What Is the LH Trading Charge on Your Bank Statement? A Guide to Understanding Unexpected Debits

Introduction

Checking your bank statement and finding an unfamiliar charge can be stressful. You might wonder if your account has been compromised or if you’ve been billed for something by mistake. An unexpected debit creates confusion and concern. A perfect example of a charge that often leaves people scratching their heads is one labeled “LH Trading.” Seeing this on your statement can be puzzling, but there is usually a simple explanation.

What Is LH Trading?

LH Trading is not always a direct merchant you shopped with. Instead, it often refers to a payment processor or a parent company that handles transactions for many different online businesses, subscription services, or mobile apps. Think of it as a middleman. When you buy something from a smaller online store, that store might use LH Trading’s system to process your payment. As a result, “LH Trading” is the name that appears on your bank statement instead of the name of the actual shop you bought from.

Why Does the LH Trading Charge Appear on Your Statement?

The main reason an LH Trading charge shows up is that the merchant’s billing name is different from their public-facing brand name. This is a common practice in online commerce.

For example, if you are tracking precious metals purchases, you might also find it helpful to understand charges related to silver investments, which often appear under payment processors rather than the retailer’s name.

Common reasons for this charge include:

- Online Purchases: You may have bought a product from an e-commerce store that uses LH Trading to manage its payments.

- Subscription Services: A new or recurring subscription for a streaming service, software, or an online course could be billed through them.

- Third-Party Merchants: If you purchased goods through a larger platform like Amazon or eBay from a third-party seller, that seller might use LH Trading for their payment processing.

Essentially, the name you recognize as a customer isn’t the same legal or billing name the bank sees.

Is the LH Trading Charge Legitimate?

In most cases, the LH Trading charge is legitimate. It is likely tied to a purchase you made, even if you do not recognize the name. A good sign that the charge is valid is if the amount matches a recent purchase you made online. If you also encounter other unfamiliar entries, you may want to check guides like what does TST mean on your credit card statement to better interpret different transaction codes.

However, there are situations where it could be a mistake or, in rare cases, fraudulent. If you are certain you haven’t made any recent purchases that match the amount and date, it is worth investigating further.

How to Verify the LH Trading Charge

Before you panic, take a few simple steps to identify the source of the charge. Many banking apps now provide detailed transaction insights similar to tools found in bank statement loan calculators, which can help you cross-reference amounts and dates.

- Check Your Emails: Search your inbox and spam folder for receipts or order confirmations that match the date and amount of the transaction. The merchant name on the receipt will likely solve the mystery.

- Review Your Online Shopping History: Log into any online stores where you’ve recently shopped. Look at your order history to see if the charge corresponds to a purchase.

- Use Your Banking App: Many banking apps provide more details about a transaction if you tap on it. You might find a more detailed merchant name, a location, or a transaction ID.

- Contact Your Bank: If you are still unsure, call your bank’s customer support. They may have more information on their end about the merchant that initiated the charge.

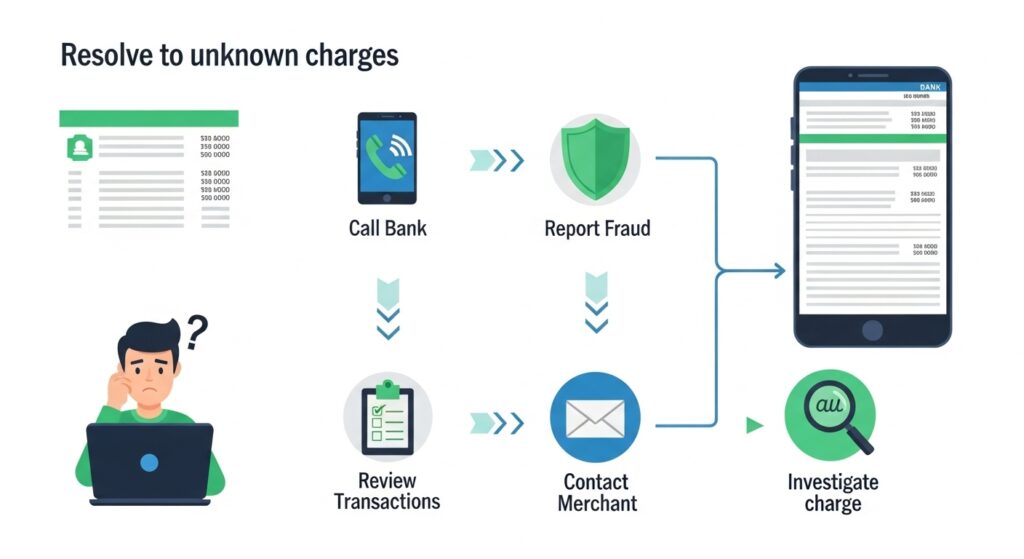

What to Do If You Don’t Recognize the Charge

If you have completed the verification steps and are confident you did not authorize the payment, you need to act quickly. In addition to contacting your bank, it’s helpful to review similar transaction disputes, such as those covered in what is the ScoresMatter charge on your bank statement, for insight into common processing errors.

- Contact Your Bank Immediately: Inform your bank that you suspect a fraudulent charge. They will guide you through their dispute process.

- Dispute the Charge: Your bank will likely open an investigation. They may temporarily credit the amount back to your account while they look into the matter.

- Cancel and Block Payments: If the charge is for a subscription you didn’t sign up for, ask your bank if they can block future payments from that merchant. You might also need a new debit or credit card issued to prevent further unauthorized charges.

Preventing Future Confusion

A little bit of organization can save you a lot of future stress. For ongoing monitoring, tools like FintechZoom’s Google stock tracker can provide a model for keeping a close eye on all digital financial activity. Additionally, understanding entries such as SQ charges can make spotting discrepancies faster and easier.

- Monitor Your Accounts Regularly: Check your bank account online every few days instead of waiting for the monthly statement. This helps you spot unusual activity right away.

- Set Up Transaction Alerts: Most banks allow you to set up email or text alerts for every transaction, or for transactions over a certain amount. This gives you real-time updates on your account activity.

- Keep Records of Purchases: For online purchases and subscriptions, save the email confirmations in a dedicated folder. This makes it easy to cross-reference your statement with your spending.

Conclusion

The “LH Trading” charge on your bank statement is usually a legitimate payment processed for a third-party merchant you did business with. The confusion arises because the processor’s name appears instead of the store’s name. By carefully reviewing your recent purchases and email receipts, you can almost always identify the source. Always remember to verify unknown charges, and if something feels wrong, contact your bank immediately to protect your account.