What Is the TPG Products Charge on Your Bank Statement?

Seeing an unfamiliar charge on your bank statement can be unsettling. Your mind might jump to the worst-case scenario, like fraud or an error. One charge that often causes this kind of confusion is “TPG Products.” If you’ve recently filed your taxes and noticed this transaction, there’s usually a simple explanation.

This article will break down what the TPG Products charge means, why it appears on your statement, and what you should do if you don’t recognize it.

What Does TPG Products Mean?

TPG Products stands for Tax Products Group. It is a company that works with tax preparation software and professionals to offer financial products related to your tax refund. TPG is not a tax preparer itself but rather a third-party service provider that helps manage the financial side of your tax filing.

Their primary service is processing tax refunds. When you choose to pay for your tax preparation fees directly from your refund, a company like TPG often handles the transaction.

Why Does the TPG Products Charge Appear on Your Statement?

The most common reason for a TPG Products charge is related to how you paid for filing your taxes. If you used a tax preparation service like TurboTax, H&R Block, or another provider and opted to have the filing fees deducted from your federal tax refund, TPG facilitates this process.

Here’s how it works:

- The IRS sends your refund to TPG.

- TPG deducts the tax preparation fees you agreed to pay.

- TPG sends the remaining balance of your refund to your bank account.

The charge on your statement may represent these tax preparation fees or other related services you selected during the filing process.

Similar to other transaction descriptors such as what does SQ mean on a bank statement or what does GPC EFT mean on a bank statement, these charges can look unusual at first but usually have a straightforward explanation.

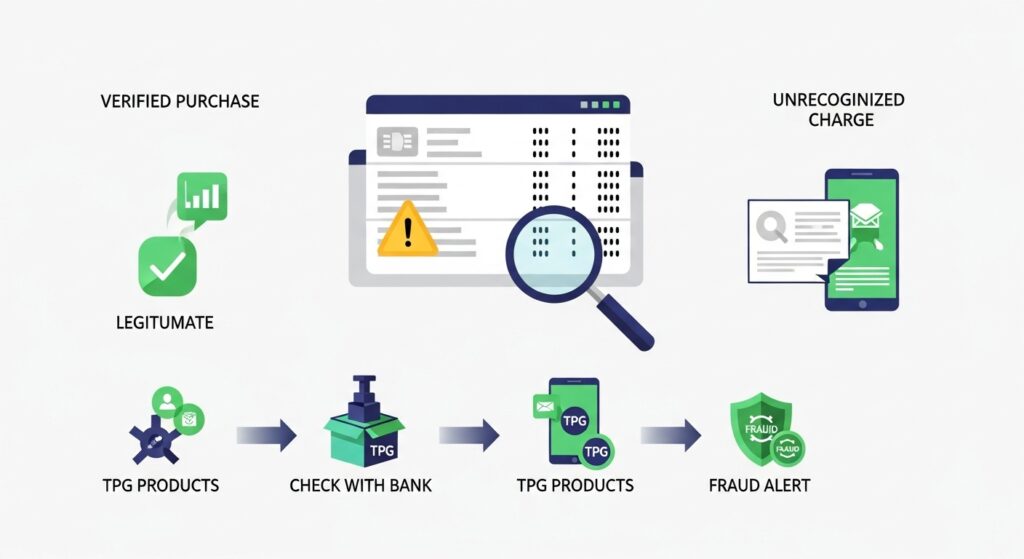

Is the TPG Products Charge Legitimate?

In most cases, the TPG Products charge is legitimate. It typically appears during tax season, shortly after you’ve filed your taxes. If you chose the “pay from my refund” option, this charge is an expected part of that transaction.

However, it can be confusing because the name “TPG Products” might not be familiar. People often search for details about the PNP BillPayment charge or the 365 Market charge for the same reason—unfamiliar wording makes a valid transaction look suspicious at first glance.

How to Verify the Charge

If you’re unsure about the charge, a little investigation can quickly clear things up.

- Check your tax preparation account: Log in to the software or online service you used to file your taxes. Look at your payment history or filing summary. It should detail how your fees were paid and may mention TPG or a similar refund processing service.

- Review your tax filing activities: Think back to when you filed. Did you select an option to deduct fees from your refund? This is the most common reason for the charge. Review any email confirmations or documents you received from your tax preparer.

- Contact customer service: You can reach out to TPG Products directly through their website or contact the customer support team for your tax preparation service. They can confirm the details of the charge.

What to Do If You Don’t Recognize the Charge

If you’ve reviewed your tax filing history and still don’t believe the charge is valid, it’s time to take action. Contact your tax preparer first to clarify, but if things still seem off, you may want to research whether it could be linked to another type of financial processing error.

Many users confuse this with unrelated charges like the Infinite Loop charge, so double-check the transaction details carefully before disputing it with your bank.

- Contact your tax preparer: Your first call should be to the tax preparer or software provider you used. They can provide a clear breakdown of your fees and confirm whether TPG was used to process them.

- Gather information: Before you call, have the date and amount of the charge ready. This will help the customer service representative locate the transaction quickly.

- Dispute the charge: If you confirm the charge is an error or potentially fraudulent, contact your bank to dispute it. They will guide you through the process of filing a formal dispute and investigating the transaction.

Tips to Avoid Confusion in the Future

A little organization can help you avoid this kind of stress next tax season.

- Keep track of tax-related payments: When you file, make a note of how you chose to pay your preparation fees.

- Save receipts and confirmations: Always save a digital or physical copy of your tax filing confirmation and payment details. This gives you a quick reference if any questions come up later.

- Monitor your account during tax season: Be extra watchful of your bank account transactions around the time you expect your refund. Knowing what to expect makes it easier to spot something that is truly out of place.

Conclusion

The “TPG Products” charge on your bank statement is most often a legitimate fee for tax preparation services that you chose to have deducted from your refund. It’s a common transaction for millions of people who use popular tax software. While it can be alarming to see an unfamiliar name, a quick review of your tax filing records will usually resolve the confusion. It’s always wise to verify any charge you don’t recognize, and following these steps will help you confirm its purpose and ensure your finances are secure.