What is the BillMatrix Charge on Your Bank Statement?

Introduction

Finding a strange charge on your bank statement can be stressful. Many people panic when they see a name they don’t recognize. One common example is the BillMatrix charge.

You may ask yourself, “What is this and why am I paying it?” The good news is that in most cases, there is a simple bank charge explanation. This article will break it down step by step.

What Is BillMatrix?

BillMatrix is a payment processing company. They work as a middleman between banks, service providers, and customers. Instead of paying your bill directly to the company, the payment goes through BillMatrix.

They handle BillMatrix payments for things like utilities, loans, mortgages, and insurance. Many large banks, including BillMatrix Wells Fargo, use their system. That’s why you may see the name even if you never signed up with them directly.

Banks and companies use BillMatrix because it makes payments fast, secure, and easy to track.

Why Does the BillMatrix Charge Appear on Your Bank Statement?

This charge usually appears because you used BillMatrix without knowing it. For example, when you pay a utility bill online, the payment may be processed through BillMatrix.

You may also see it when making credit card payments, loan payments, or mortgage payments. Some banks, like Wells Fargo, process online or phone payments through BillMatrix.

Even if you never signed up with BillMatrix, their name shows on your statement because they handled the debit card charge.

If you’re curious about similar charges, you might also want to see our guide on what is the Cantaloupe Malvern PA charge on your bank statement for another example of a payment processor charge.

Common Situations Where You Might See This Charge

- Paying bills through your bank’s website. Many banks use BillMatrix to process online bill payments.

- Utility bills. Payments for electricity, water, gas, or phone service often go through BillMatrix.

- Wells Fargo payments. Many customers see “BillMatrix Wells Fargo” when paying credit cards or mortgages.

- Auto-pay. If you set up recurring payments, they may run through BillMatrix without you noticing.

These are all normal situations where the charge is legitimate.

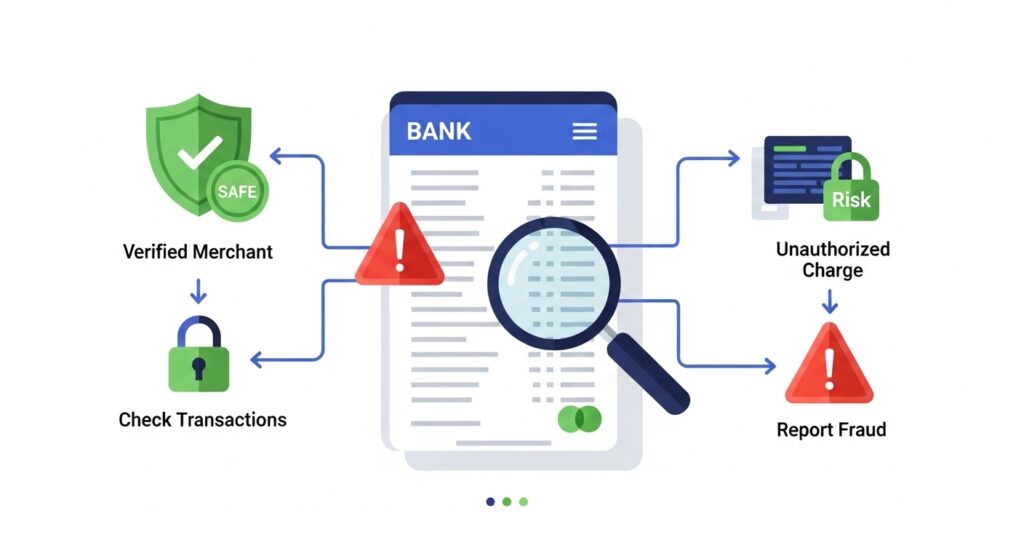

Is the BillMatrix Charge Safe or Fraudulent?

In most cases, the BillMatrix charge on statement is safe. It simply means your bank or service provider used BillMatrix to process the payment.

However, you should still watch for red flags. If you don’t remember making a BillMatrix payment, or if the amount looks wrong, it could be an unexpected charge.

For more information on similar payment processing concerns, you can also check our article about the Bmach charge on bank statement.

Fraudsters sometimes use familiar company names to trick people. If the charge doesn’t match your transaction history, treat it as suspicious.

How to Check if the Charge Is Real

The first step is to look at your recent bills. Did you pay for electricity, water, or a mortgage around that date? If yes, the BillMatrix charge is probably just that payment.

Second, check your online banking transaction history. Compare the amount with your last bill. If the numbers match, the charge is likely safe.

