How Do Venmo Charges Appear on Your Bank Statement?

Introduction

Seeing unfamiliar charges on your bank statement can be stressful. Many people notice Venmo charges and wonder what they mean.

This is often just the way Venmo transactions are displayed by your bank. The purpose of this article is to explain how Venmo transactions appear, why they sometimes look confusing, and how to verify them.

By the end, you’ll understand your Venmo Charges entries and know how to handle them safely.

What Is Venmo and How Does It Work?

Venmo is a popular mobile payment app that allows you to send and receive money quickly. It links directly to your bank account, debit card, or credit card.

You can make peer-to-peer payments to friends, pay merchants online, or use the Venmo debit card for everyday purchases.

Because it interacts with banks, all transactions show up on your bank statement with a billing descriptor or transaction note.

Understanding Venmo Charges on Your Bank Statement

Venmo charges typically appear with a billing descriptor like “VENMO *PAYMENT” or “VENMO *TRANSFER.”

The exact wording may vary depending on your bank, similar to how other digital payments, like a BGC charge or a WLY Complete Save charge, appear on statements. Understanding these descriptors helps you recognize legitimate transactions and avoid confusion over unexplained bank charges.

Understanding these descriptors helps you recognize legitimate transactions and avoid confusion over unexplained bank charges.

Types of Venmo Transactions and How They Appear

Peer-to-Peer Payments

When sending money to a friend, the amount usually appears as:

*VENMO JANE DOE $25

This shows the recipient’s name and the payment amount.

Merchant Payments

Payments to online or in-store merchants using Venmo appear with the merchant name. For example, *VENMO STARBUCKS $5 shows a $5 purchase at Starbucks.

This is similar to how other digital transactions, such as VF Northern Europe charges or even stock-related payments like Google stock transactions, are reflected on your bank statement, helping you identify and verify each payment clearly.

Venmo Debit Card Transactions

If you use a Venmo debit card, purchases at stores or ATMs will show the merchant name or ATM location, along with the Venmo transaction amount.

Pending Transactions

Pending charges appear temporarily before being posted. For example, a payment to a friend may show as VENMO PENDING until the transfer completes.

If you’ve ever noticed other pending entries like a Grindr charge or similar online payment, the process is the same—these temporary holds are normal and will post once the transaction is fully processed.

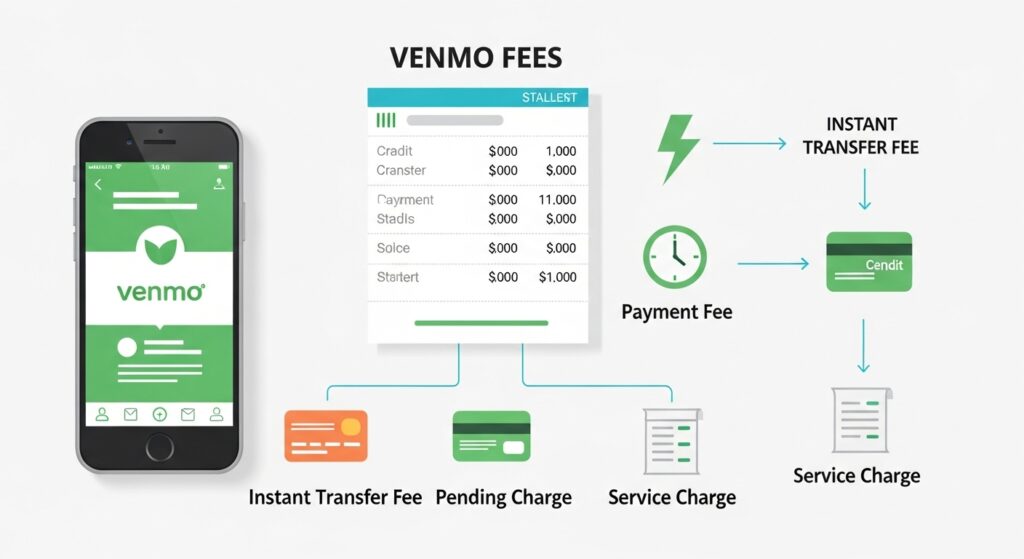

Venmo Fees and How They Appear on Your Statement

Instant Transfer Fee

If you use Venmo instant transfer to move funds to your bank, there is a small fee, usually 1–1.5% of the transfer. The fee appears as a separate line item on your bank statement charges.

Credit Card Fees

Using a credit card for a Venmo payment incurs a 3% fee. For example, sending $50 with a credit card may show $51.50 on your statement.

Other Service Fees

Occasionally, other small service fees may appear, such as ATM withdrawal fees with the Venmo debit card. Always check the Venmo fees page for updates.

Common Issues and Confusing Entries

Sometimes you may notice duplicate charges or delays in posting. For example, a single $20 payment might appear twice temporarily before settling.

