How Do Unauthorized DoorDash Charges Show Up on Your Bank Statement?

Spotting an unrecognized charge on your bank statement can be frustrating and worrying. You scroll through your recent transactions and a purchase you don’t remember making catches your eye. For many people, these unexpected deductions come from services they use regularly, and unauthorized DoorDash charges have become a growing concern.

If you’ve found a mysterious charge from the popular food delivery service, you’re not alone. This guide will help you understand how these charges appear, why they happen, and what you can do to resolve them.

What Do Unauthorized DoorDash Charges Look Like?

When a DoorDash charge appears on your statement, it’s not always straightforward. The way it’s listed can vary depending on your bank or credit card company. Most often, the charge will include the merchant name, but it might not just say “DoorDash.”

These descriptors can sometimes be confusing. For instance, a charge for “DOORDASH*DASHPASS” could be a legitimate subscription renewal you forgot about. The key is to look for any DoorDash-related transaction that doesn’t match a recent order you placed or a subscription you knowingly have.

Common Reasons for Unauthorized Charges

There are several reasons why you might see a DoorDash charge you don’t recognize. While it’s easy to assume the worst, it’s helpful to consider all possibilities.

- Fraudulent Use of Stolen Cards: If your physical credit or debit card was lost or stolen, or if the card number was skimmed, a thief could have added it to their own DoorDash account to place orders.

- Account Hacking: Your DoorDash account itself might have been compromised. This can happen if your login details (email and password) were exposed in a data breach from another website and you reuse passwords across different services.

- Family or Friends Using Your Account: Sometimes, the culprit is closer to home. A family member or friend who has access to your phone, computer, or account details might have placed an order without your permission. This is especially common with shared devices.

- Mistaken Recurring Payments: You may have signed up for a free trial of DashPass, the service’s subscription for free delivery, and forgotten to cancel it before it renewed. These recurring charges can easily be mistaken for unauthorized activity.

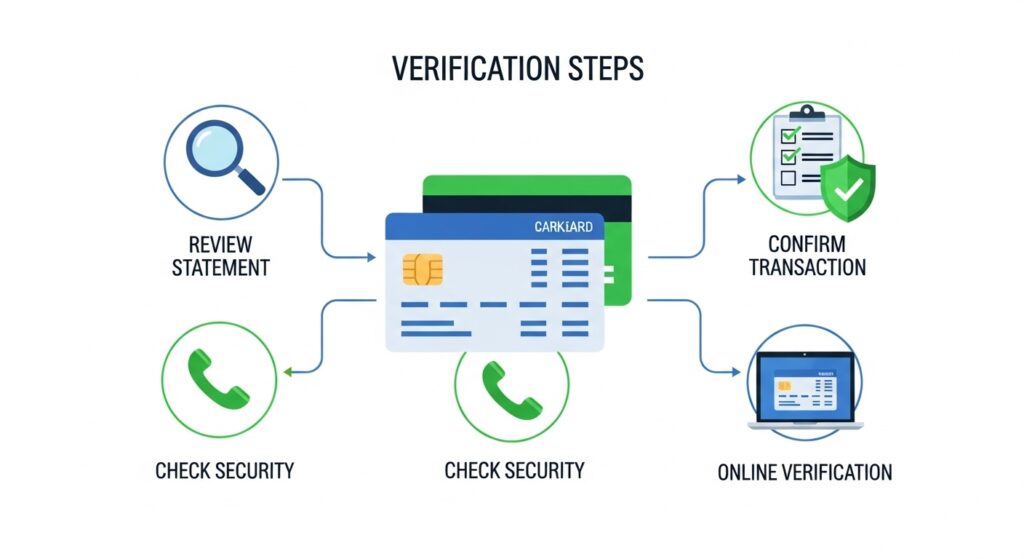

How to Verify If the Charge Is Truly Unauthorized

Before you panic, take a few simple steps to confirm whether the charge is legitimate.

- Check Your DoorDash Order History: Open the DoorDash app or log in on their website. Navigate to the “Orders” section and review your recent order history. Look for an order that matches the date and amount of the charge on your bank statement. If you’re trying to compare other service charges as well, you might find our guide on how does Uber show up on your bank statement useful to spot similar patterns.

- Review Saved Payment Methods: In your account settings, look at the saved payment methods. Do you recognize all the cards listed? Sometimes, an old card you thought was removed is still active.