If you want to learn more about verifying other unusual charges, see our guide on the Cro charge on bank statement.

What To Do If You Don’t Recognize the Charge

If the charge seems wrong, don’t ignore it. Start by reviewing your account activity. Make sure no one else in your household made the payment.

Next, contact your bank and ask for details about the charge. They can explain which company requested the payment.

If it’s still unclear, you can dispute the charge. Ask your bank about filing a claim or chargeback. You can also call BillMatrix directly for help. For another example of handling an unfamiliar charge, you can read about the Chegg order charge on bank statement.

How to Prevent Future Confusion or Fraud

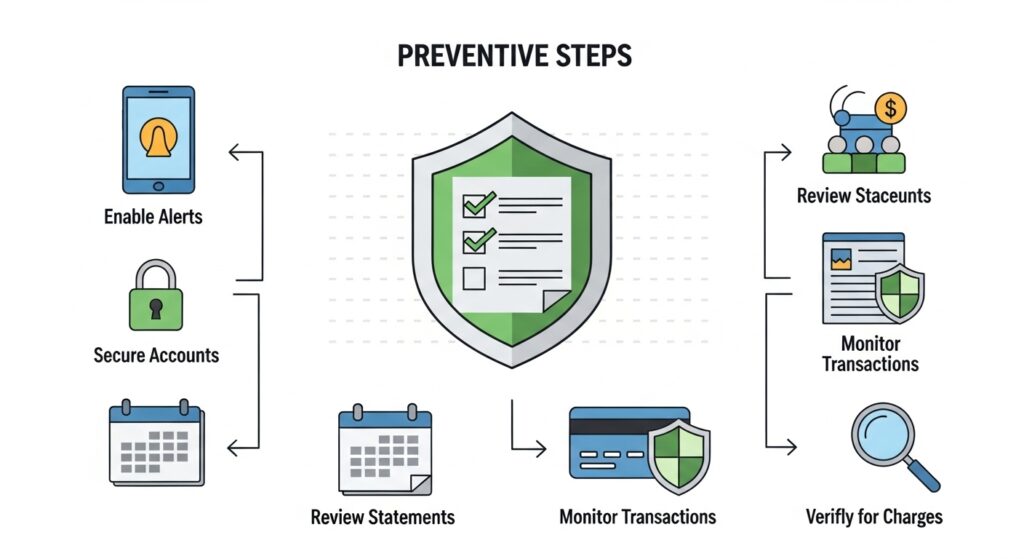

Here are some tips to avoid stress over unexpected charges:

- Keep a payment record. Write down when and how you pay bills.

- Set up payment alerts. Many banks send texts or emails when a payment goes through.

- Monitor your bank statements. Checking weekly helps you spot problems early.

- Use secure online payment methods. Always pay through official websites, not through links in emails.

These steps are simple but powerful for fraud prevention.

Real-Life Examples (Simple Scenarios)

Example 1: Paying electricity through BillMatrix.

Maria pays her electric bill online. She sees a charge from BillMatrix instead of the power company. This is normal, because the utility uses BillMatrix for processing.

Example 2: Mortgage payment on Wells Fargo via BillMatrix.

John pays his mortgage through his Wells Fargo app. His statement shows “BillMatrix Wells Fargo.” This is just the payment processor, not fraud.

Example 3: Unauthorized charge and dispute.

Lisa sees a $150 BillMatrix charge she doesn’t recognize. She checks her bills and finds nothing due. She calls her bank, files a dispute, and gets a refund.

If you’re curious about other processing services that sometimes appear unexpectedly, check out our article on Epoch charge on bank statement for another real-world scenario.

Frequently Asked Questions (FAQ)

Is BillMatrix owned by banks?

No. BillMatrix is an independent payment processor. But many banks and companies use it.

Do I pay extra fees when using BillMatrix?

Sometimes. Some billers add a small fee for using BillMatrix, especially for debit card charges.

Can fraudsters use the BillMatrix name?

Yes, scammers may fake the name. Always double-check your transaction history to be safe.

How long do refunds take?

If you dispute a charge, refunds may take a few days to a few weeks, depending on your bank.

Conclusion

The BillMatrix charge on your bank statement may look strange, but in most cases, it’s just a BillMatrix payment for a bill. It shows up because many banks, utilities, and lenders use BillMatrix as a processor.

Still, it’s important to stay alert. If the charge doesn’t match your activity, follow steps for fraud prevention and dispute the charge if needed.

By keeping records, checking statements, and using secure online payments, you can avoid confusion and protect your money. Remember: most of the time, there’s no need to panic—just take a closer look.