What is the BMACH Charge on Your Bank Statement?

Introduction

Seeing an unexpected bank charge on your statement can be confusing. Many people feel worried when they spot a fee they don’t understand. One common example is something called the BMACH charge.

This type of charge often appears when you use an ATM or make a transaction through certain banking networks. The good news is that it’s usually easy to explain once you know what it means.

What Is the BMACH Charge?

The BMACH charge is a fee linked to using the BMACH network, which connects banks and ATMs. Think of it as a middleman that helps banks handle debit card transactions and ATM requests.

When you withdraw cash, check your balance, or make certain card transactions, the system that processes the request may be BMACH. If your bank charges a fee for using this service, it shows up as a “BMACH charge” on your bank statement.

So, the word isn’t random. It’s simply the name of the network your transaction passed through.

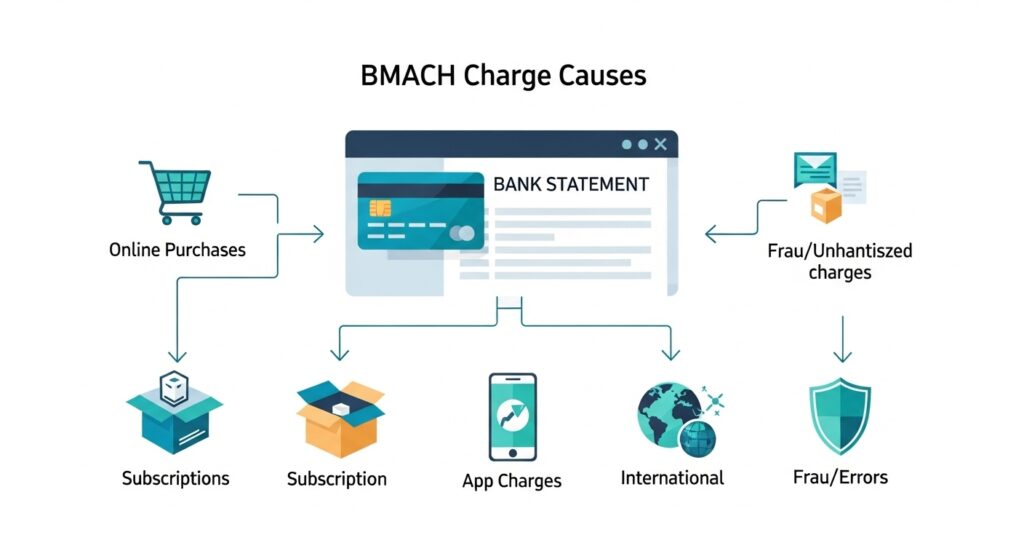

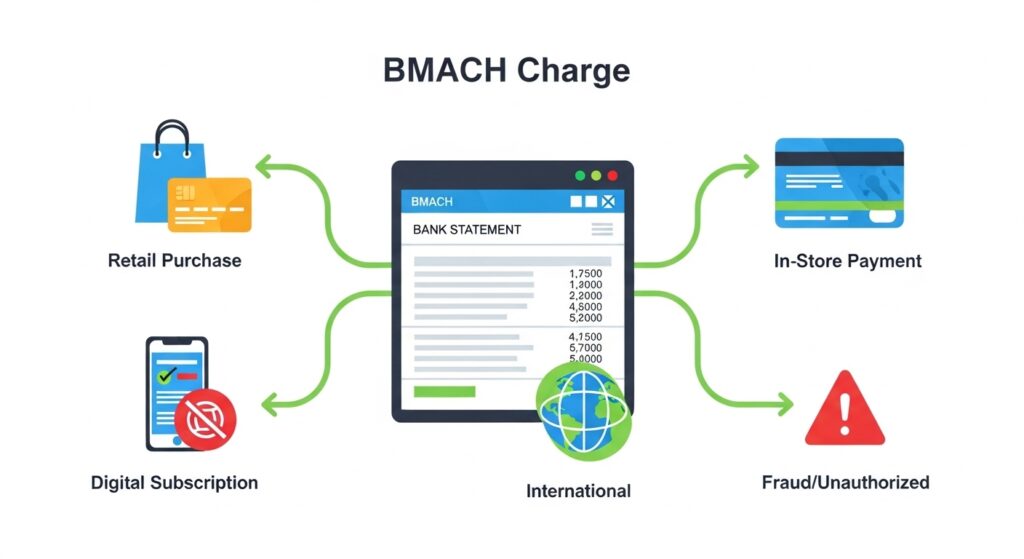

Why Does the BMACH Charge Appear on Your Bank Statement?

There are several reasons this charge might show up. The most common one is when you use an ATM outside your bank’s network. Banks often charge a fee for that, and BMACH may be the processor.

It can also appear when you check your balance at an ATM that doesn’t belong to your bank. Even simple actions like this may trigger a small fee. In some cases, the charge appears during online transactions that use the BMACH system.

Is the BMACH Charge Legitimate or Fraudulent?

Not all unexpected charges are scams. In fact, most BMACH charges are legitimate fees from real banking activity. If you used your card at an ATM recently, the charge likely matches that action.

For instance, if you’ve seen other unexpected charges like the Epoch charge on your bank statement, it’s usually a sign that these are normal network or processing fees rather than fraud.

But it’s still important to be careful. If you don’t remember using an ATM or making a related transaction, it could be an unauthorized transaction. Always review your activity before assuming the charge is safe.

