing is unexpected, or you don’t recall setting up any payments with the listed merchant. Just like confusing entries such as GPC EFT or Infinite Loop charge, NWEDI can cause concern when details don’t match your records.

How to Verify the NWEDI Charge

If an NWEDI charge looks unfamiliar, don’t panic. There are a few simple steps you can take to verify it.

- Check Transaction Details: Log in to your online banking portal or app. Often, clicking on the transaction will reveal more details, such as the name of the company that initiated the charge.

- Review Your Records: Think about recent financial activity. Did you sign up for a new subscription? Did you make a one-time bill payment online? Check your bills, payroll stubs, and email receipts for clues.

- Contact Your Bank: If you’re still unsure, call your bank’s customer service line. They can look up the transaction’s origin and provide you with more specific information about who requested the funds.

What to Do If You Don’t Recognize the Charge

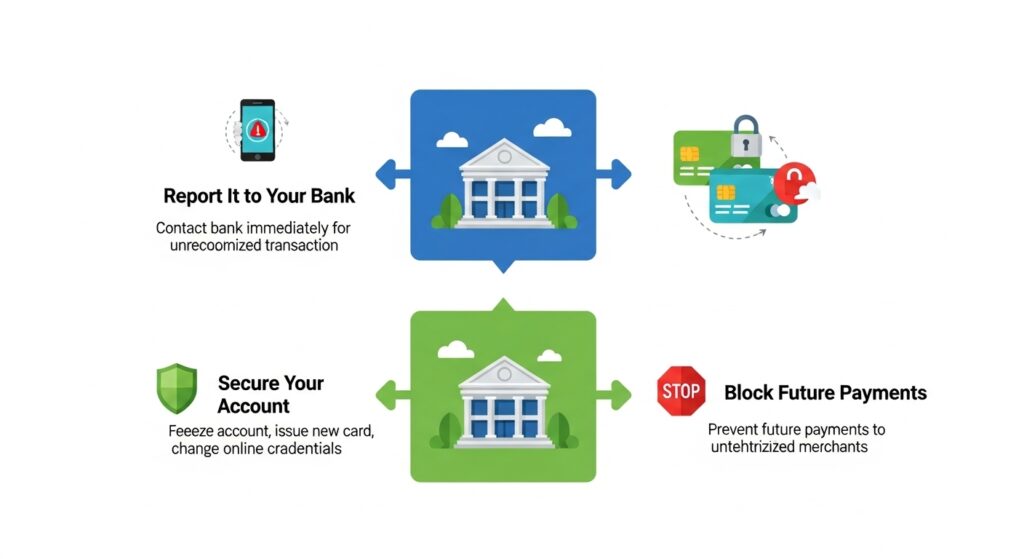

If you’ve done your research and still can’t identify the charge, it’s important to act quickly.

- Report It to Your Bank: Immediately contact your bank and report the transaction as unrecognized or unauthorized. They will guide you through the process of disputing the charge.

- Secure Your Account: If you suspect fraud, ask the bank to take steps to secure your account. This might include freezing the account, issuing a new debit card, or changing your online banking credentials.

- Block Future Payments: Your bank can help you block any future payments to the unauthorized merchant.

Tips to Avoid Confusion in the Future

Staying on top of your finances can help you spot issues quickly and avoid confusion. If you’re someone who frequently reviews charges, it’s also worth learning how Walmart shows up on a bank statement or checking out guides on identifying different merchant codes.

- Set Up Notifications: Most banks allow you to set up email or text alerts for any electronic transactions. This way, you’ll know right away when money moves in or out of your account.

- Keep Track of Payments: Maintain a simple list or use a budgeting app to track your recurring bills, subscriptions, and direct deposits. This makes it easier to match transactions on your statement.

- Review Your Statements Regularly: Make it a habit to look over your bank statement at least once a month. The sooner you catch an error, the easier it is to fix.

Conclusion

Seeing “NWEDI” on your bank statement can be puzzling, but it usually just refers to a standard electronic transaction like a direct deposit or automatic bill payment. While these charges are typically valid, it’s always a wise practice to investigate any entry you don’t recognize. By regularly reviewing your account and knowing how to verify transactions, you can ensure your money is safe and accounted for.