What is the Epoch Charge on Your Bank Statement?

Introduction

Finding a strange charge on your bank statement can be stressful. One name that often confuses people is the Epoch charge. You might not recognize it right away, which can make you wonder if your account was hacked.

The truth is, this charge is linked to certain online payments. Sometimes it’s legitimate, other times it may point to an unauthorized transaction. Understanding what it means will help you decide what steps to take.

Understanding the Epoch Charge

The Epoch charge comes from Epoch Payment Solutions, a company that processes online payments. Instead of seeing the company you actually bought from, your bank may list “Epoch” as the merchant. That’s why the name often feels unfamiliar.

Similar to how a charge like Home Retail Group charge on bank statement might appear under a parent company’s name, Epoch works in the background while your bank statement shows only the processor’s label.

Many digital subscriptions, apps, or online services use Epoch to handle billing. For example, if you signed up for a membership, a gaming service, or a streaming site, Epoch might be the one processing the payment in the background.

It’s similar to when you shop online and see a third-party payment processor like PayPal or Stripe. Epoch works the same way, but the statement just shows “Epoch” instead of the brand you recognize.

Why You Might See This Charge

There are a few reasons why the Epoch charge might appear on your bank statement. The most common one is a recurring subscription you signed up for but forgot about. Streaming apps, dating services, or cloud storage plans often renew automatically.

In some ways, it’s comparable to seeing a charge for Cantaloupe Malvern PA charge on bank statement, where the payment processor’s name appears instead of the service you recognize.

Another reason could be an app purchase or online service you made recently. Maybe you bought premium features in a game, or upgraded from a free trial to a paid account. If the platform uses Epoch, that’s the name that shows on your bill.

In some cases, it could also point to an unauthorized bank transaction. If you never signed up for the service or don’t recognize the amount, it’s worth taking a closer look.

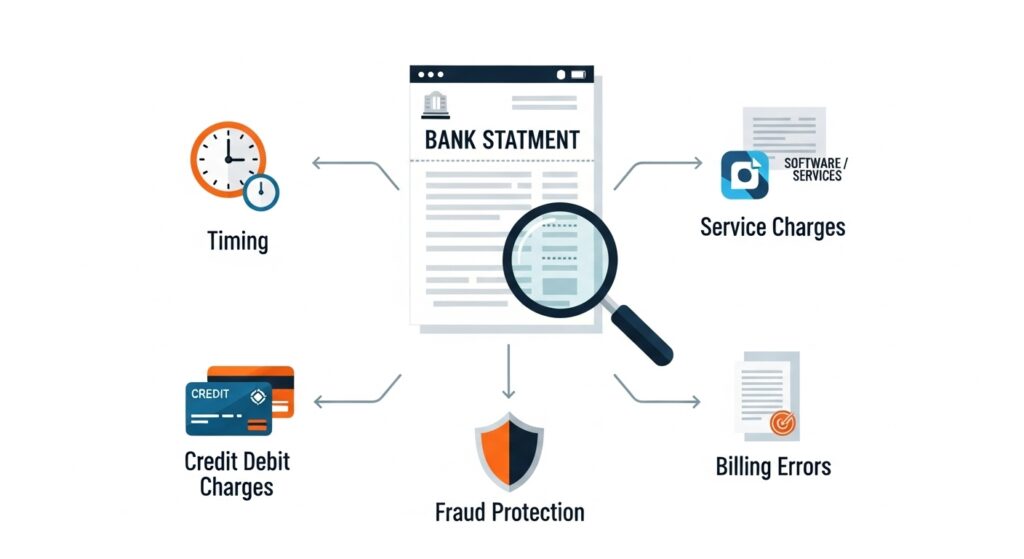

How to Verify the Epoch Charge

When you spot this charge, the first step is to check your bank statement carefully. Look at the date, the exact amount, and how often it appears. If it shows up monthly, it’s probably a subscription.

Next, try to match the amount with recent purchases. For example, if you pay $9.99 for a streaming app, see if the charge lines up with your subscription cycle. Checking your email for digital receipts can also help.

Most banking apps let you tap on a transaction for more details. Sometimes you’ll find extra information, such as the merchant’s contact number or website. This makes it easier to connect the charge to the right service.

Is the Epoch Charge Legitimate or Fraudulent?

Not every unexpected charge is a scam. If you signed up for a service and simply forgot, the Epoch charge is legitimate. It’s similar to how a legitimate LBK or LC charge on your bank statement might appear under a payment processor rather than the merchant name. But there are signs of fraudulent bank transactions you should not ignore, such as multiple charges in a short period or amounts you never agreed to.

