What Does TST Mean on Your Credit Card Statement?

Looking at your credit card statement can sometimes feel like trying to decipher a secret code. With so many abbreviations and cryptic entries, it’s easy to get confused or even worried about unfamiliar charges. One code that often causes a second look is “TST.” If you’ve seen this on your statement and wondered what it is, you’re not alone. This guide will explain what TST mean, why it appears, and what you should do about it.

What Does TST Stand For?

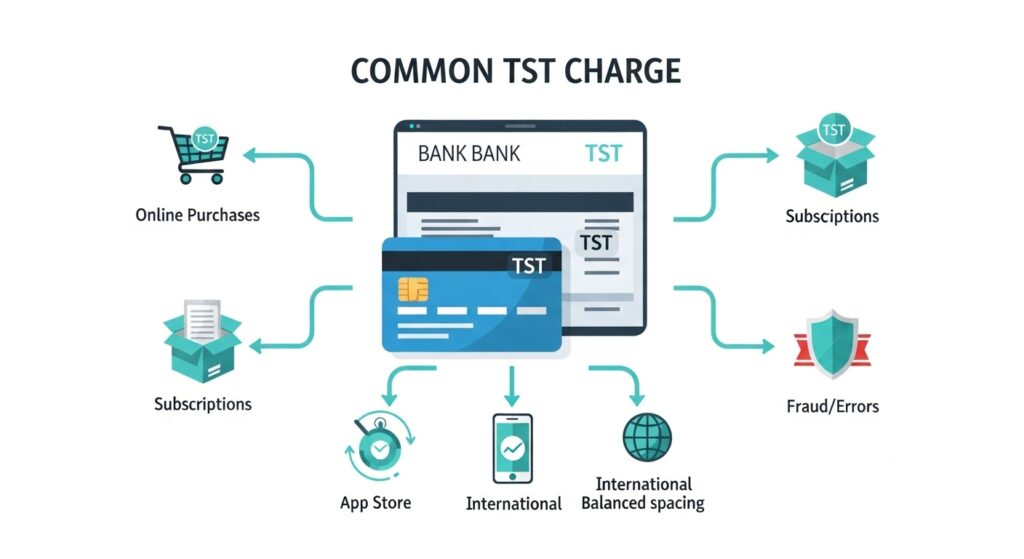

The abbreviation “TST*” can be a bit tricky because it can mean a few different things depending on the situation. Most commonly, it stands for one of two things:

- Test Transaction: Often, TST* indicates a small, temporary charge used to verify that your credit card account is active and valid.

- Ticketmaster: TST* is also frequently used as a shortened name for purchases made through Ticketmaster, the popular online service for event tickets.

Banks and merchants use these codes and abbreviations to save space on billing statements and to categorize transactions efficiently. While this system works well for their records, it can leave cardholders scratching their heads.

Why Does TST Appear on Your Credit Card Statement?

The context of the transaction usually determines why you see a TST* charge. If it’s a test transaction, you might see it after signing up for a new service, starting a free trial, or adding a new payment method to an online account. A merchant will send a small charge (often around $1) to your account to confirm the card details are correct.

These test charges are usually reversed within a few business days and don’t permanently take money from your account. For example, if you’ve noticed similar unfamiliar charges before, you might also find our guide on how do unauthorized DoorDash charges show up on your bank statement helpful to understand pre-authorizations or temporary holds.

If it’s related to Ticketmaster, the TST* code will appear next to the purchase amount for tickets to a concert, sporting event, or another live event you bought through their platform.

Is the TST Charge Legitimate?

In most cases, a TST* charge is perfectly legitimate. It is likely a valid charge if you recently purchased tickets from Ticketmaster, signed up for a free trial, added your credit card to a new online account, or updated your payment information.

If you are curious about other merchant codes and their meanings, our article on what is the MSFT charge on your bank statement provides a useful comparison for interpreting cryptic charges from major companies.

It is likely a valid charge if you recently:

- Purchased tickets from Ticketmaster or a related live event vendor.

- Signed up for a free trial or subscription service.

- Added your credit card to a new online account (like a ride-sharing app or food delivery service).

- Updated your payment information on a website you already use.

However, like any charge, it could be suspicious if none of these situations apply to you. If you see a TST* charge from a merchant you don’t recognize or for an amount that seems wrong, it’s worth investigating further.

