What is the FirstOnline Charge on Your Bank Statement? A Simple Guide

Have you ever checked your bank statement and seen a charge that made you scratch your head? Finding a mysterious transaction can be stressful. Many people feel this way when they see something called a “FirstOnline Charge” listed on their account.

This guide will give you a clear bank charge explanation for this common entry. We will explore what this charge is, why it appears, and what you should do about it. By the end, you will know how to handle it confidently.

What Is the FirstOnline Charge?

A “FirstOnline Charge” is a label that appears on your bank or credit card statement for a purchase made online. It is not a charge from a company named “FirstOnline.” Instead, it is a general description used by some banks or payment processors for an online transaction.

This label can show up for payments made with a debit card, credit card, or through a digital wallet. The name on your statement can sometimes be confusing. Your bank might use terms like “FirstOnline Payment” or another generic description for an online transaction charge.

Why Does the FirstOnline Charge Appear?

There are several reasons you might see a FirstOnline charge. The most common reason is that you recently bought something on the internet. This could be anything from clothes and gadgets to digital software or movie tickets.

Sometimes, this charge is for a subscription service that automatically renewed. It might also be from a free trial that has ended and turned into a paid membership. The name “FirstOnline” is used because the payment was processed through an online system, and the merchant’s name wasn’t clearly passed to your bank.

Is the FirstOnline Charge Legitimate or Fraudulent?

Deciding if the charge is real or fake is the most important step. A charge is legitimate if you or someone you authorized made the purchase. Think back to any recent online shopping you have done, even for small amounts.

However, it could be a fraudulent charge if you have no memory of making the transaction. This unauthorized transaction could mean someone has stolen your card information. Warning signs include multiple small charges or a large purchase from a store you have never visited.

How to Confirm the Source of the Charge

Before panicking, take a few steps to investigate the charge on your credit card statement. First, look at the date and the amount of the transaction. Does it match any recent online activity or email receipts you have?

If you recognize the amount but not the name, try searching online for the merchant associated with the charge description. Sometimes a quick search reveals the company behind the generic name. Checking your email for receipts from around the same date is also a great way to connect the dots.

If you are still unsure, think about any free trials you signed up for. Many services start charging your card automatically after the trial period ends. This is a common reason for a surprise FirstOnline payment.

Sometimes a quick online search can help identify the merchant behind a generic name. If you encounter other ambiguous transaction names, you might find guidance in resources like What Is the FTB MCT Refund Charge on Your Bank Statement? or What Is the Google Supercell Charge on Your Bank Statement?. These examples show how banks often list charges differently than the merchant’s actual name, which can help you spot legitimate purchases versus unauthorized ones.

Common Examples of FirstOnline Transactions

Many types of online purchases can appear with this label. It is often linked to digital goods, like streaming service subscriptions, e-books, or software downloads. E-commerce websites that sell physical products can also trigger this description.

A very common scenario involves free trials. You might sign up for a service, provide your card details, and forget to cancel. When the trial ends, the company charges your card, and it might appear as a FirstOnline charge.

Fraudsters also use this confusion to their advantage. They might make a small “test” charge to see if your card is active before making larger, more obvious fraudulent purchases. Always pay attention to even the smallest unknown charges.

What To Do If You Don’t Recognize the Charge

If you have reviewed your records and still do not recognize the transaction, you must act quickly. The first thing you should do is contact your bank or credit card company immediately. Their phone number is usually on the back of your card.

Explain that you see a charge you do not recognize and ask for more details. The bank may be able to provide more information about the merchant. If it looks like a fraudulent charge, ask them to freeze or block your card to prevent any more unauthorized transactions.

How to Dispute a FirstOnline Charge

If you confirm the charge is unauthorized, you have the right to challenge it. This process is called filing a dispute. Your bank will guide you through the steps of how to dispute bank charges.

You will typically need to fill out a form or speak with the fraud department. Be prepared to explain why you believe the charge is incorrect. Under consumer protection laws, you are protected from paying for fraudulent credit card billing.

Once you file a dispute, the bank will investigate the claim. This can take anywhere from a few days to a couple of months. While they investigate, they will often issue a temporary credit to your account for the disputed amount.

