What is the Home Retail Group Charge on Your Bank Statement?

Seeing an unfamiliar name on your bank statement can be worrying. You check your account, and a transaction you don’t recognize is listed. If you see the name “Home Retail Group,” it might not be immediately clear where the charge came from.

Many people feel a bit of panic when they find a mysterious transaction on their bank statement. You might wonder if your card has been stolen or if it’s a mistake. This article provides a simple bank charge explanation to help you understand what this charge means.

We will explain what the Home Retail Group is and why its name might appear on your account. We’ll also walk you through how to tell if the charge is legitimate or fraudulent and what steps to take if you need to dispute it. By the end, you’ll feel more confident about managing your bank transactions.

What is the Home Retail Group?

The Home Retail Group was a large retail company based in the United Kingdom. It owned several well-known brands that millions of people shopped at. The most famous of these were Argos and Homebase.

For many years, if you bought something from one of its stores, the charge might have appeared under the parent company’s name. This is a common practice for large corporations that own multiple brands. The central company handles the payment processing for all its stores.

Although the Home Retail Group was acquired by the supermarket chain Sainsbury’s in 2016, its name can still occasionally appear on statements. This is often due to older payment systems, recurring payments set up years ago, or how a bank processes the transaction data. The Home Retail Group meaning on your statement almost always links back to one of its former brands.

Why Does the Charge Appear?

There are several common reasons why you might see a “Home Retail Group charge” on your bank statement. Understanding these can help you quickly identify the source of the payment.

The most frequent reason is a recent purchase from Argos. If you bought electronics, toys, or furniture from an Argos store or its website, the charge might be labeled this way. Similarly, a purchase from Homebase for DIY supplies or garden items could also be the cause.

Another possibility is an online purchase charge. When you buy things online, the company name that appears on your statement can sometimes be the parent company rather than the specific website you shopped at. This is especially true if you have a subscription or a payment plan, which might be processed by a central financial department.

Sometimes, an unknown charge on a debit card is linked to a third-party payment service like PayPal. If you used PayPal to buy something from Argos or Homebase, the transaction description might show the merchant’s registered business name, which could be Home Retail Group.

Legitimate vs Fraudulent Charges

It’s important to figure out if the transaction on your bank statement is real or a sign of fraud. There are clear signs for both, which can help you decide what to do next.

A charge is likely legitimate if you or someone in your household recently made an Argos purchase or shopped at Homebase. Think back over the last few days. Did you buy a new kettle, a video game, or some paint?

The amount on your statement should match your receipt. If you notice other unfamiliar transactions, it may also help to check guides on similar entries, like what is the CCI Care Com charge on your statement to understand patterns of legitimate versus unusual charges.

On the other hand, there are red flags that could point to a fraudulent transaction. If you haven’t shopped at Argos or Homebase in months, or the charge amount seems random, you should be cautious. Small, unusual charges can also be a test by fraudsters to see if your card is active before making a larger purchase.

Also, look at the status of the transaction. A “pending” charge is one that the merchant has started but your bank has not yet finalized. It might look a little different once it is “posted,” or fully processed. Sometimes, the merchant name becomes clearer once the transaction is complete.

How to Verify the Charge

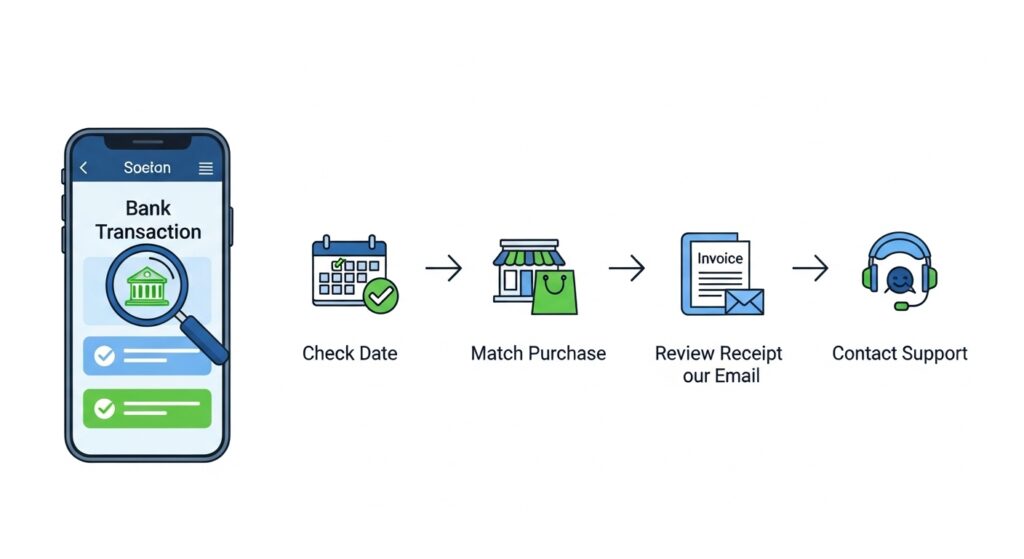

If you are unsure about the charge, there are a few simple steps you can take to verify it. This can give you peace of mind or confirm that you need to take action.