But there are signs of fraudulent bank transactions you should not ignore. If you see multiple charges in a short time, charges in amounts you never agreed to, or services you never used, those are red flags.

When in doubt, try to log in to the service you suspect is linked. If you don’t have an account, or the amount doesn’t match, treat it as suspicious and take action right away.

Steps to Resolve an Unauthorized Epoch Charge

If you’re sure the charge isn’t yours, start by contacting your bank. Most banks allow you to dispute the charge through their app, website, or by calling customer service. Tell them it’s an unauthorized bank transaction and request a review.

You can also check guides like CRO charge on your bank statement or FTB MCT refund charge on your bank statement to see how similar disputes are handled, giving you confidence during the resolution process.

Next, you can also contact the merchant or service provider directly. Sometimes they’ll confirm what the charge was for and offer a refund if it was a mistake.

If needed, go through the payment dispute process. Banks may temporarily credit the amount back to your account while they investigate. Keep records of emails, receipts, and screenshots in case you need proof.

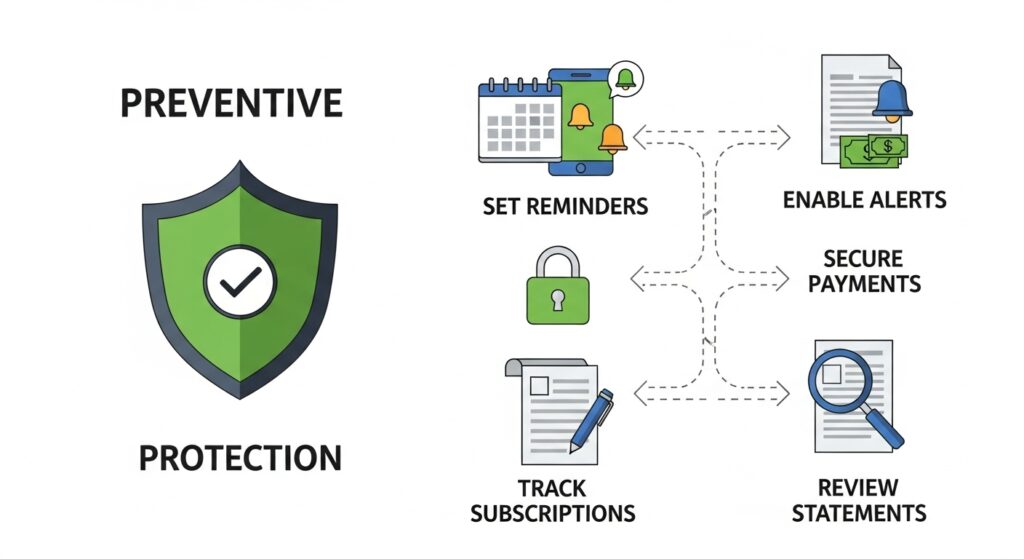

Preventing Future Unexpected Charges

To avoid surprises, make a habit of monitoring subscriptions regularly. Check which apps or services have your card on file and cancel the ones you no longer use.

Consider using virtual cards or payment alerts. Many banks now let you create a temporary card number for online purchases. If that card is charged, you’ll know exactly which service used it.

Also, practice secure online banking. Use strong passwords, avoid saving card details on every site, and enable two-factor authentication where possible. These small steps reduce the risk of fraudulent charges.

Frequently Asked Questions (FAQs)

How long does it take to reverse an Epoch charge?

It depends on your bank. Some resolve disputes within a few days, while others may take weeks to complete an investigation.

Can I prevent Epoch charges completely?

You can’t stop the processor from being used, but you can manage your subscriptions and payment methods. Keeping track of digital subscription charges will reduce surprises.

Who can I contact if I don’t recognize the charge?

Start with your bank. You can also visit Epoch’s official website, where they have a charge lookup tool. By entering details like the last digits of your card, you may be able to see which service billed you.

Conclusion

Seeing an Epoch charge on your bank statement can feel alarming at first. In most cases, it’s just a digital payment linked to a subscription or online service you’ve used. But sometimes it can be a sign of fraudulent bank transactions that need immediate attention.

By knowing how to identify unknown charges, verify payments, and follow the refund for bank charge process when needed, you stay in control of your money. Checking your statements often, managing subscriptions, and using secure payment methods will keep your finances safe.