What is the BGC Charge on Your Bank Statement?

Introduction

Seeing a strange charge on your bank statement can be confusing. Many people panic when they see “BGC charge” and don’t know what it means.

The goal of this article is to explain the BGC charge in simple terms. You will learn why it appears, whether it’s safe, and what to do if it isn’t.

What Is a BGC Charge?

The term BGC is often used by banks to indicate a payment processed by a financial institution. It can appear on both credit card charges and bank statements.

This charge is usually related to a direct debit, bill payment, or subscription service. Banks may use the abbreviation “BGC” for internal processing, so it might not match the merchant’s name exactly.

Common scenarios include utility bills, subscription services, or service fees from companies you’ve authorized to withdraw money from your account.

Why Does the BGC Charge Appear?

There are several reasons a BGC charge may show up. Sometimes it’s a recurring payment you signed up for, like a streaming service or gym membership.

Other times, it may be a one-time payment, such as a utility bill or loan payment. Banks may also use it to show service fees or other hidden bank fees applied to your account.

Understanding the origin helps you decide if the charge is safe or needs attention.

Is the BGC Charge Safe or Suspicious?

Many BGC charges are completely normal. For example, paying your electricity bill or a monthly subscription could show up this way.

However, be alert for suspicious charges. If the amount looks wrong or you don’t recognize the merchant, it could be an unauthorized transaction.

Knowing the difference is key. Legitimate charges match services you use, while suspicious charges are unexpected or repeated without explanation.

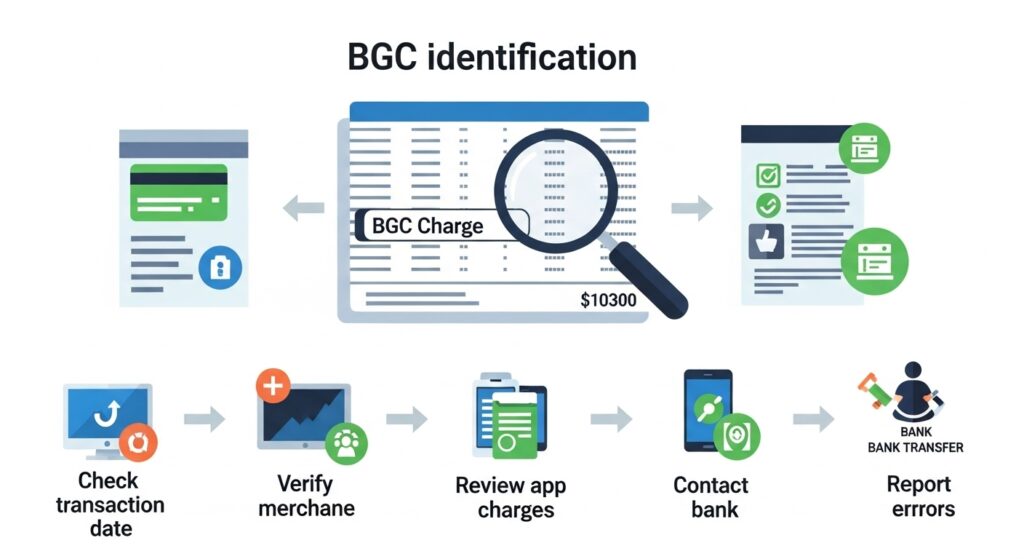

How to Identify the Source of the Charge

Start by checking your billing statement carefully. Look for dates, amounts, and descriptions that match your known payments.

Use online banking or a mobile app to review recent transactions. Many banks provide extra details that help identify the merchant or service.

If the charge still isn’t clear, reach out to your bank’s customer support or the service provider directly.

Examples of BGC Charges

Utility Payment Example: You pay your electricity bill, and the payment is processed through your bank. The statement may list “BGC charge” instead of the utility’s name. For other unusual payment references, you can also check our guide on the BillMatrix charge on bank statement to understand similar transaction patterns.

Subscription Payment Example: A monthly streaming subscription may show as a recurring payment with BGC listed. This is normal if you authorized it. If you use multiple subscription services, you might also find helpful insights in our article on Chegg order charge on bank statement.

Mistaken or Fraudulent Charge Example: You see a BGC charge but didn’t make any payment. This could indicate an unauthorized transaction or a billing error. n such cases, it’s good practice to compare with other banking anomalies like the Ikano Bank charge on bank statement to spot irregularities.

When the BGC Charge Is Unauthorized

Unauthorized BGC charges can occur if someone steals your card or account information.

Other reasons include incorrect billing or an error from the service provider. Such charges can reduce your balance or cause financial safety concerns.