Other times, you might see unauthorized Venmo charges. These could be from someone accessing your account without permission.

Always compare the charge to your recent Venmo transactions to ensure it matches a legitimate payment.

Steps to Verify and Reconcile Your Venmo Charges

- Open your Venmo app and go to Activity to review recent transactions.

- Match the date, recipient, and amount with your bank statement entries.

- Check for any pending charges that may not have fully posted yet.

- If a charge looks suspicious, contact Venmo customer support for clarification.

Keeping a record of receipts or transaction confirmations makes reconciliation easier.

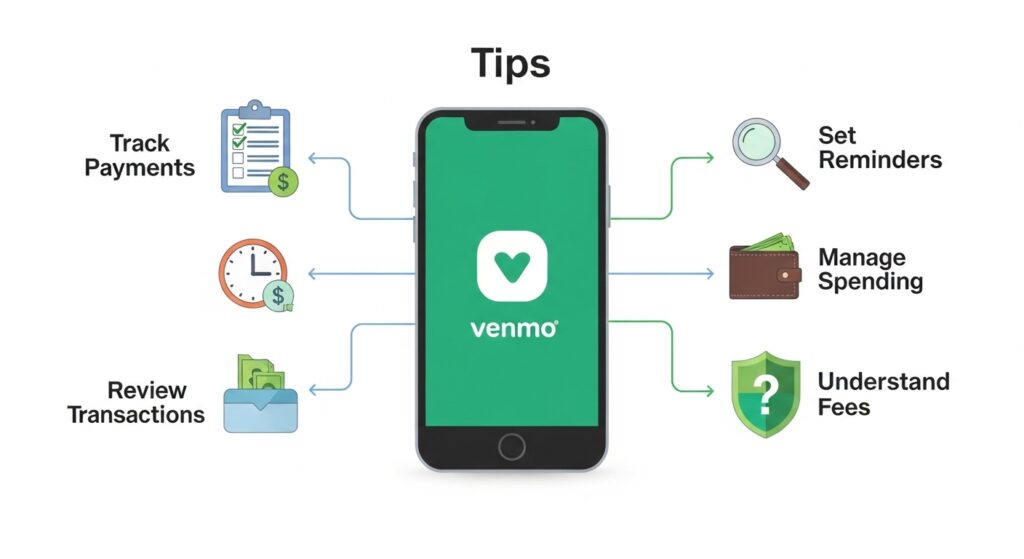

Tips to Avoid Confusion in the Future

Track all your Venmo payments and subscriptions. Even small recurring amounts, like monthly app fees, can appear unexpectedly on your bank statement.

Use clear notes when sending money to friends. For example, “Dinner $25” helps you identify transactions later.

Review your bank statement regularly to spot unusual Venmo charges early. This ensures you catch errors or unauthorized activity quickly.

Real-Life Examples

Example 1: Sending $25 to a friend for lunch shows as *VENMO JANE DOE $25.

Example 2: A $10 coffee purchase using the Venmo debit card shows as *VENMO STARBUCKS $10 on your bank statement.

Example 3: You use instant transfer to move $100 to your bank, and a $1.50 fee appears as a separate line item: VENMO INSTANT TRANSFER FEE $1.50.

These examples illustrate typical ways Venmo transactions appear and clarify billing descriptors.

Understanding Pending Charges

Pending transactions can make your statement look confusing. For example, a friend’s payment may show as pending for 1–2 days.

Pending entries are normal and will either post or disappear once the transaction completes.

Check your Venmo app for the most up-to-date status of your transactions.

How to Spot Unauthorized Venmo Charges

Look for transactions you didn’t make, repeated charges, or unfamiliar merchants. Just as with other unexpected bank entries such as a fintechzoom, scrutinizing your statement and cross-checking with your Venmo activity ensures you can quickly identify suspicious activity. Report anything unusual to Venmo immediately to protect your account.

Check your Venmo debit card activity separately, as ATM withdrawals or POS purchases might be unfamiliar.

If you spot suspicious charges, report them to Venmo immediately to protect your account.

Frequently Asked Questions (FAQs)

Why do Venmo charges look different than in the app?

Banks often display a billing descriptor that differs slightly from the name you see in Venmo.

Can I dispute a Venmo charge with my bank?

Yes, if the charge is unauthorized or incorrect, contact both Venmo and your bank for a payment dispute.

Do Venmo fees appear separately?

Yes. Instant transfer fees and credit card fees are usually listed as separate line items.

How long do pending charges take to post?

Typically 1–3 business days, depending on your bank and the recipient’s account.

Conclusion

Understanding the Venmo Charges makes it easier to identify legitimate transactions and spot unauthorized activity.

Check your Venmo app, track online payments, and monitor your bank statements regularly.

By paying attention to billing descriptors, fees, and pending transactions, you can avoid confusion and manage your money confidently.