What is the Cardtronics Charge on Your Bank Statement?

Introduction

Have you ever looked at your bank statement and seen a charge you didn’t expect? Many people feel nervous when they see a name they don’t know. One common example is the Cardtronics charge.

This can raise questions like: “What is this?” or “Was my account hacked?” The truth is that most of the time, the charge has a simple explanation.

What Is Cardtronics?

Cardtronics is a company that manages ATMs around the world. They are not a bank, but they provide ATM services for many different banks and stores.

You may have used a Cardtronics ATM without noticing. Their machines often sit in convenience stores, gas stations, and shopping areas.

When you use one of their ATMs, the fee may appear on your statement as a Cardtronics bank charge.

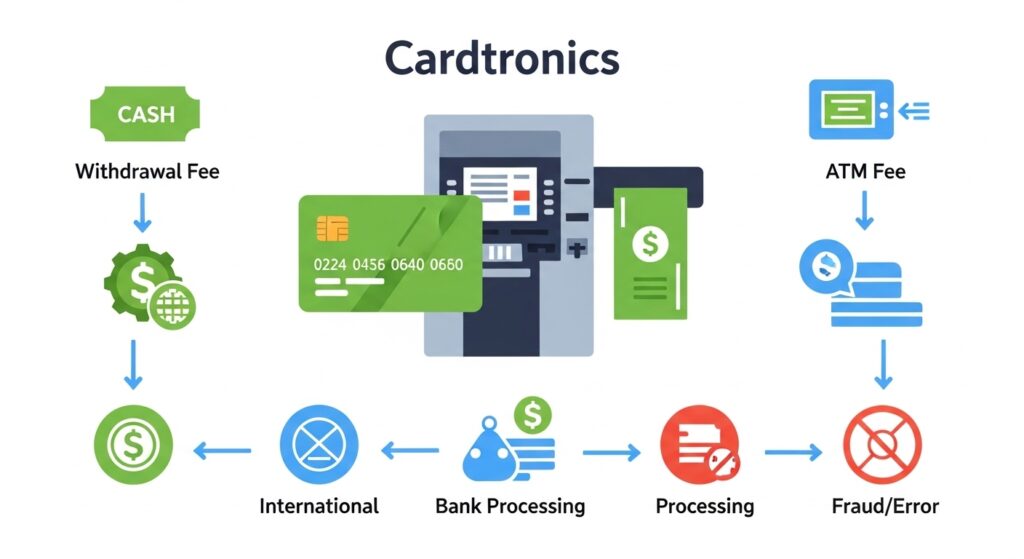

Why Does the Cardtronics Charge Appear?

This charge usually shows up when you withdraw money from a Cardtronics ATM. The company may add a Cardtronics withdrawal fee or surcharge to cover the cost of using their machine.

Banks sometimes charge extra when you use an ATM outside their network, similar to other transaction fees you might see, like a BillMatrix charge on your bank statement. If Cardtronics handled the transaction, their name appears on your statement. In short, it’s a normal part of ATM payment processing.

Common Reasons for Seeing a Cardtronics Charge

There are a few everyday reasons for seeing this charge:

- Using a convenience store ATM. Many stores host Cardtronics machines.

- Out-of-network withdrawals. If your bank doesn’t own the ATM, extra fees may apply.

- Balance inquiry or mini statement. Some ATMs charge even for checking your balance.

- Multiple small transactions. If you withdraw money several times, each one may create a fee.

These charges are common and usually legitimate.

Is the Cardtronics Charge Legit or Fraudulent?

Most of the time, a Cardtronics transaction is safe. If you recently used an ATM at a store or gas station, the charge is likely just the ATM surcharge.

However, Cardtronics fees can sometimes be confused with other uncommon charges, such as an Epoch charge on your bank statement. Always double-check your activity to ensure that the transaction is legitimate.

Cardtronics fraud can happen if someone steals your card details and uses them at one of their machines. Always double-check your activity.

How to Verify a Cardtronics Charge

Start by reviewing your transaction history. Look for any recent ATM withdrawals or balance checks.

Comparing these with other unusual charges, like the Chegg order charge on your bank statement, can help you distinguish normal ATM fees from unauthorized transactions. If you’re unsure, call your bank’s customer service. They can tell you exactly where and when the Cardtronics payment processing took place.

If you’re unsure, call your bank’s customer service. They can tell you exactly where and when the Cardtronics payment processing took place.

What to Do If You Don’t Recognize the Charge

If the charge doesn’t match your activity, take action right away. First, check with family members to make sure they didn’t use your card.

If no one did, report it as suspicious. Call your bank and explain that you don’t recognize the charge.

Your bank may freeze the card, issue a new one, and guide you through a Cardtronics fee dispute. Acting fast helps prevent bigger losses.