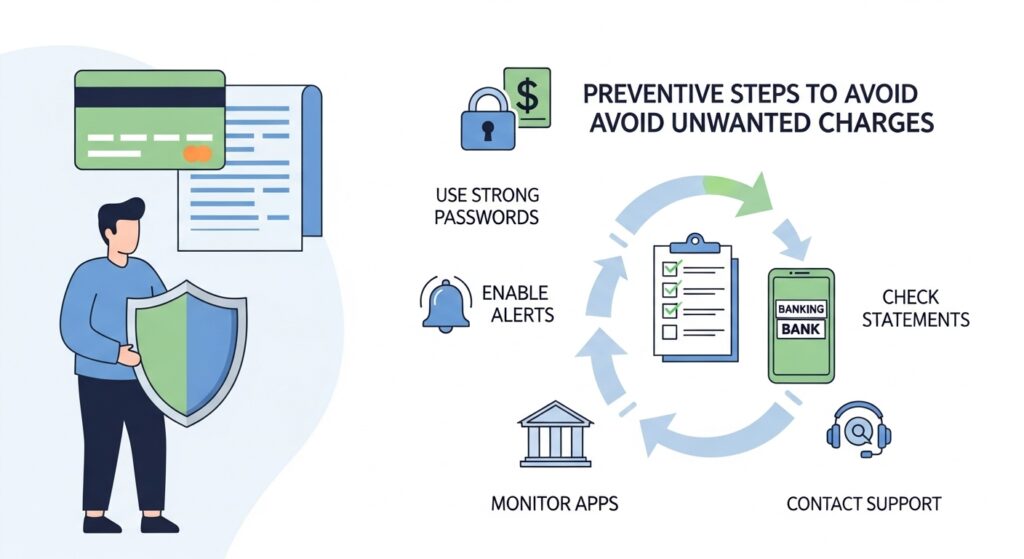

Protecting Yourself from Future Unwanted Charges

You can take several simple steps to protect yourself from confusing or fraudulent charges. One of the best habits is to check your bank and credit card statements regularly, at least once a week. Setting up transaction alerts with your bank can also notify you of any activity right away.

For better security, consider using virtual credit cards for online shopping. These create a temporary card number for a single transaction, protecting your real card details. This makes for a more secure online payment and reduces the risk of fraud.

Finally, be careful with free trials that ask for your card information. If you sign up for one, set a reminder on your phone or calendar to cancel it before it ends. This simple step can save you from unwanted subscription fees down the line.

For further reading on preventing confusion with unexpected charges, consider reviewing Infinite Loop Charge on Your Statement. This article offers insight into how some recurring or automated online payments can appear unexpectedly on your account, and tips to avoid them in the future.

Frequently Asked Questions

Is FirstOnline a scam?

No, “FirstOnline” itself is not a scam or a company. It is a generic label that some banking systems use to describe an online transaction. However, a charge labeled this way could be fraudulent if you did not authorize it.

Can my bank remove the charge instantly?

Banks typically cannot remove a charge instantly. They must follow a dispute process to investigate the transaction with the merchant. They will usually provide a temporary credit to your account while the investigation is ongoing.

Will I get my money back if it’s a fraudulent charge?

Yes, in most cases, you will get your money back for a confirmed fraudulent charge. Consumer protection laws limit your liability for unauthorized transactions. As long as you report the fraudulent charge promptly, your bank should refund the money after its investigation.

You can also explore similar common charges to better understand unusual transactions. For instance, if you want to see another example of a confusing charge, check out What Is the Harland Services Charge on Your Bank Statement? or learn about digital purchase labels via Fastspring or Fsprg.com Charges on Bank Statement. Understanding these can help you quickly identify unfamiliar entries on your own statements.

Conclusion

Seeing an unfamiliar “FirstOnline Charge” can be alarming, but it is usually a problem you can solve. Most of the time, it is a legitimate purchase with a confusing description. By carefully checking your records, you can often identify its source. If you determine it is a fraudulent charge, know that you have rights and protections.

The key is to act quickly by contacting your bank to dispute the transaction. Regularly monitoring your credit card statement and practicing safe online shopping habits will help you stay in control of your finances and avoid future surprises.