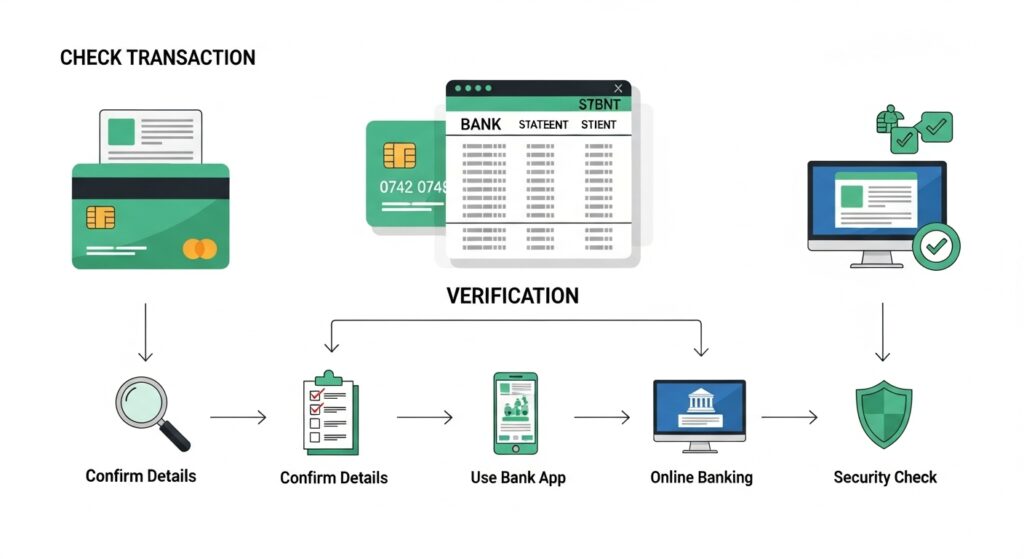

How to Verify the TST Charge

If you’re unsure about a TST charge, don’t panic. Check your receipts and think about recent activity, like subscribing to a new service.

- Check Your Receipts: Look through your recent email confirmations and digital receipts. If you bought tickets, you should have an email from Ticketmaster that matches the date and amount of the charge.

- Think About Recent Activity: Did you recently sign up for a streaming service or an online subscription? The TST* could be a pre-authorization charge from that company.

- Use Online Banking Tools: Most credit card providers have online portals or mobile apps with detailed transaction information. Click on the charge to see if more details are available, such as the full merchant name or location.

- Contact Your Bank: If you still can’t identify the charge, your credit card issuer’s customer service team can often provide more specific information about the merchant who initiated it.

Many online banking tools now give detailed merchant information. For a deeper dive into decoding unknown charges, see our guide on what is NWEDI on a bank statement: a simple guide, which explains similar codes and helps you identify whether a transaction is legitimate or needs further investigation.

What to Do If You Don’t Recognize the Charge

If you’ve gone through the verification steps and are confident you did not authorize the transaction, it’s time to act.

- Contact Your Credit Card Company Immediately: Report the charge as potentially fraudulent. The phone number is on the back of your card. They will guide you through the process of disputing the charge.

- Dispute the Charge: Your bank will launch an investigation into the transaction. While the investigation is ongoing, you typically are not responsible for paying the disputed amount.

- Consider Cancelling Your Card: If fraud is confirmed, your bank will likely recommend closing the compromised card and issuing a new one with a different number to prevent further unauthorized charges.

How to Avoid Confusion in the Future

taying on top of your credit card activity is the best way to prevent fraud and avoid confusion over statement entries.

- Set Up Purchase Alerts: Most banks allow you to set up email or text alerts for every transaction, so you are notified of charges in real-time.

- Keep Track of Subscriptions: Maintain a list of your recurring subscriptions and free trials. This helps you remember which companies are authorized to charge your card.

- Review Your Statements Regularly: Make it a habit to check your credit card statement at least once a week, not just when the bill is due. This allows you to spot and address suspicious activity quickly.

Keeping track of subscriptions, and reviewing statements regularly is key. You can also explore insights on what is the WLY Complete Save charge on your bank statement to familiarize yourself with other common codes and avoid unnecessary stress when monitoring transactions.

Conclusion

Seeing “TST” on your credit card statement usually isn’t a cause for alarm. It’s typically just a test charge to verify your account or a purchase from Ticketmaster. By understanding what this code means and how to verify its legitimacy, you can manage your finances with greater confidence. Being proactive and regularly monitoring your account is the key to keeping your financial information safe and sound.