What is the LPS Charge on Your Bank Statement?

Have you ever looked at your bank statement and seen a charge you didn’t recognize? It happens to many people. One of the most common mystery charges is labeled “LPS Charge.” Seeing this on your statement can be confusing and even a little scary, but there’s usually a simple explanation.

This guide will help you understand what an LPS charge is. We will explore why it appears, how to know if it’s legitimate, and what to do if you think it’s a mistake. Learning about these charges is a great step toward better financial security.

What is the LPS Charge?

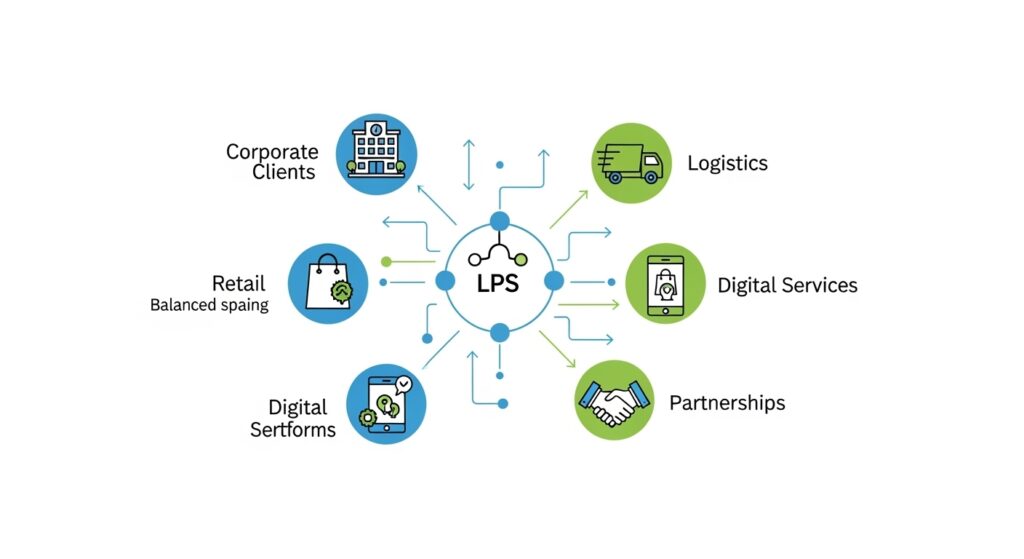

An LPS charge is a transaction that appears on your bank or credit card statement. The letters “LPS” are an abbreviation, but they can stand for a few different things. Most often, LPS stands for “Loan Processing Solutions,” “Lender Processing Services,” or a similar company that handles payments for other businesses.

You will see this merchant charge on your bank statement when you check your account online or get a paper copy in the mail. It can show up as a debit from your bank account or a charge on your credit card. The key thing to remember is that LPS is often a middleman for another company you do business with.

Common Reasons for the LPS Charge

There are several common reasons why you might see an LPS charge on your account. Understanding these can help you quickly figure out where the charge came from. It is often related to a service you use or a bill you pay regularly.

Payment for Services or Subscriptions

One of the most frequent reasons for an LPS charge is for recurring payments. This could be a monthly subscription for a streaming service, a gym membership, or an online software tool. Companies use payment processors like LPS to handle these automatic withdrawals, making it easier for them to manage customer billing.

Similar to how other services appear on your statement, such as the CCI Care Com charge. These charges often happen on the same day each month, so reviewing your subscriptions carefully can help you match payments to their source.

These charges often happen on the same day each month. If you see an LPS charge, think about any new services you signed up for recently. It might be the first payment for a trial that has just ended.

A Merchant Using LPS as a Payment Processor

Many businesses, big and small, do not process payments themselves. Instead, they hire a third-party company to handle all their credit card and debit card transactions. LPS is one of these processors, much like the systems used for FTB MCT refund charges.

As a result, the statement may say “LPS Charge” instead of the store or service you actually paid. This can be confusing but is standard practice in digital payment processing.

For example, you might have paid your monthly utility bill or your car insurance premium. The utility or insurance company might use LPS to process that payment. As a result, your statement says “LPS Charge” instead of the company’s name you know.