Fraudulent charges usually appear in odd amounts, repeat several times, or come from locations you’ve never visited. Those are warning signs to act quickly.

Common Scenarios Where You May See BMACH Charges

Here are some everyday examples of when you might see this fee:

- ATM withdrawals outside your bank. If you take out cash at another bank’s ATM, the BMACH fee may apply.

- Balance checks at ATMs. Even checking your account balance can lead to a small BMACH charge.

- Cross-bank transactions. If your card is used at a bank that isn’t your own, the network often applies this charge.

- International card use. Using your card abroad may involve BMACH or similar networks, leading to extra fees.

- Online transactions. Some digital payments are processed through BMACH, creating a line item on your statement.

How Much Does a BMACH Charge Cost?

The cost depends on your bank and the type of transaction. Some BMACH fees are just a few cents, while others can be a few dollars.

For example, withdrawing cash from another bank’s ATM might cost $2–$5. A balance check might be less, but still enough to show up as an unexpected charge.

The exact fee can vary because each bank sets its own rules. That’s why two people may see different amounts for the same type of transaction.

How to Confirm If the Charge Is Real

To be sure the charge is legitimate, start by checking your own actions. Ask yourself if you used an ATM or made an online purchase around that time.

Comparing it with similar entries, such as Home Retail Group charge on your bank statement, can help you spot patterns in fees and identify what is routine versus unusual.

Next, compare the transaction details with your recent activity. Most banking apps let you tap on a charge to see the date, time, and sometimes even the location of the ATM.

If you’re still unsure, contact your bank’s customer support. They can explain the charge and confirm whether it came from your own transactions or from suspicious activity.

