What Is the Harland Services Charge on Your Bank Statement?

Have you ever looked at your bank statement and seen a charge you did not recognize? It can be a little worrying. One charge that sometimes confuses people is the “Harland Services Charge.”

This article will explain what this charge is in simple terms. We will explore why it might be on your statement and what you should do about it. You will learn how to tell if it’s a real fee or a mistake and how to protect your money.

What Is the Harland Services Charge?

The Harland Services Charge is a fee that can appear on your bank statement. It is usually related to products or services for your bank account. The company behind this charge is often Harland Clarke, a well-known provider of banking products.

Harland Clarke works with thousands of banks to provide things like checkbooks, deposit slips, and other financial documents. When you order these items through your bank, the charge might show up with “Harland” in the name. For example, it could look like “HARLAND-SVCS-FEE” or “HARLAND-CLARKE-CHECKS.”

This charge is one of many possible bank fees you might see. It is important to understand what it is for before you worry. A quick statement review can help you find these types of transactions.

Why Does This Charge Appear on Your Statement?

There are a few common reasons why a Harland Services Charge might show up. The most frequent reason is that you recently ordered new checks for your checking account. Many banks use Harland Clarke as their official check printer.

Another reason could be fees for other banking supplies, like a new checkbook cover or a register for tracking transactions. Sometimes, a bank might use the “Harland” name as a general label for various processing fees. This can make it tricky to know the exact reason without asking.

Finally, it could be a simple billing error. Mistakes happen, and a charge meant for someone else could accidentally appear on your account. That is why it is always a good idea to look closely at every transaction.

Is the Harland Services Charge Legitimate or a Scam?

Most of the time, the Harland Services Charge is a legitimate fee. If you ordered checks or other banking supplies recently, the charge is likely real. The amount is usually small, often between $15 and $50, which matches the cost of check printing.

However, you should always be careful. Scammers sometimes try to trick people by using names that look official. These unauthorized charges are a form of fraud. A key part of fraud prevention is learning to spot the signs of a scam.

If you see a Harland charge but have not ordered anything, it could be a red flag. Also, be suspicious if the amount is very large or if you see it appearing as one of many recurring payments you did not set up.

How to Confirm the Source of the Charge

If you are not sure about a Harland Services Charge, a little detective work can help. Follow these simple steps to find out where it came from. This process can give you peace of mind, just as you would when investigating other mysterious entries like the Infinite Loop charge on your statement.

Step 1: Review Your Recent Activity

First, think about your recent banking actions. Did you visit your bank to order checks? Did you place an order for checks through your online banking portal?

Look through your emails and receipts for any confirmation of a purchase. Many banks send an email right after you order supplies. This is the fastest way to confirm if the charge is yours.

Step 2: Contact Your Bank’s Customer Service

If you cannot find any record of an order, the next step is to call your bank. Their customer service team can look up the transaction for you. They have detailed records and can see exactly where the charge came from.

When you call, have your bank statement and account number ready. Ask the representative to explain the “Harland Services Charge” from a specific date. They can tell you if it was for checks, a service fee, or something else.

What to Do If You Don’t Recognize the Charge

If you and your bank confirm you did not make the purchase, you must act quickly. Treating it as a potential unauthorized charge protects your account from further problems. Swift action is the best defense against fraud, similar to how you would handle FastSpring or FSPRG.com charges on your bank statement.

The first thing to do is tell your bank the charge is unauthorized. They will likely recommend freezing or closing your debit card to prevent any more fraudulent charges. This is a critical step in fraud prevention.

Your bank will then guide you through their dispute process. This is the formal way to report a charge you did not make. Keeping a close eye on your account through transaction monitoring can help you catch these issues early.

How to Dispute a Harland Services Charge

If you need to dispute the charge, your bank will help you file a formal claim. This process is also known as a chargeback. Here are the steps you will likely follow.

Step 1: Gather Your Information

Before you call your bank to start the dispute, get your information together. Write down the date of the charge, the exact amount, and the name that appears on your statement. Also, make notes about why you believe it is a mistake.

Step 2: Officially File the Dispute

Contact your bank’s fraud or disputes department to formally start the process. You may be able to do this over the phone, online, or by filling out a form at a branch. Be clear and honest about why you are disputing the charge.

Step 3: Wait for a Resolution

After you file the dispute, the bank will investigate. They may provide a temporary credit to your account for the disputed amount while they work. The investigation can take anywhere from a few days to a few weeks, but the bank will contact you with the results.