Cardtronics Fees Explained

Cardtronics fees vary, but here are the common ones:

- ATM surcharge. This is the extra fee for using an out-of-network machine.

- Daily withdrawal limits. If you go over, the ATM may reject the request or charge extra.

- Cross-bank costs: Your bank may add its own fee on top of the Cardtronics withdrawal fee, similar to how CRO charges or other banking fees appear on your statement. That’s why charges may look different depending on the situation.

That’s why charges may look different depending on the situation.

How to Dispute a Cardtronics Charge

If you believe a charge is wrong, you can dispute the Cardtronics fee. Here’s how:

- Review your transaction history.

- Collect receipts or screenshots of your bank statement.

- Call your bank’s dispute department.

- Explain why you believe the charge is incorrect.

- File the official dispute form if required.

Banks often give a temporary refund while they investigate. Resolution can take days or weeks, depending on the case.

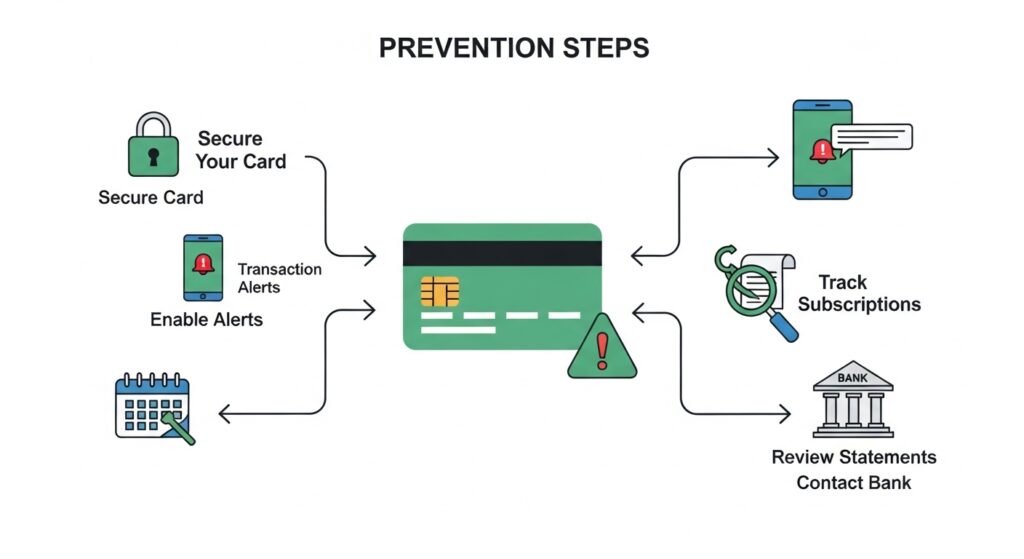

How to Prevent Unexpected Cardtronics Charges

Here are some tips to avoid surprises:

- Use in-network ATMs. Stick to your own bank’s machines whenever possible.

- Keep receipts. They help you track withdrawals and confirm charges.

- Set up alerts. Most banks let you get texts or emails for every card use.

- Check your account often. Weekly reviews help catch errors early.

Tips to Stay Safe from ATM Fraud

Not all ATMs are safe. Some may be targeted by criminals. Here’s how to protect yourself:

- Avoid shady ATM locations. Use machines in well-lit areas or inside stores.

- Inspect the machine. Look for loose card slots or hidden cameras that may signal skimmers.

- Cover your PIN. Use your hand when typing your code.

- Prefer bank ATMs. They are usually more secure than stand-alone machines, much like using trusted financial platforms such as FintechZoom for Google stock updates to stay informed. These habits lower your risk of Cardtronics fraud and other scams.

These habits lower your risk of Cardtronics fraud and other scams.

Frequently Asked Questions (FAQs)

Why do Cardtronics charges vary?

The fee depends on the ATM, your bank, and the type of transaction. Some machines charge more than others.

Can you get a refund?

Yes, if the charge was made in error or is fraudulent. But normal ATM surcharge fees usually can’t be refunded.

Is Cardtronics the same as my bank?

No. Cardtronics is a payment processing company that runs ATMs. They are not your bank.

Are Cardtronics charges tax deductible?

No. ATM fees are personal expenses and cannot be deducted on taxes.

Conclusion

The Cardtronics charge explanation is simple in most cases: it’s a fee for using one of their ATMs. If you used a convenience store or out-of-network machine, the charge is normal.

But if you see an unauthorized Cardtronics charge, act fast. Contact your bank, dispute the charge, and protect your account.

By learning how Cardtronics transactions work and practicing safe banking, you can avoid confusion and stay in control of your money. Always remember: most charges are harmless, but awareness is your best defense.