What to Do If You Don’t Recognize the BMACH Charge

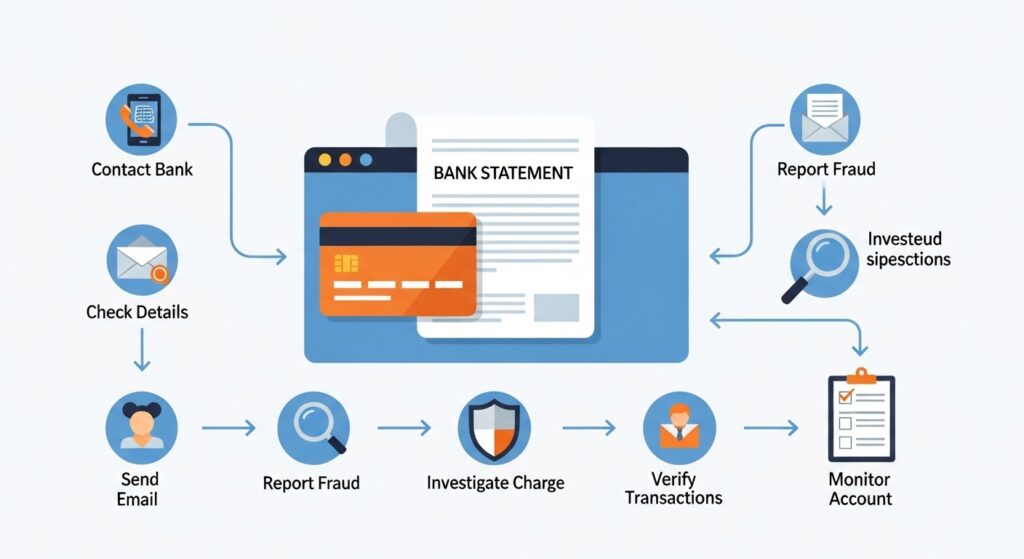

If you believe the charge is a mistake or fraud, don’t ignore it. Take these steps right away:

- Check your history. Look at all your recent ATM and debit card transactions.

- Call your bank’s customer support. Explain that you don’t recognize the BMACH charge.

- Request details. Ask for the exact location or service linked to the charge.

- Dispute the charge. If it wasn’t your transaction, file a claim with your bank.

- File a fraud report. If needed, the bank may block your card and send you a new one.

Seeing unexplained charges similar to Cantaloupe Malvern PA charge on your bank statement or CRO charge is a common reason to start this process. Acting promptly protects you from potential fraud.

How to Avoid BMACH Charges in the Future

Here are some ways to cut down on these charges:

- Use in-network ATMs. Stick to machines owned by your bank to avoid extra network fees.

- Check bank fee policies. Before traveling or withdrawing money, know what your bank charges for out-of-network use.

- Use online banking apps. Instead of checking balances at ATMs, log in to your bank’s app for free.

- Plan withdrawals. Take out enough cash at once so you don’t need multiple out-of-network transactions.

Learning from other charges, like the FTB MCT Refund charge on your bank statement, can also give insight into avoiding similar fees in the future.

Safe Banking Tips

While small fees are annoying, the bigger concern is fraud prevention. Protecting your card and account details can save you from major problems.

Here are a few safe banking practices:

- Monitor bank statements every week to catch unexpected bank charges early.

- Set up account alerts. Many banks will text or email you when a new transaction happens.

- Protect your card information. Never share your PIN, and cover the keypad at ATMs.

- Avoid suspicious ATMs. Stick to machines in secure, well-lit areas.

These steps not only help with BMACH fees but also reduce the chance of unauthorized transactions.

FAQs About BMACH Charges

Is it always a fee?

Not always. Sometimes it’s just the network’s name on your statement, but usually it does involve a small fee.

Can I get it refunded?

If the fee was charged by mistake or linked to fraud, you can often get it refunded. But if it was a legitimate fee, banks usually won’t refund it.

Will it affect my credit score?

No. A BMACH charge does not affect your credit score. It’s just a debit card or ATM transaction, not a credit report item.

Conclusion

The BMACH charge on your bank statement may look strange, but in most cases it’s just a normal ATM fee or debit card transaction. It usually happens when you use your card outside your bank’s network.

Still, it’s important to double-check. If you don’t recognize the charge, follow the dispute process and contact your bank’s customer support right away.

By keeping track of your activity, watching for unexpected charges, and following safe banking tips, you’ll stay in control of your money. Don’t panic when you see BMACH on your statement—just take the right steps to understand it.