How to Avoid Surprise Charges in the Future

The best way to handle surprise fees is to prevent them from happening in the first place. By being proactive, you can keep your bank account secure and avoid the stress of unexpected charges. This approach also applies to other recurring or confusing fees, like the FirstOnline charge on your bank statement or the Google Supercell charge.

Tip 1: Review Your Bank Statements Regularly

Make it a habit to check your bank statement at least once a month. A regular statement review helps you spot any unauthorized charges or billing errors quickly. You can do this with your paper statement or through your bank’s website or app.

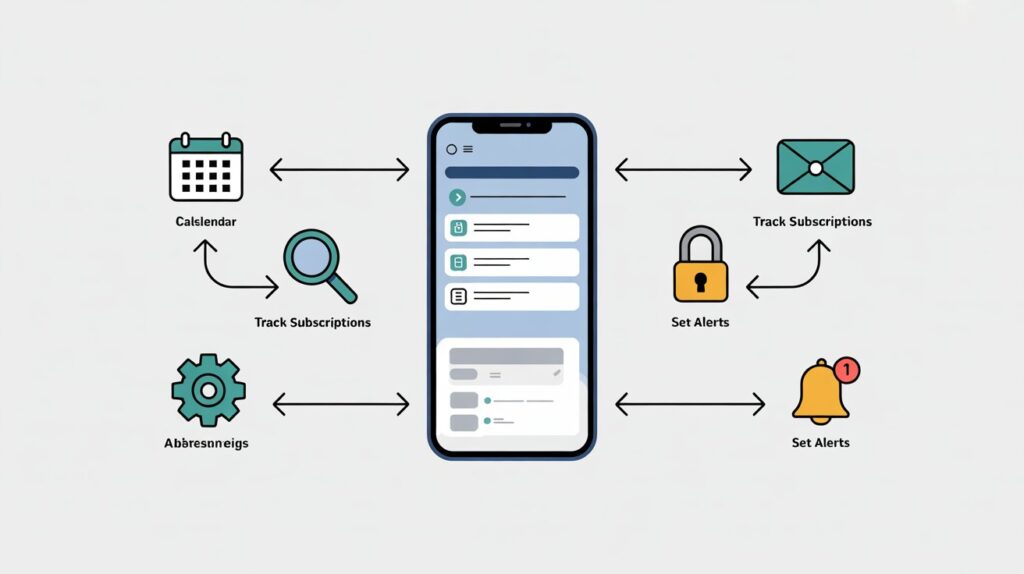

Tip 2: Set Up Transaction Alerts

Most banks allow you to set up alerts for your account. You can get a text or email every time a transaction occurs or when a charge is over a certain amount. This real-time transaction monitoring is a powerful tool for catching fraud immediately.

Tip 3: Understand Your Bank’s Fees

Take some time to read your bank account’s terms and conditions. This document explains all the potential bank fees, including overdraft charges and other hidden fees. Knowing what to expect makes it easier to spot a charge that does not belong.

Tip 4: Cancel Unused Subscriptions

Many surprise charges come from recurring payments for subscriptions you forgot about. Go through your statements and identify all recurring charges. If you find any for services you no longer use, cancel them right away.

Frequently Asked Questions (FAQs)

Here are answers to a few common questions about the Harland Services Charge.

Is Harland Services the same as Harland Clarke?

Yes, they are usually connected. Harland Clarke is the full name of the company that provides check printing and other services. “Harland Services” is often the shorter name that appears on bank statements for their fees.

Can I get a refund for this charge?

If the charge is a legitimate fee for a service you ordered, you generally cannot get a refund. However, if it is a billing error or an unauthorized charge, you can get your money back by going through your bank’s dispute process.

Will a disputed charge affect my credit score?

No, disputing a charge on your debit card or bank account does not affect your credit score. Credit scores are related to your history of borrowing money, like loans and credit cards. A bank account dispute is a separate issue.

What if the charge keeps appearing every month?

If you see the charge every month, it may be a recurring payment. Contact your bank immediately to identify the source. If it is fraudulent, they will need to block the merchant and may need to issue you a new card or account number.

Final Thoughts

Seeing a mysterious charge on your bank statement can be unsettling, but now you know what to do. The Harland Services Charge is usually just a fee for ordering checks. However, it is always wise to be sure.

Remember to review your statements, question any charge you do not recognize, and use your bank’s customer service team as a resource. By staying on top of your account activity, you can manage your money confidently and keep it safe. If you are ever in doubt, a quick call to your bank is the best next step.