What Is the LBK or LC Charge on Your Bank Statement?

Finding an unfamiliar charge on your bank statement can be unsettling. Your mind might race through recent purchases, trying to place the mysterious transaction. It’s a common experience, and often, the confusion comes from cryptic codes used by banks and merchants. One such code that frequently causes concern is “LBK” or “LC.” Let’s break down what this charge means and what you should do when you see it.

What Does LBK or LC Mean?

In the context of banking, LBK and LC are not universal acronyms with a single meaning. Instead, they are shorthand codes that payment processors or banks use to label a transaction. These codes can be confusing because they often represent a broader category of payment or a specific merchant whose name doesn’t appear in full.

Think of them as internal identifiers. For example, “LC” could stand for “Loan Charge,” “Local,” or even be part of a merchant’s name. Similarly, “LBK” might refer to “Local Bank” or a business with those initials. The key is that these are not standardized codes, which is why they can be hard to decipher at first glance.

Why Does the LBK or LC Charge Appear on Your Statement?

Common reasons for an LBK or LC charge include transactions from local merchants, loan payments, or specific financial services. For example, if you want to better understand how different loan payments reflect on your statement, you can use our bank statement loan calculator to see how recurring charges appear.

Similarly, charges from certain merchants may look unfamiliar at first, much like the Cantaloupe Malvern PA charge which often confuses account holders.

- Transactions from local merchants: A small local business might have a processing name that shows up as a code.

- Loan payments: If you have a personal loan, car loan, or mortgage, “LC” might signify a “Loan Charge” or payment.

- Specific financial services: The charge could be from a financial institution for a service like a wire transfer, a letter of credit, or another banking product.

Is the LBK or LC Charge Legitimate?

Most of the time, these charges are valid but poorly labeled. If you frequently encounter unclear banking codes, you may also want to check our guides on the Google Supercell charge or SEI charge for examples of other legitimate but confusing transactions. Understanding how these charges are processed can make it easier to distinguish real purchases from potential fraud.

However, you should never assume a charge is valid. It’s always best to verify any transaction you don’t immediately recognize.

How to Verify the Charge

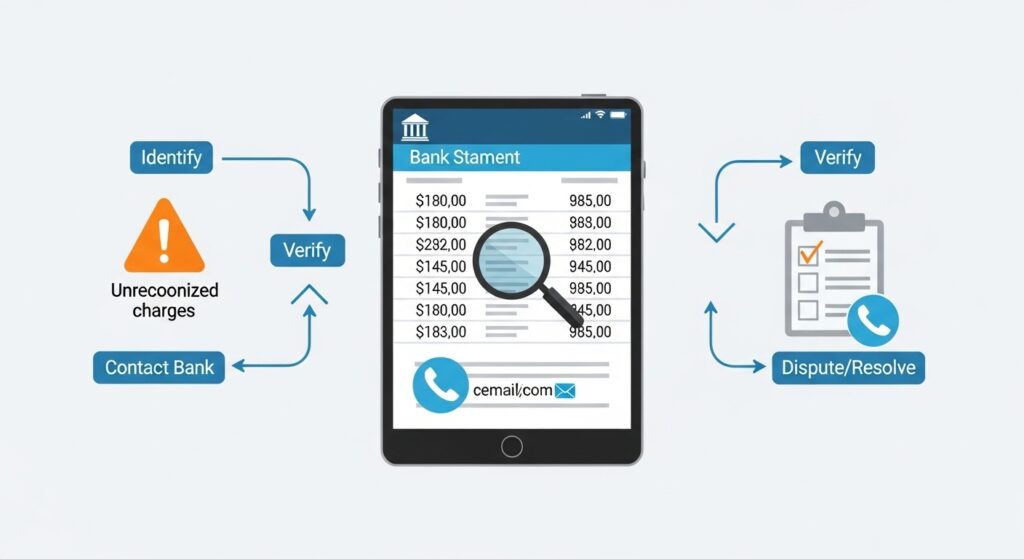

If you see an LBK or LC charge and aren’t sure what it’s for, a little investigation can quickly clear things up.

- Check transaction details online: Log in to your online banking portal or app. Click on the transaction to see if there are more details, such as the full merchant name, location, or transaction type.

- Review your activities: Think about where you were and what you purchased around the date of the charge. Did you make a loan payment, visit a new local shop, or sign up for a service?

- Contact your bank: If you’re still unsure, call your bank’s customer service line. They have access to more detailed transaction information and can often identify the merchant or source of the charge for you.

When verifying an LBK or LC charge, reviewing transaction details online is a key step. You can also explore related guides to recognize similar cryptic entries on your bank statement, like our article on NWEDI on a bank statement. These resources show how common financial and merchant codes appear, helping you identify unfamiliar transactions faster.

What to Do If You Don’t Recognize the Charge

If after your investigation the charge still seems suspicious, you must act quickly to protect your account.

- Contact your bank immediately: Inform your bank that you suspect an unauthorized transaction. They will guide you through the process of disputing the charge.

- Dispute the charge: Your bank will likely have you fill out a form to formally dispute the transaction. This starts an investigation into the charge’s validity.

- Secure your account: If fraud is suspected, the bank may recommend canceling your current card and issuing a new one to prevent further unauthorized charges.

How to Avoid Future Confusion

To prevent unexpected charges from causing stress, maintain a record of recurring payments and subscriptions. Tracking commodity or investment purchases can also help, such as monitoring precious metals with tools like our Silver price FintechZoom guide. This ensures that even if a charge appears with a cryptic code, you can quickly confirm its legitimacy.

- Set up transaction alerts: Most banks allow you to set up email or text alerts for every transaction, or for those over a certain amount. This helps you monitor activity in real-time.

- Keep track of recurring payments: Maintain a list of your subscriptions and automatic loan payments. This makes it easier to recognize them on your statement, even if they have odd names.

- Review statements regularly: Make it a habit to check your bank statement at least once a week. The sooner you spot an issue, the easier it is to resolve.

Conclusion

An LBK or LC charge on your bank statement is usually a legitimate payment that has been poorly labeled by a payment processing system. It could be anything from a loan payment to a purchase at a local store. While often harmless, you should always take the time to verify any charge you don’t recognize. By staying vigilant and regularly reviewing your account, you can ensure your financial safety and peace of mind.