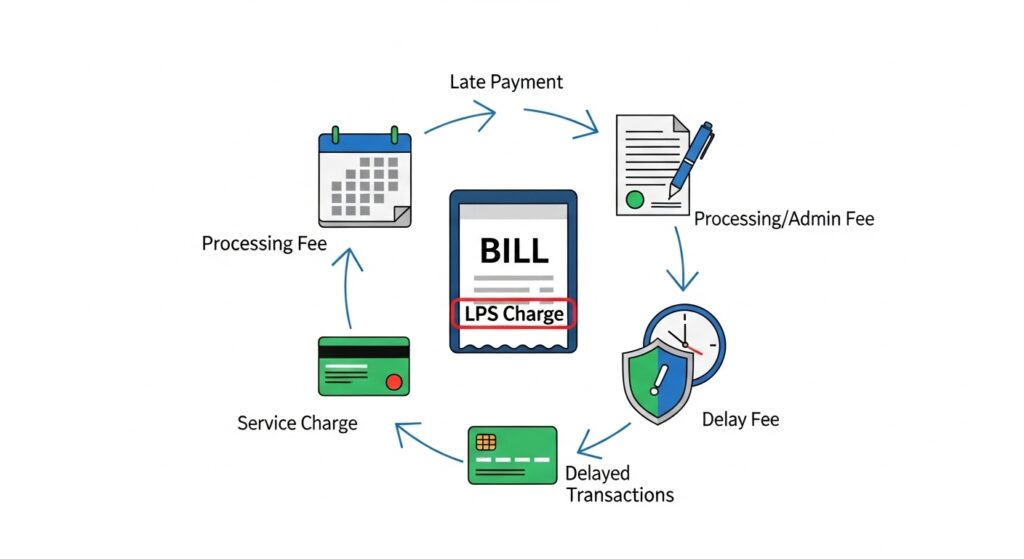

Hidden Service Fees

Sometimes, an LPS charge can be a small fee associated with another transaction. These hidden fees are not unique—similar unexpected charges can appear, such as the Infinite Loop charge. A loan servicing company might add a small processing fee each time you make a payment, so reviewing terms and fine print when signing up for services or loans is essential to avoid surprises.

These small bank fees can add up over time. It is always a good idea to read the fine print when you sign up for a loan or service. This can help you avoid surprises on your bank statement later.

Companies or Services Linked to LPS

Because LPS acts as a payment processor, it is connected to a wide range of industries. You might see this charge if you have dealings with companies in certain sectors. The charge on your statement is just a clue that leads back to the original business.

Here are some common examples of services that might use LPS:

- Loan Servicing: This is the most common one. If you have a mortgage, student loan, or personal loan, the company that manages your payments might use LPS. The charge would be for your regular loan payment.

- Insurance Companies: Many insurance providers use third-party processors for monthly or annual premium payments. This could be for your car, home, or life insurance.

- Utility Providers: Your electric, water, or gas company might use LPS to process your monthly bill payments, especially if you are set up for automatic payments.

- Digital Subscriptions: Services like cloud storage, antivirus software, or online news subscriptions may bill you through a processor like LPS.

The reason the company’s name doesn’t appear directly is for efficiency. The processor sends a standard code to the bank for all its transactions. This makes the statement confusing for you but simplifies the billing process for the businesses they serve.

Is the LPS Charge Legitimate?

Most of the time, an LPS charge is completely legitimate. It’s simply a payment for a service you know and use. The tricky part is connecting the “LPS” name to that service.

A good sign that the charge is valid is if the amount is familiar. Does the charge match the amount of your monthly loan payment or a subscription you have? If the amount and the date line up with a bill you expect, it is likely a legitimate transaction charge.

Another normal situation is seeing this charge after you’ve recently applied for a loan or signed up for a new insurance policy. The first payment might be processed through LPS. Checking your recent financial activities can often solve the mystery.

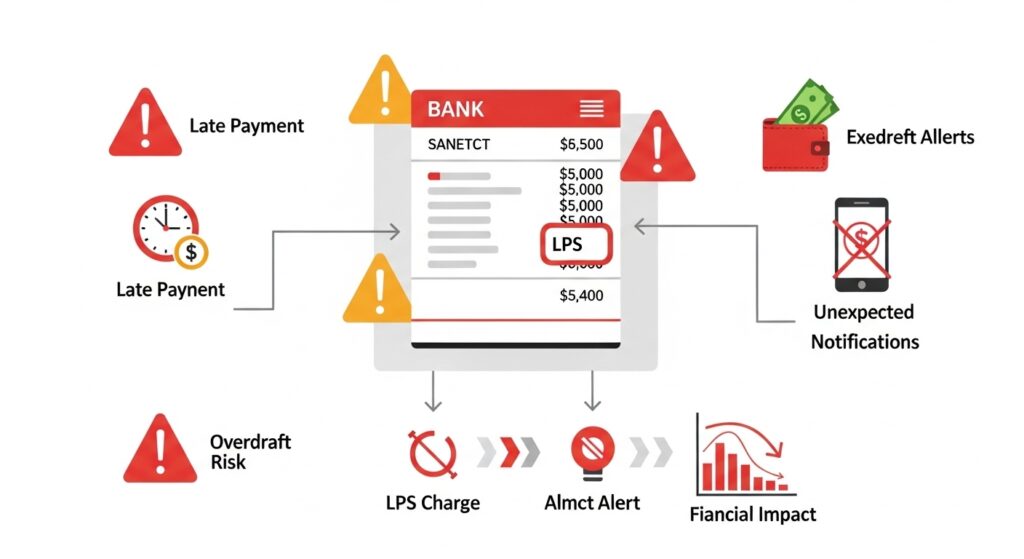

When the LPS Charge Could Be a Problem

While most LPS charges are legitimate, you should always be careful. Sometimes, these charges can signal a problem with your account. It’s important to recognize the warning signs of unauthorized charges to protect your money.

