How Does Uber Show Up on Your Bank Statement? A Clear Guide

Scanning your bank statement and seeing a charge you don’t immediately recognize can be worrying. Unfamiliar company names or transaction codes often lead to a moment of confusion. Among the most common of these are charges from Uber. Whether you’re a frequent rider or an occasional Uber Eats user, understanding how these transactions appear can save you time and stress. This guide will walk you through what Uber charges look like, why they might seem confusing, and how to verify every transaction.

How Uber Payments Are Processed

Uber’s convenience comes from its seamless payment system. When you set up your account, you link a payment method, such as a credit card, debit card, or PayPal account. After you complete a ride or receive a food delivery, the cost is automatically charged to your selected payment method. This direct link between the app and your bank is what makes the process so smooth.

If you’re curious about other financial transactions appearing on statements, you might also find our guide on what is the WLY Complete Save charge on your bank statement useful for comparison.

What Uber Charges Look Like on a Bank Statement

The description of an Uber charge on your bank statement can vary. It depends on your bank, your country, and the specific service you used. Most of the time, you will see a clear and recognizable descriptor.

Common examples include:

- UBER TRIP

- UBER TRIP

- UBER EATS

- UBER EATS

- UBER BV

- UBER.COM

The “BV” in “UBER BV” refers to a specific corporate entity of Uber based in the Netherlands, which processes many international payments. You might see this even if you are not in Europe. The key is to look for the “UBER” name, which is almost always present.

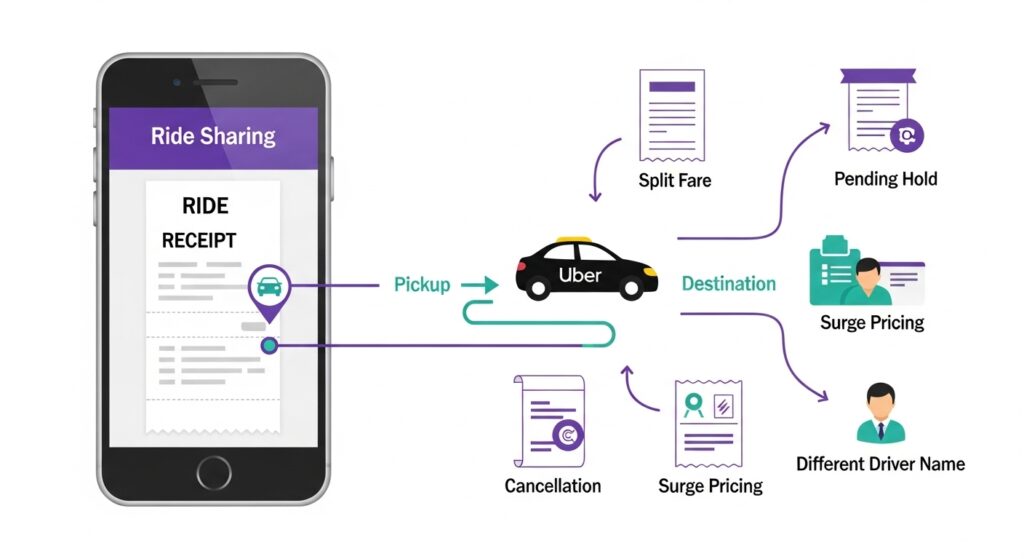

Why Uber Transactions Might Look Confusing

Sometimes, an Uber charge doesn’t match the final price you remember, or you might see multiple entries for a single trip. Here are a few common reasons why. Pending vs. Posted Charges: When you first take a trip, your bank may show a “pending” charge.

This might be a temporary authorization hold to ensure your payment method is valid. The final, “posted” charge will appear a day or two later and will reflect the actual cost of your ride, including any tips or adjustments.

Understanding similar temporary holds can also help when reviewing other transactions, like those detailed in our article on what is NWEDI on a bank statement: a simple guide.

How to Verify an Uber Charge

If you see an Uber charge and want to confirm its legitimacy, the best place to start is within the Uber app itself. It keeps a detailed record of all your activity. Open the app, navigate to your trip history, and compare dates and amounts.

Similarly, if you’re reviewing other unfamiliar charges, you might find it helpful to read how does Paramount Plus show up on a bank statement to understand how subscription-based services report transactions.

Follow these steps:

- Open the Uber app on your smartphone.

- Tap the menu icon (usually three horizontal lines) or your profile picture.

- Select “Your Trips” or “Wallet” and then “Trip History.” For food orders, go to the Uber Eats app or section and check your “Orders.”

- Here, you’ll find a list of all your past rides and orders, complete with dates, times, routes, and final costs.

- Tap on any specific trip or order to view a detailed receipt. You can match the date and amount on the receipt with the charge on your bank statement.

What to Do If You Don’t Recognize an Uber Charge

If you’ve checked your trip history and still can’t identify a charge, it’s time to take action.

- Dispute Within the App: For any trip or order, there is an option to get help or report an issue. You can use this feature to flag an incorrect fare or a trip you don’t believe you took. Uber’s support team will review your claim.

- Contact Your Bank: If you suspect fraud or can’t resolve the issue through Uber, contact your bank or credit card company immediately. They can investigate the charge, block further unauthorized transactions, and guide you through the process of filing a formal dispute.

- Identify Possible Fraud: If you don’t have an Uber account but see a charge, it’s a clear sign of fraud. Someone may have stolen your card information. In this case, your first call should be to your bank to cancel the card and dispute the charge.

Tips to Avoid Future Confusion

A few simple habits can help you keep track of your Uber spending and avoid any future surprises on your bank statement. Regularly check your history and consider using alerts from your bank. For example, keeping tabs on fluctuations in commodities or digital assets can be simpler if you understand how charges are presented, as explained in our guide on Silver Price FintechZoom.

Using a dedicated payment method also makes it easier to reconcile all your expenses, including unfamiliar entries from financial apps or services like FintechZoom Google Stock.

- Regularly Check Your History: Make it a habit to periodically review your trip and order history in the Uber app. This helps you stay familiar with your spending.

- Set Up Alerts: Most banks and credit card companies allow you to set up transaction alerts. You can receive a text or email notification every time your card is charged, helping you spot unauthorized use instantly.

- Use a Dedicated Payment Method: Consider using a single credit card or a digital wallet for all your Uber transactions. This makes it much easier to track and review your spending in one place.

Conclusion

Seeing an “UBER” charge on your bank statement is usually nothing to worry about. Most transactions are legitimate and can be easily verified within the app by checking your ride or order history. By understanding the difference between pending and posted charges and knowing how to investigate a transaction, you can manage your account with confidence. If you do spot a charge that seems wrong, act quickly by contacting Uber support or your bank to ensure your financial information stays secure.