What is the TFL BOps Charge on Your Bank Statement?

Introduction

If you live in London and use public transport, you may have seen a TFL BOps charge on your bank statement. Many commuters notice this charge and feel confused or worried.

Transport for London (TFL) manages buses, tubes, trains, and other services in the city. The BOps charge usually relates to automated fare deductions or administrative processes.

Understanding this charge helps you know whether it is legitimate, how to verify it, and what to do if it seems incorrect. For example, similar to checking unusual entries like a BillMatrix charge on your bank statement, reviewing your TFL BOps charge ensures you aren’t missing any unexpected deductions.

What Is the TFL BOps Charge?

The TFL BOps charge is a payment processed by Transport for London for services like the Tube, buses, or Oyster card travel.

It is often an automated charge applied to cover fares, top-ups, or adjustments. Sometimes it appears as a routine deduction for travel you made.

In some cases, it may represent an administrative or fare charge related to refunds, penalties, or corrections to your account.

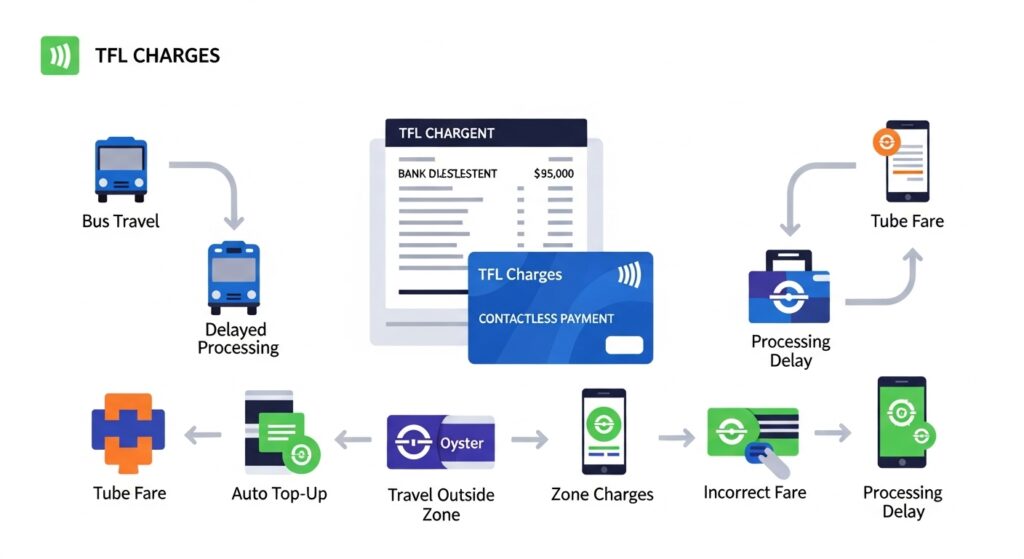

Why Does the TFL BOps Charge Appear on Your Bank Statement?

There are several reasons a TFL BOps charge may appear. One common reason is a routine fare deduction after you use the Tube, bus, or train.

It can also appear if there is an overlap with unpaid Oyster cards or travel passes. For example, if your balance is low, the charge may cover trips you already took.

Additionally, the charge may reflect processing of refunds, penalties, or adjustments applied by TFL’s payment system.

How to Verify the TFL BOps Charge

Start by checking your travel history through your TFL account or the Oyster app. Look for recent trips that match the date and amount on your bank statement. You can also compare this process to verifying other automated payments, such as an Amazon Digital charge on your bank statement, to ensure all transactions are legitimate.

Make sure to check for any pending refunds or adjustments. Sometimes TFL processes a refund that temporarily appears as a charge.

Matching the amount and date ensures you know whether the charge is legitimate or an error.

Common Errors That Trigger the Charge

Occasionally, a TFL BOps charge may appear due to errors. Duplicate transactions or double payments can happen if you tap your Oyster card multiple times.

Payment method issues, such as expired cards or declined transactions, may also result in unexpected charges.

Technical errors in TFL systems can occasionally create automated charges that don’t match your travel history.

What to Do If You Don’t Recognize the Charge

If you cannot identify a TFL BOps charge, first confirm it is not fraudulent. Compare the amount and date to your travel records. For guidance on managing similar unexpected charges, see how others handle entries like an Ikano Bank charge on your bank statement.

Next, contact TFL customer service via phone, email, or online portal. Provide details such as your Oyster card number, recent trips, and bank statement information.

Providing clear and accurate information helps speed up the resolution process.