Unauthorized or Unknown Charges

The biggest red flag is seeing a charge for an amount you don’t recognize from a company you’ve never heard of. If you have checked all your subscriptions and bills and still can’t place the charge, it might be unauthorized. This is a serious issue that requires immediate action for your financial security.

Double Billing Issues

Another problem is being charged twice for the same thing. A technical glitch can sometimes cause a payment processor to bill you two times in a row. If you see two identical LPS charges on your statement, you should investigate it right away.

Potential Fraud

In a worst-case scenario, an LPS charge could be a sign of fraud. Criminals sometimes make small test charges on a stolen debit card or credit card number to see if it works. If you see a small, odd charge from LPS, it could be a warning that your card information has been compromised. This requires immediate action for fraud prevention.

How to Check if the LPS Charge is Yours

If you are unsure about an LPS charge, there are a few simple steps you can take to verify it. Start by reviewing your receipts and subscriptions carefully, and also cross-reference unusual charges against resources like our guide on what SQ means on a bank statement. This approach helps you confirm legitimate payments versus unknown or unauthorized charges.

1. Review Your Receipts and Subscriptions

First, look back at your recent purchases and any new recurring payments you have set up. Check your email for receipts or welcome messages from new services. Cross-reference the date and amount of the LPS charge with any payments you know you made.

2. Contact the Merchant Directly

If you suspect the charge is from a specific company, like your insurance provider, contact their customer support. Ask them if they use LPS as a payment processor and if they can confirm the transaction. They should be able to check their records and tell you if the charge came from them.

3. Check with Your Bank

Your bank can also provide more details about a merchant charge. Call the number on the back of your debit card or credit card and speak with a representative. They may have more information about the company behind the LPS charge that isn’t visible on your statement.

How to Dispute an LPS Charge

If you have completed your checks and are certain the charge is not yours, you need to dispute it. The process is straightforward, but it’s important to act quickly.

Here is a step-by-step guide to dispute the charge:

- Contact Your Bank or Credit Card Company: Call the customer support number immediately. Tell them you want to report an unrecognized charge and start the dispute process.

- Provide All the Details: Give them the date of the charge, the exact amount, and the name that appears on your statement (LPS Charge). Explain why you believe it is an error or fraud.

- Follow Their Instructions: The bank will likely freeze the charge and open an investigation. They may require you to fill out a form or send a written statement.

- Ask About the Refund Process: Ask the bank how their refund process works. In cases of clear fraud, they will often issue a provisional credit to your account while they investigate.

Banks are required by law to investigate dispute claims. They will contact the merchant’s bank to get more information. This process can take some time, but keeping in touch with your bank will help you stay informed.

Preventing Future Unwanted Charges

Protecting your financial information is key to preventing unwanted charges in the future. A little bit of regular account monitoring can save you a lot of trouble. Good fraud prevention habits are essential for your peace of mind.

Here are a few tips to help you stay in control of your finances:

- Monitor Your Bank Account Regularly: Don’t wait for your monthly statement. Log in to your online banking portal or use your bank’s app to check your transactions every few days. This helps you spot unauthorized charges almost as soon as they happen.

- Set Up Transaction Alerts: Most banks allow you to set up alerts for new transactions. You can get an email or text message every time your card is used. This gives you real-time information and helps you react quickly to fraud.

- Cancel Unused Subscriptions: Go through your recurring payments once or twice a year. If you find subscriptions you no longer use, cancel them. This stops old charges from reappearing and frees up your money.

FAQs on LPS Charges

Here are some quick answers to common questions about LPS charges.

Can the charge be refunded?

Yes, if the charge is found to be fraudulent or an error, it can be refunded. You will need to go through the dispute charge process with your bank. If the charge is legitimate but you are unhappy with the service, you will need to contact the merchant directly to ask for a refund.

Is it safe to ignore the charge?

No, it is never safe to ignore a charge you do not recognize. It could be a simple mistake, but it could also be a sign of fraud. Ignoring it could lead to more unauthorized charges on your account.

How long does a bank dispute take?

A bank dispute investigation can take anywhere from a few days to a few months. Federal law gives banks up to 90 days to resolve a dispute. However, many are resolved much faster, often within 10 to 30 days.

Final Thoughts

Finding an “LPS Charge” on your bank statement can be unsettling, but most charges are legitimate. Similar to tracking other charges like the ones described in our FintechZoom best credit cards guide, the key is proactive account monitoring. Regularly reviewing your statements, investigating unknown charges, and understanding payment processors keeps your finances safe and prevents small fees from accumulating unnoticed.

The most important takeaway is to be proactive. Regularly check your debit card and credit card statements. If you see something you don’t recognize, take immediate steps to investigate it. By staying vigilant, you can protect your financial security and keep your money safe.