First, check your recent receipts, both paper and email. If you made an Argos or Homebase purchase, the amount and date on the receipt should match the transaction on your bank statement. This is the quickest way to solve the mystery.

Next, log into your online accounts for Argos or any other relevant retailers. Look at your order history. This will show a detailed list of your recent purchases, which you can compare against the charge on your bank account.

For additional clarity on strange merchant names, you might also review articles about Fastspring or Fsprg.com charges on bank statement to see how parent company names can appear on statements.

If you still can’t find a match, consider calling the retailer’s customer service support. They can look up transactions and may be able to confirm if the charge came from them. Have the date and amount of the transaction ready when you call.

Finally, check any direct debit charges or recurring payments you have set up. You might have an old payment plan for a large purchase, like a sofa or a washing machine, that is still active.

Steps if You Don’t Recognize It

If you have checked your records and still don’t recognize the charge, it’s time to act quickly. Taking immediate steps can protect your account from further unauthorized use.

Your first step should be to contact your bank or credit card company right away. Use the phone number on the back of your card. Tell them you have an unknown charge on your debit card or credit card and that you suspect it might be fraudulent.

While waiting for guidance, it can be helpful to read about other common statement queries, such as what is the FTB MCT refund charge on your bank statement, to better understand how banks handle unusual entries.

The bank will guide you through their process to dispute bank charges. They will likely ask you some questions to confirm your identity and the details of the transaction. Be prepared to explain why you believe the charge is not yours.

If fraud is suspected, your bank will probably recommend freezing or canceling your card to prevent any more fraudulent charges. They will then issue you a new card with a new number. This is a crucial step to secure your account.

How to Dispute the Charge

Disputing a charge you don’t recognize is a standard process, and banks are very experienced in handling these situations. The process is often called a “chargeback.”

To start the refund process, you must officially report the unauthorized transaction to your bank. They will open an investigation into the matter. You will likely need to provide any evidence you have, such as noting that you haven’t shopped at the retailer.

The bank will then contact the merchant’s bank to get more information about the charge. During this time, they may issue a provisional credit to your account for the disputed amount. This means you get your money back while they investigate.

The investigation can take some time, from a few weeks to a couple of months. If the bank rules in your favor, the provisional credit becomes permanent. If the merchant proves the charge was legitimate, the credit may be reversed. Strong customer service support from your bank is key during this process.

Preventing Future Unknown Charges

While it’s good to know how to handle a suspicious charge, it’s even better to prevent them from happening in the first place. A few simple habits can greatly improve your financial security.

Get into the habit of regular credit card monitoring. Check your online banking portal or mobile app every few days. This helps you spot any unusual activity quickly, rather than waiting for your monthly statement.

Set up transaction alerts with your bank. You can often choose to receive a text message or email for any online purchase charge, transactions over a certain amount, or foreign transactions. These real-time notifications can alert you to fraud immediately.

For additional insights on recurring unknown charges and ways to monitor them, consider reviewing resources like what does SQ mean on a bank statement or Infinite Loop charge on your statement.

Be careful about where you store your card details online. While it’s convenient to save your card for future purchases, it also increases the risk if that website’s security is breached. Consider using a digital wallet or a service that masks your card number.

Finally, practice safe online shopping. Only make purchases from secure websites (look for “https://” in the URL) and be wary of deals that seem too good to be true. A little bit of caution can save you a lot of trouble.

FAQs

Here are answers to some common questions about the Home Retail Group charge and bank statement security.

Is Home Retail Group still an active company?

No, the Home Retail Group as a standalone company no longer exists. It was acquired by Sainsbury’s in 2016. However, its name may still be used by payment processors for transactions related to its former brands, Argos and Homebase.

Why do charges still appear with this name after the company changed?

This is usually due to legacy payment systems. When companies merge, it can take a long time to update all the financial and technical systems. A merchant account might still be registered under the old name, causing it to appear on your statement.

Can a small, unfamiliar charge be a fraud test?

Yes, absolutely. Fraudsters often test a stolen card number by making a very small purchase, sometimes for less than a dollar. If it goes through, they know the card is active and will proceed to make larger, more expensive fraudulent purchases.

Do banks refund fraudulent charges quickly?

The refund process timeframe can vary. Many banks will issue a temporary credit to your account very quickly, often within a day or two of you reporting the fraud. The full investigation to make that credit permanent can take longer, but you typically get access to the funds while they work on it.

Conclusion

Finding a charge from “Home Retail Group” on your bank statement can be confusing, but it usually has a simple explanation. Most of the time, it is a legitimate transaction from a past or recent purchase at Argos or Homebase.

The key is to stay calm and check your records. By following the steps to verify the charge, you can quickly determine if it’s a normal purchase or something that needs attention. Vigilance is your best tool for financial safety. Check your bank statements carefully and regularly. If something feels wrong or you don’t recognize a transaction, act fast. Contacting your bank immediately is the best way to protect yourself and resolve any issues.