What is the FTB MCT Refund Charge on Your Bank Statement?

Checking your bank statement and seeing an unfamiliar transaction can be unsettling. Mysterious acronyms and codes often do little to clarify where the money came from or went. One such entry that can cause confusion is the “FTB MCT Refund.” While it might look cryptic, this is often a legitimate transaction from a state government agency. This article will break down what it means, why it appears, and what you should do when you see it.

What Does FTB MCT Refund Mean?

To understand this entry, let’s break down the acronyms.

- FTB: This stands for the Franchise Tax Board. The FTB is the California state agency responsible for administering and collecting state personal income tax and corporate tax. If you live or work in California, you interact with the FTB when you file your state tax return.

- MCT: This part is less straightforward but generally relates to a specific type of tax or program. It is often associated with the Middle Class Tax Refund, a one-time payment issued to eligible California residents. However, it can also refer to other tax-related adjustments or credits.

In short, an “FTB MCT Refund” is typically a deposit into your bank account from the California Franchise Tax Board, often related to a state tax refund, credit, or special payment program.

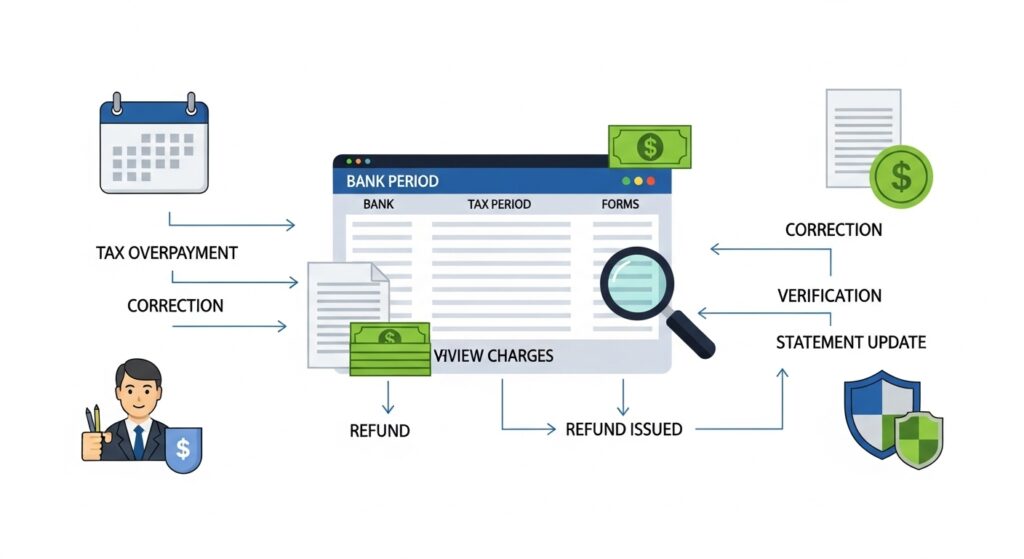

Why Does the FTB MCT Refund Appear on Your Statement?

If you are uncertain about the deposit, it’s always best to verify its authenticity. Here are the steps you can take to confirm the source of the refund:

Adjustments: The FTB may have reviewed your past tax filings and found that you were owed an additional amount due to an error or adjustment. For context on other adjustment-related charges, see our breakdown of the SEI charge.

Tax Overpayment: You may have paid more in state taxes than you owed, and this is your refund. Similar to other common statement entries, like the LBK or LC charge, understanding the origin of each transaction can give you peace of mind.

Tax Credits: You might be eligible for certain state tax credits, such as the Middle Class Tax Refund, which are issued as direct deposits or debit cards. If you want to compare with other credit-related entries, you can check our guide on the Cantaloupe Malvern PA charge.

Is the FTB MCT Refund Legitimate?

In most cases, a deposit labeled “FTB MCT Refund” is a legitimate payment from the California Franchise Tax Board. If you recently filed your California state taxes or were expecting a state-sponsored refund like the Middle Class Tax Refund, this transaction likely corresponds to that.

The key is to match the transaction to your own financial records. Does the amount align with the refund you were expecting on your tax return? Did you receive any official notices from the FTB about an upcoming payment? If the details line up, you can be reasonably sure it is valid.

