What Does GPC EFT Mean on a Bank Statement?

Reviewing your bank statement is a good financial habit, but it can sometimes feel like trying to decode a secret message. Financial institutions use many abbreviations and codes to describe transactions, and these can often be confusing. One such code that might leave you scratching your head is “GPC EFT mean.” Seeing this on your statement can be puzzling, but understanding what it means is the first step toward managing your finances effectively.

This guide will break down what GPC EFT stands for, why it appears on your statement, and what to do if you don’t recognize the transaction.

What Does GPC EFT Stand For?

To understand the full term, let’s look at each part separately.

- GPC: This acronym can have a couple of different meanings depending on the context. Most commonly, it stands for Government Purchase Card. This is a type of commercial credit card used by U.S. federal government agencies for official purchases. In other cases, GPC might refer to a company name, such as Global Payment Concepts, a third-party payment processor.

- EFT: This part is more straightforward. EFT stands for Electronic Funds Transfer. An EFT is any transfer of money from one bank account to another that happens electronically, without the direct intervention of bank staff. Common examples include direct deposits, online bill payments, and wire transfers.

When combined, “GPC EFT” on your bank statement typically signifies an electronic payment made to or received from a government agency or a business using a payment processor like Global Payment Concepts.

Why Does GPC EFT Appear on a Bank Statement?

A GPC EFT transaction appears on your statement when money has been moved electronically in a transaction involving one of the “GPC” entities. These transactions are recorded with this label to identify the nature of the payment.

Common reasons for a GPC EFT entry include:

- Government Transactions: You may have paid for a government service, fee, or product. This could be anything from renewing a license to paying a federal park entrance fee online.

- Vendor Payments: If you are a business owner or contractor who provides goods or services to a government agency, you might receive payment via a GPC EFT.

- Refunds: A government agency might issue you a refund for overpayment or a returned item, which would appear as a GPC EFT credit on your statement.

- Purchases from a Third-Party Vendor: You might have purchased something from a company that uses a payment processor whose name abbreviates to GPC.

If you’ve ever spotted other codes such as an SQ charge on your bank statement or an LPS charge, you’ll know that banks use a wide range of abbreviations to flag the type of transaction.

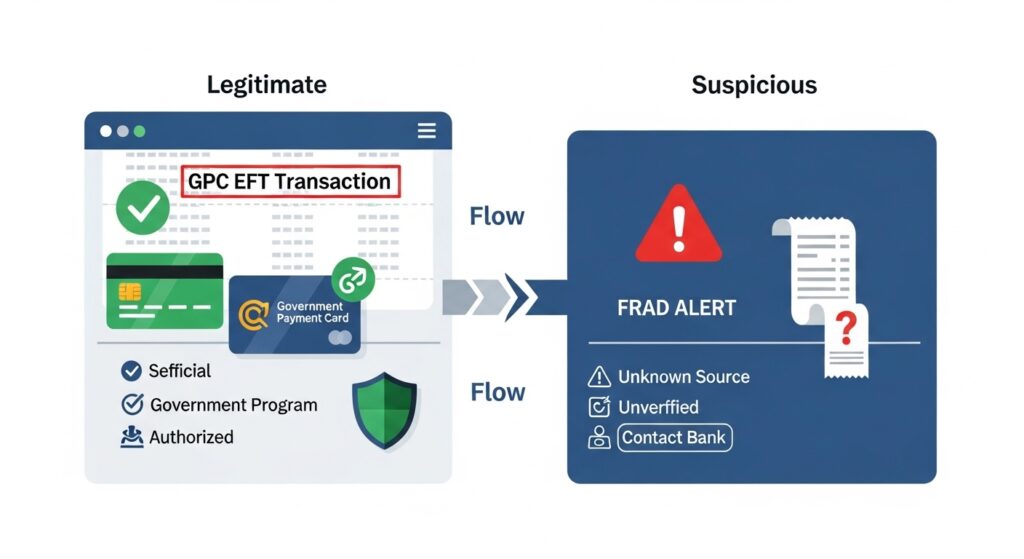

Is the GPC EFT Transaction Legitimate?

Most of the time, a GPC EFT transaction is perfectly legitimate. If you have recently interacted with a government agency or a business that uses a specific payment processor, the charge is likely valid. For instance, if you paid your property taxes online or received a tax refund, you might see this description.

Still, it’s worth comparing it with other common statement codes like the PNP BILLPAYMENT charge or the 365 Market charge, both of which can also appear unexpectedly but often have straightforward explanations.

However, there are times when it could be an error or a sign of suspicious activity. A mistake could happen if your account number was entered incorrectly by someone else. More seriously, it could be a fraudulent charge if someone has gained unauthorized access to your account information.

How to Verify the GPC EFT Transaction

If you’re unsure about a GPC EFT transaction, a little investigation can quickly clear things up.

- Check Transaction Details: Log in to your online banking portal or mobile app. Look for more details associated with the transaction, such as the full merchant name or a transaction ID number.

- Contact Your Bank: Your bank’s customer service team can often access more information about a transaction than what is shown on your statement. They may be able to identify the exact source of the charge or credit.

- Cross-Check Your Records: Think back to your recent activities. Did you make any payments to a government entity? Do you have any receipts, invoices, or email confirmations that match the transaction amount and date?

What to Do If You Don’t Recognize the Charge

If you’ve checked your records and still can’t identify the source of the GPC EFT charge, you must act quickly to protect your account.

- Dispute the Transaction: Contact your bank immediately to report the unfamiliar transaction. They will guide you through the process of filing a dispute. Banks have established procedures for investigating and resolving unauthorized charges.

- Block Unauthorized Activity: If you suspect fraud, ask your bank to block your card or account to prevent further unauthorized transactions. They may issue you a new card or account number.

- Report Suspected Fraud: Your bank will likely handle the fraud report, but it’s important to follow their instructions and provide any information they need.

How to Stay on Top of Such Charges

Staying vigilant is the best way to protect yourself from financial errors and fraud.

- Set Up Alerts: Most banks allow you to set up email or text alerts for specific transaction types, such as EFTs or purchases over a certain amount. These instant notifications can help you spot suspicious activity right away.

- Keep Good Records: Maintain a file of your digital and physical receipts for purchases and payments, especially for non-routine transactions. This makes it easier to cross-reference your bank statements.

- Review Your Statements Regularly: Don’t wait until the end of the month to review your transactions. Make it a weekly habit to log in to your online banking and check for any activity you don’t recognize.

Staying vigilant is the best way to protect yourself from financial errors and fraud. In addition to checking your statements, you can use financial tools and resources to make better sense of codes and charges.

For example, some people keep track of their spending habits with helpful guides like the FintechZoom best credit cards article, which breaks down which cards work best for specific needs. At the same time, learning to identify unusual entries like the Infinite Loop charge ensures you’re never left confused about where your money is going.

Conclusion

A “GPC EFT” entry on your bank statement might seem strange at first, but it usually refers to a standard electronic transaction with a government agency or a specific payment processor. By understanding what the abbreviation means and how to investigate it, you can take control of your financial security. Always take the time to verify any transaction that seems unclear. A few minutes of review can provide peace of mind and ensure your hard-earned money is safe.