Spotting these early is important to avoid bigger problems.

Steps to Take if You Don’t Recognize the Charge

If you don’t recognize a BGC charge, contact your bank immediately. Provide them with the date, amount, and any other information. Sometimes, the charge is linked to services like laundry or prepaid cards, so reviewing articles such as How to get a CSC ServiceWorks Laundry Card can help clarify legitimate charges.

Check with the merchant or service provider. Sometimes the charge is legitimate but mislabelled.

If it remains unclear, file a dispute with your bank. This starts the dispute process and may temporarily refund the amount.

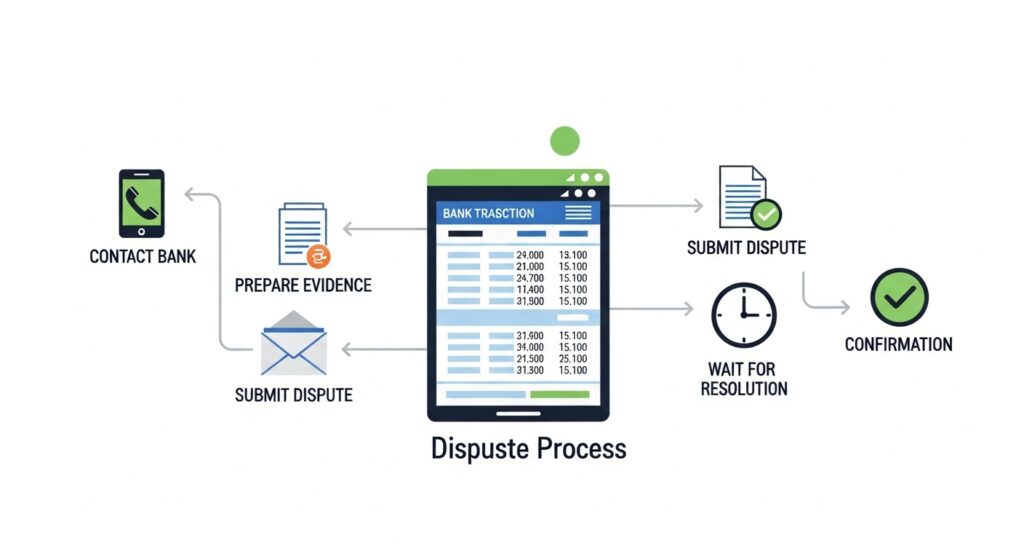

How to Dispute a BGC Charge

Start by gathering proof, like receipts or account records. Contact your bank’s customer support to explain the issue. If your account uses ATM networks or cash access services, you may also want to check the Cardtronics charge on bank statement guide to understand possible sources of disputed charges.

Most banks have a formal dispute process. They may investigate for several days or weeks. Keep records of all communication and any online transactions linked to the charge.

Once resolved, the bank may issue a refund if the charge was unauthorized.

Preventing Future Unexpected Charges

Monitoring your account regularly helps spot hidden bank fees early. Set up alerts for new transactions or charges.

Cancel subscriptions you no longer use and check that your direct debits are correct. Only use secure websites for online transactions and avoid sharing card information unnecessarily.

Practicing these habits improves fraud prevention and keeps your money safe.

Practical Examples and Scenarios

Scenario 1: Jane notices a monthly BGC charge from a streaming service she forgot to cancel. She logs into the service and stops the subscription.

Scenario 2: Mike sees a BGC charge he doesn’t recognize. He calls his bank, who confirms it was an unauthorized transaction, and the money is refunded.

Scenario 3: Lisa pays her water bill via direct debit, but the bank lists it as a BGC charge. She checks the billing statement, sees it matches her payment, and no action is needed.

FAQs About BGC Charges

What does BGC stand for in banking?

It usually represents a payment processed by a bank or financial institution.

Is a BGC charge always a fee?

Not always. It can be a bill payment, subscription, or a service fee.

Can I get my money back if it’s fraud?

Yes. Report it to your bank immediately to start the dispute process.

How long does it take to resolve disputes?

Resolution can take a few days to several weeks, depending on the bank and investigation.

Should I change my card if I see strange charges?

If you suspect fraud or repeated unauthorized transactions, it’s a good idea to cancel your card and get a new one.

Conclusion

The BGC charge on your bank statement is usually a normal payment for bills, subscriptions, or bank services. Most of the time, it’s safe.

However, it’s important to stay alert for suspicious charges or unauthorized transactions. Regularly check your statements, use secure payments, and contact customer support if needed.

By following these simple steps, you can protect your account, avoid surprises, and practice good financial safety habits. Awareness and vigilance are the keys to safe banking.