How to Verify the Refund

If you are uncertain about the deposit, it’s always best to verify its authenticity. Here are the steps you can take to confirm the source of the refund:

- Check Your Recent Tax Filings: Review a copy of your most recently filed California tax return. Look for the refund amount you calculated. Does it match the deposit?

- Log into the FTB Website: The most reliable way to verify the payment is to log into your “MyFTB” account on the official Franchise Tax Board website. Your account will show a history of payments, refunds, and correspondence. You can also compare similar entries to better understand how different refund codes work, such as the CRO charge.

- Review Official Correspondence: Check your mail and email for any notices from the FTB. They often send letters explaining any refunds or adjustments made to your account.

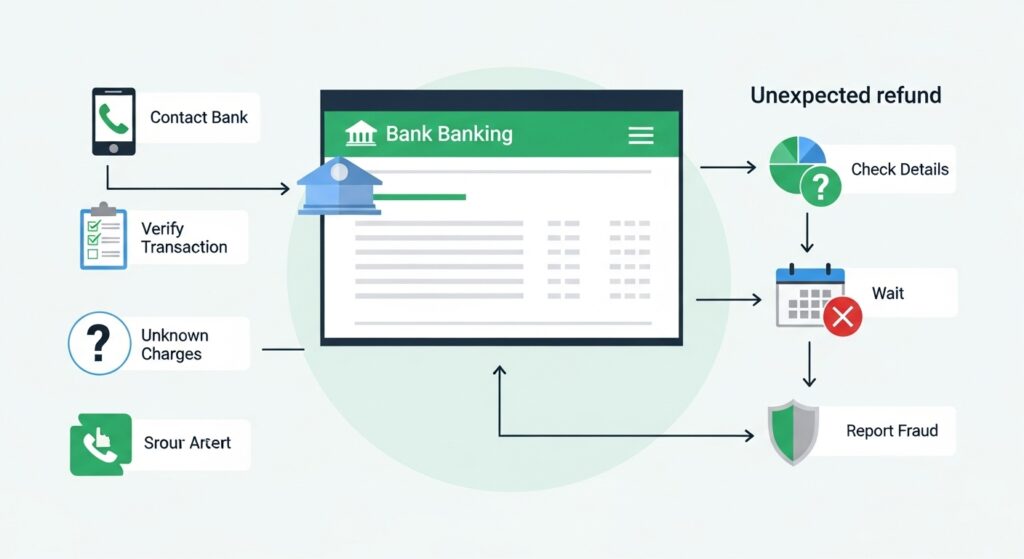

What to Do If You Don’t Expect This Refund

Sometimes, a refund can appear when you weren’t expecting one. If this happens, it’s important to act cautiously.

First, do not spend the money until you have confirmed it belongs to you. It could be an error, and if you spend it, you will likely have to pay it back.

Next, contact the appropriate parties. You can call the Franchise Tax Board directly to ask about the transaction. Have your personal information and the transaction details ready. You can also contact your bank to see if they have any more information on the source of the deposit.

How to Protect Yourself from Fraud

While most FTB MCT Refunds are legitimate, it’s wise to be vigilant. Scammers can use the confusion around tax refunds to their advantage. Here are some warning signs of potential fraud:

- You receive a phone call, text, or email from someone claiming to be from the FTB asking for personal information to “process” your refund. The FTB typically communicates via official mail or through your secure MyFTB account. For more insights on safeguarding your financial transactions, see our tips on Silver Price FintechZoom.

- The amount is significantly different from what you expected.

- The deposit is followed by a request to send some of the money back or to another account.

Always verify unexpected transactions directly through official channels. Never provide personal information like your Social Security number or bank details in response to an unsolicited request. If you suspect fraud, report it to your bank and the FTB immediately.

Conclusion

An “FTB MCT Refund” on your bank statement is usually good news—it’s money back from the California Franchise Tax Board. In most instances, it represents a standard tax refund or a special credit you were eligible for. However, because financial security is so important, you should always take a moment to verify any unexpected deposit.

By checking your tax records and using the official FTB website, you can confirm the payment is legitimate and enjoy your refund with peace of mind.