What Is Full Coverage Car Insurance?

Financing A Used Car: The Facts

While most states don’t require you to get coverage for car insurance when purchasing a car, many finance lenders who want to protect their investments require full coverage regardless of whether your car is gently used or new. Here is a little bit about what is full-coverage car insurance is and more about how this process works:

- Whether buying used or new, the auto loan term agreements will establish how many years you’ll pay a lender until you’re able to receive the title to the car.

- For example, if you apply for financing and obtain a loan for a term of 36 months, your lender will hold the vehicle’s title for that period of time.

- Full coverage insurance in this case is typically required for the entirety of the 36-month finance period.

How To Finance A Used Car: Insurance Coverage

What Is Full Coverage Car Insurance?

Car shoppers should be aware that most states don’t require them to have full auto insurance coverage when they leave the dealership after buying a used or new car. While it is perfectly legal to not have full coverage, lending institutions—banks, credit unions, or online lenders—want to make sure that their investment is protected, so they will require full coverage on all vehicles.

If you go the finance route to buy a used car, you will need to pay the lender for a certain amount of time before you get the title. For example, if you apply for financing and get a car loan with a term of 60 months or 84 months, then your lender will have your car’s title for that whole term. The majority of the time, you will need full coverage from an insurance company for as long as you are making car payments.

What Else To Know About How To Finance A Used Car?

Do you need full coverage on a used, financed car? As mentioned earlier, you don’t legally need full coverage, but you’ll have a harder time getting a loan for your vehicle if you don’t opt for full insurance coverage.

Here are a few other things you’ll need to keep in mind as you submit applications for used car financing:

- Loan Length: How many years can you finance a used car? It depends on the contract you negotiate with your dealership. A typical contract is 36 months, but your loan term could be much shorter or longer. Just remember that longer terms mean lower monthly payments but more interest. Shorter terms mean less interest but higher monthly payments.

- Down Payment: Your down payment is the amount of money you’re willing to put towards your vehicle from the outset. The higher your down payment, the lower your monthly payments will be, and the more bargaining power you’ll have to negotiate for a lower interest rate.

- Interest Rate: Your interest rate is a service fee that the lender charges you for providing you with a loan. You’ll pay a percentage of the total loan amount on top of the original value of the money you borrow (otherwise called the principal). Things like your credit score and the size of down payment will often affect the interest rate offered by your lender.

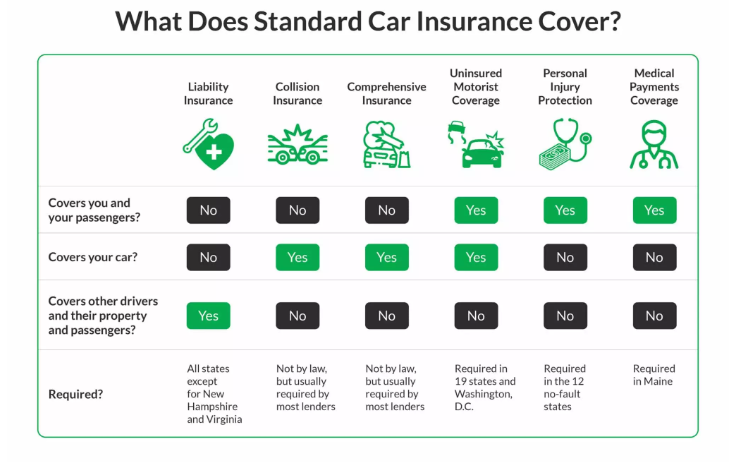

What Does Standard Car Insurance Cover?

Type Of Coverage

- Liability insurance

- Collision insurance

- Comprehensive insurance

- Personal injury protection (PIP)

- Uninsured/underinsured motorist coverage (UM/UIM)

- Medical payments coverage (MedPay)

How Many Years Can You Finance A Used Car?

The list of guidelines for buying a pre-owned vehicle isn’t long. However, many Fenton drivers have additional questions like, How many years can you finance a used car? After you’ve done your research on used vs. certified pre-owned vehicles and decided on your next car, truck, or SUV, you’ll provide the necessary information to our finance experts, who will then contact lending institutions on your behalf. This will be the first step in the process. You may need to provide:

- A valid driver’s license

- Proof of insurance

- Proof of income (i.e., bank statements or pay stubs)

- Existing documentation for your current vehicle, if necessary

How Much Does Full Coverage Insurance Cost?

According to Quadrant Information Services, the average annual cost of a full-coverage insurance policy is $1,730. The table below shows average premiums for a 35-year-old married driver with good credit and a clean driving history.

Do I Need Full Coverage On A Financed Car?

Most lenders will require you to carry a full-coverage auto insurance policy because your vehicle is the collateral for your loan. Liability insurance only covers property damage and medical expenses for other parties when you’re at fault for an accident. If your car is stolen or totaled and you don’t have full coverage, you’ll still need to pay off the loan for a vehicle you no longer have.

Once you’ve paid your vehicle off, you can decide whether to drop certain coverages and get a liability-only policy. Depending on your circumstances and where you live, you may decide that full coverage is best for you.

Full coverage is more expensive than your state’s minimum liability limits, but the benefits of having full coverage are clear. If you’re involved in an accident or your car is stolen, a liability-only policy won’t cover your repair bills or help you get a new car. If you have a new car, you may want to consider getting new car replacement insurance.