- Contact DoorDash Support: If you still can’t identify the charge, reach out to DoorDash support directly through the app or website. Provide them with the transaction date, amount, and the last four digits of your card. They can often trace the charge and tell you which account it was used on. For additional insights on unfamiliar statement entries, you can also check our article on what is NWEDI on a bank statement.

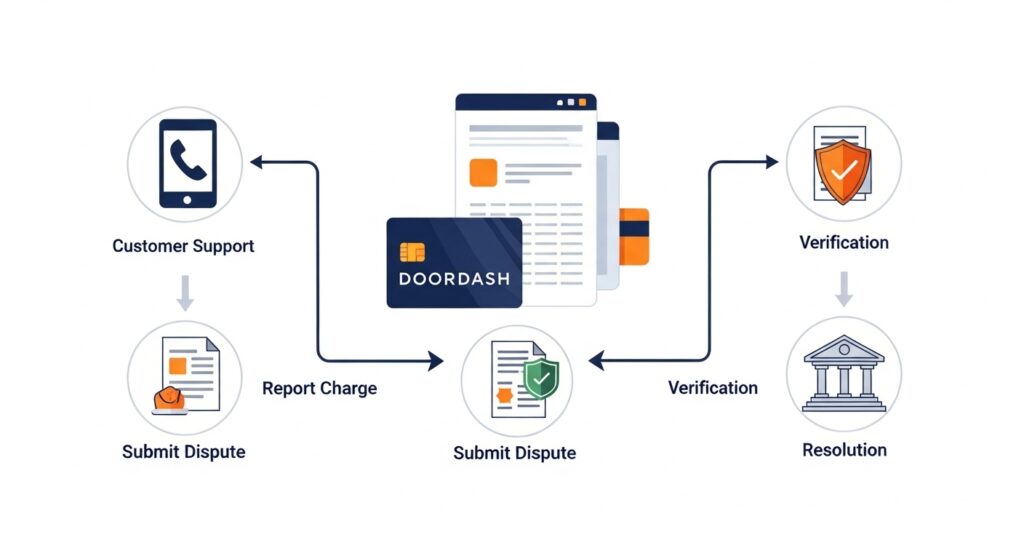

What to Do If You Spot an Unauthorized DoorDash Charge

If you’ve confirmed the charge is not yours, it’s important to act quickly to protect your account and your finances.

- Immediate Steps: The first thing you should do is report the charge to DoorDash’s support team. At the same time, change your DoorDash password to something strong and unique. As a precaution, remove all saved payment methods from your DoorDash account until the issue is resolved. If you’re dealing with other service cards or subscriptions, our guide on how to get a CSC ServiceWorks laundry card offers practical tips for managing and securing recurring payments.

- Contact Your Bank: Call your bank or credit card company immediately to report the unauthorized transaction. They will guide you through their dispute process. Many banks allow you to file a dispute directly through their mobile app or website.

- Block or Replace the Card: Your bank will likely recommend canceling the compromised card and issuing a new one. This prevents any further fraudulent charges from being made.

How Banks Handle Disputes Over DoorDash Charges

When you dispute a charge, your bank initiates a process called a chargeback. They will temporarily credit the disputed amount back to your account while they investigate. The bank will contact DoorDash’s payment processor to get more information about the transaction.

This process can take time, with timelines ranging from a few days to several weeks, depending on your bank’s policies. As long as you report the charge promptly, financial institutions are generally very helpful in resolving clear cases of fraud.

Tips to Prevent Future Unauthorized Charges

You can take several proactive steps to secure your account and avoid future issues.

- Enable Two-Factor Authentication (2FA): Turn on 2FA in your DoorDash account settings. This adds an extra layer of security by requiring a code from your phone to log in, making it much harder for someone to access your account.

- Regularly Check Your Transactions: Make a habit of reviewing your bank and DoorDash order history at least once a week. The sooner you spot a problem, the easier it is to fix.

- Use Virtual Cards or Payment Alerts: Consider using a service that provides virtual credit card numbers for online purchases. You can set spending limits or lock the card after use. Additionally, set up transaction alerts with your bank so you get a notification for every purchase made with your card. This strategy is especially useful if you follow investment-related purchases or track fluctuations like in FintechZoom Google Stock or precious metals prices such as in Silver Price FintechZoom.

Conclusion

Finding an unauthorized charge is unsettling, but it’s a common issue that can usually be resolved. By staying vigilant, you can quickly identify suspicious activity and take the necessary steps to correct it. Remember to regularly monitor your accounts, use strong security practices like two-factor authentication, and act quickly if you see anything amiss. A little bit of caution goes a long way in keeping your financial information