How to Dispute a TFL BOps Charge

Begin by gathering proof of trips and payments. Screenshots from your Oyster app or receipts are helpful.

Contact TFL through their official channels and explain the charge. Include all relevant information, such as dates, times, and amounts.

Track the dispute until it is resolved. TFL may adjust your account or issue a refund if the charge was applied in error.

Preventing Future TFL BOps Charges

Set up automatic notifications for your bank or Oyster account to monitor new transactions.

Check your travel card balances regularly to avoid insufficient funds triggering extra charges.

Monitor your bank statements frequently. This helps catch payment errors or unauthorized charges early.

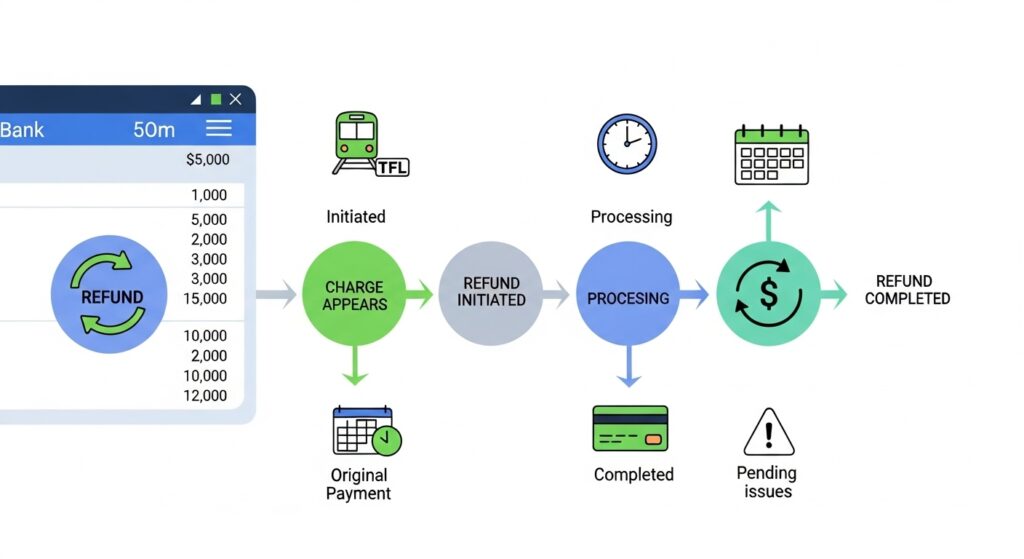

Understanding Refunds and Timelines

Refunds for incorrect TFL BOps charges usually take a few business days to process. Similar to handling other financial adjustments, like obtaining credits or refunds through a CSC ServiceWorks laundry card, keeping documentation ensures your refunds are processed smoothly.

After a successful dispute, the amount will appear back in your bank account or be applied as a credit to your Oyster card.

Keep records of all communication and confirmations for future reference. This ensures a smooth process if there are repeated issues.

Examples of TFL BOps Charges

Routine Fare: Emma uses the Tube daily, and a TFL BOps charge appears for £3.20 covering a single trip.

Overpaid Travel Card: John topped up his Oyster card twice by mistake. One of the BOps charges was later refunded.

Penalty or Adjustment: Lisa tapped in twice accidentally. The BOps charge applied a small correction to her account.

Refund Processing: Michael received a refund for a canceled bus journey. A temporary BOps charge appeared before the refund finalized.

FAQs About TFL BOps Charges

What does TFL BOps charge mean?

It is an automated payment processed by Transport for London for fares, adjustments, or administrative fees.

Is it always a fare?

Not necessarily. It may also cover refunds, penalties, or corrections to previous transactions.

Can I dispute the charge?

Yes. Contact TFL customer service with your travel and payment information.

How long does it take to resolve?

Disputes usually take a few business days, depending on the complexity of the issue.

Should I change my bank card if I see a BOps charge I don’t recognize?

Only if you suspect an unauthorized charge. Otherwise, verify with TFL first.

Conclusion

A TFL BOps charge on your bank statement is usually legitimate and relates to your travel on London public transport. Most charges cover fares, top-ups, or administrative adjustments.

Always check your travel history and match charges to trips. If you notice a mistake, contact TFL customer service promptly.

By monitoring your bank statements, keeping your Oyster balance updated, and providing accurate information when disputing charges, you can ensure your travel payments are accurate and secure.

Staying informed and vigilant helps London commuters manage their accounts confidently and avoid unnecessary worry.